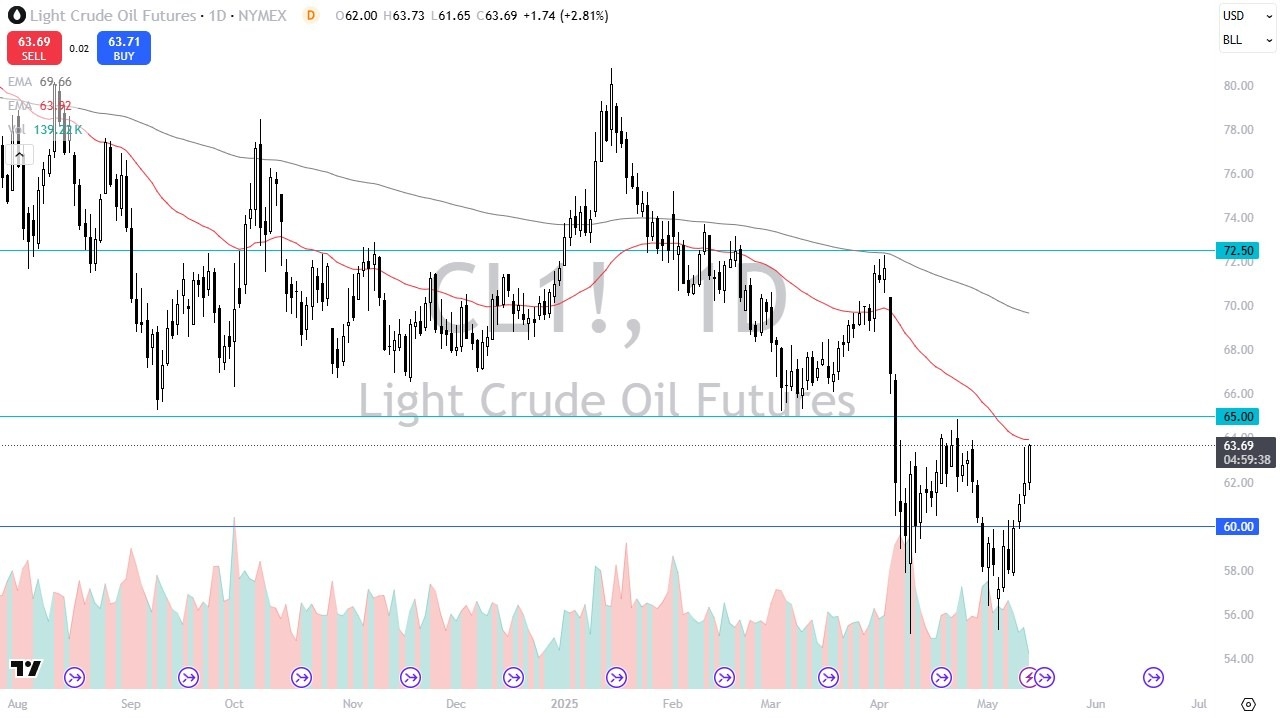

- The light sweet crude markets had another bullish session on Tuesday, as we raced toward the 50 Day EMA.

- The 50 Day EMA of course is an indicator that a lot of people will be paying close attention to, especially considering that it sits just below the crucial $65 level.

- Furthermore, this is a market that has a lot of external pressures on it at the moment, so to be very interesting to see how this plays out.

Worldwide Demand

Top Regulated Brokers

The biggest problem is that there has been a lot of concern about worldwide demand when it comes to crude oil, as there have been so many tariff war negotiations going on at the same time that most traders have no idea how many goods and services will be moving across the planet. If we slip into a global recession, that obviously could drive down the demand for crude oil, as less things will have to be moved. That being said, if we do see a lot of good news coming out of the trade situation, then we have a market that will be looking at crude oil going much higher.

If crude can crack above the $65 level, it’s very likely that the crude oil market will continue to go much higher, as it will certainly break out to the upside and start to take out a lot of thin air above. If that happens, then I anticipate that we will go looking for the 200 Day EMA, near the $69 level. If we pull back from here, then I think we just simply reenter the consolidation area, with the $60 level underneath being a major support level. Ultimately, this is a market that I think continues to see a lot of back and forth sideways action, but I also recognize that it is in the midst of an attempted bottoming pattern, which is the beginning of a trend change.

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.