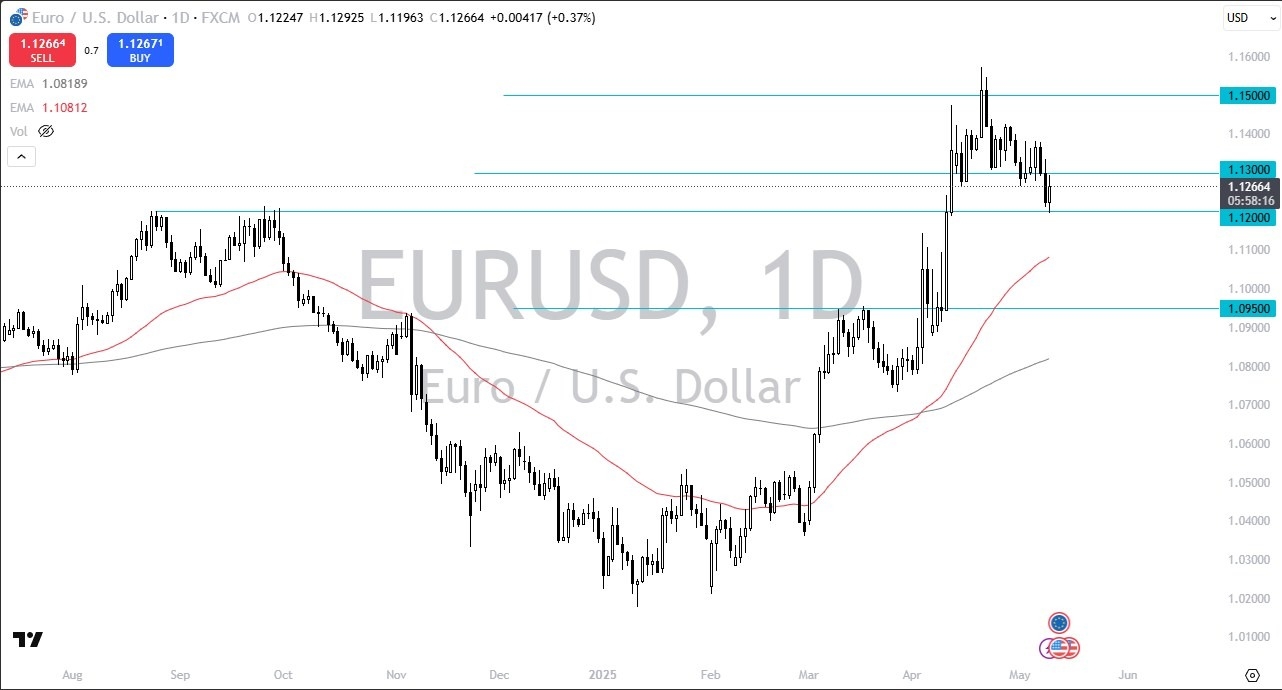

- The Euro has initially fallen against the US dollar only to turn around and rally against the US dollar before running into trouble with the 1.13 level.

- This has been one of those sessions where pretty much everybody had a chance to lose money as day traders get chopped up.

As far as a longer term move is concerned, I'd be watching the 1.12 level more than anything else because I think that's the most important level on the chart, at least in the short term. Breaking down below that level could kick off something somewhat negative. And it looks to me like the Euro is trying to do exactly that. On the other hand, though, if we do break above the 1.13 level, we could then test on 1.14 level followed by the 1.15 level.

Topping Pattern Here?

Top Regulated Brokers

All things being equal, this is a market that when you look at longer term charts, you can see what I see and that is a potential topping pattern. That doesn't necessarily mean that the market needs to fall significantly. It just means that a pullback is probably more likely than not. We'll have to wait and see how things play out, but if there is some type of progress made over the weekend with the Chinese, the US dollar probably gets inflows, we'll just have to wait and see how that plays out.

Nonetheless, this is a market that had been overdone, so this pullback made a certain amount of sense. Now, I'll be watching the 1.12 level to see if that pullback becomes something a little bigger. On the other hand, if we do break above that 1.13 level, then I think we will just continue the same choppy sideways noisy consolidation while we wait to see if there's any reason whatsoever to push the Euro above the 1.15 level.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.