- The euro initially did try to rally against the US dollar but really has struggled quite a bit during the trading session.

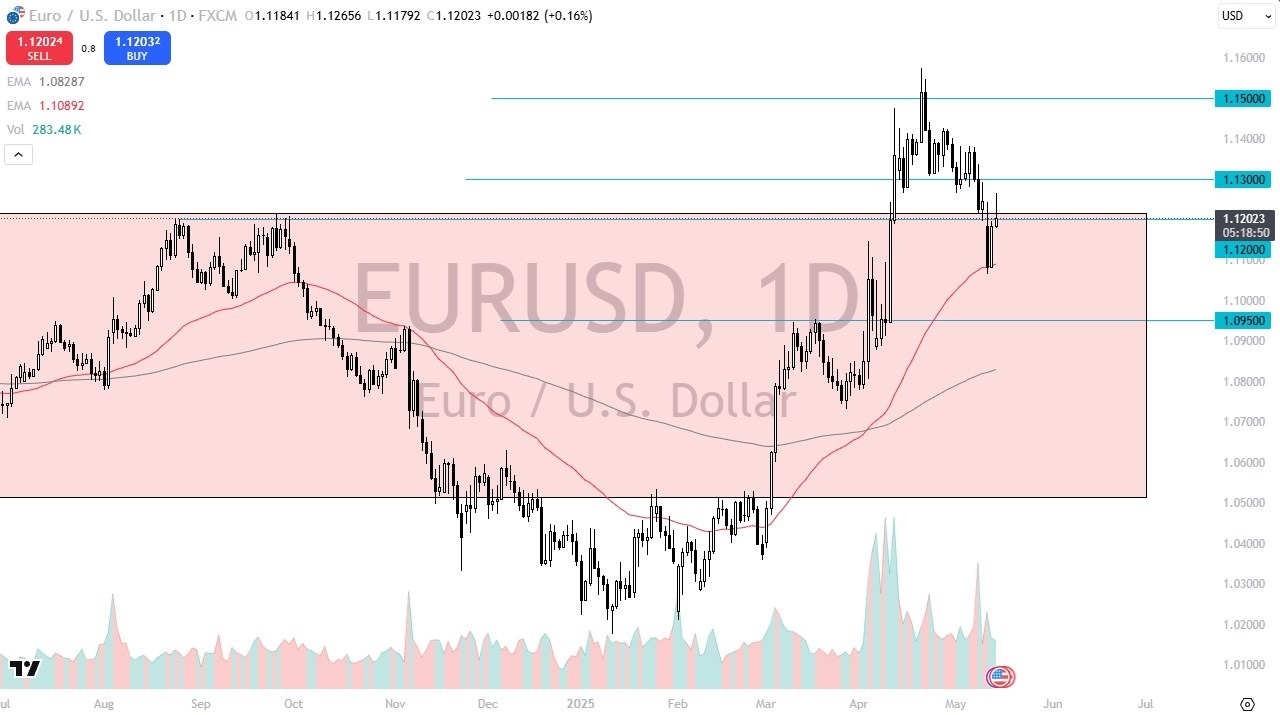

- Above the 1.12 level, the 1.12 level is an area that I had been talking about in the past.

- I think it does make a certain amount of sense that we continue to pay close attention to it due to the fact that when you look at the last couple of years, it's been a major area of resistance.

We had a little bit of a throw over here in the last couple of weeks, but we also had one at the end of last year to the downside. So, the question is, are we re-entering this area yet again? It's very possible. That's exactly what happens. We'll just have to wait and see. But I do think that you have to basically take this market as one that I think got a little overdone and therefore it does make a certain amount of sense that we pull back at the very least. That doesn't necessarily mean that I am looking for a major meltdown, but I do think that a return to the 50-day EMA near the lows of the past couple of trading sessions is very viable.

On Further Selling

Top Regulated Brokers

And then if we break down below there, we could be looking at the 1.0950 level, an obvious area of both support and resistance over the longer term. To the upside, if we do take out the 1.13 level, then we could start looking at the 1.15 level again, an area that has a certain amount of importance from both psychology and the longer term charge.

All things being equal with the interest rates in America climbing the way they did, it makes perfect sense that the US dollar continues to attract inflows.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.