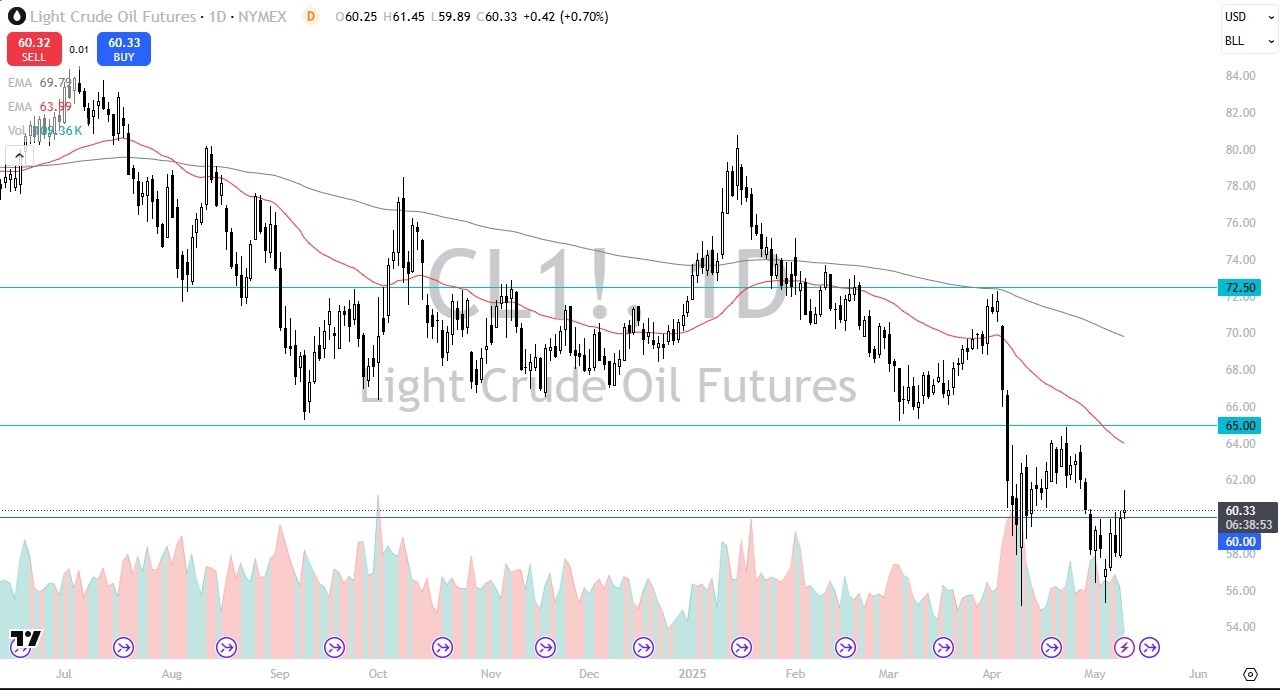

- The light sweet crude oil market has initially tried to rally, but we gave back gains rather quickly.

- The daily candlestick that is forming is starting to look a bit like a shooting star.

- While this is a negative candlestick, it doesn't necessarily make me want to short this market.

After all, we are at extraordinarily low levels. And at this point, we have to find another fundamental reason for the market to fall apart. Furthermore, you can see that the $55 level may have just kicked off a double bottom. And if that's the case, it's probably worth taking a look at this as a potential floor. We'll just have to wait and see.

If we can break above the candlestick for the Friday session, that would obviously be a very bullish sign. And there is a fundamental reason that may happen, as we have a weekend meeting between the Chinese and the Americans. And that of course could produce good headlines and that has people buying more oil based on the idea of demand and trade. We'll just have to wait and see whether or not that actually happens. But it is something that could be out there.

Top Regulated Brokers

Breaking Above $60 Does Matter

It's also worth noting that the $60 level has been broken. So that is a victory despite the fact that the candlestick doesn't look that strong. So, I'm still leaning to the idea of buying on short-term dips that show signs of a bounce. Ultimately, if we do rally from here, the 50-day EMA probably comes into the picture as resistance near the $64 level, so don't forget that either. I like the idea of buying oil at these really cheap levels, but now we just need some type of fundamental reason to get us moving to the upside.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.