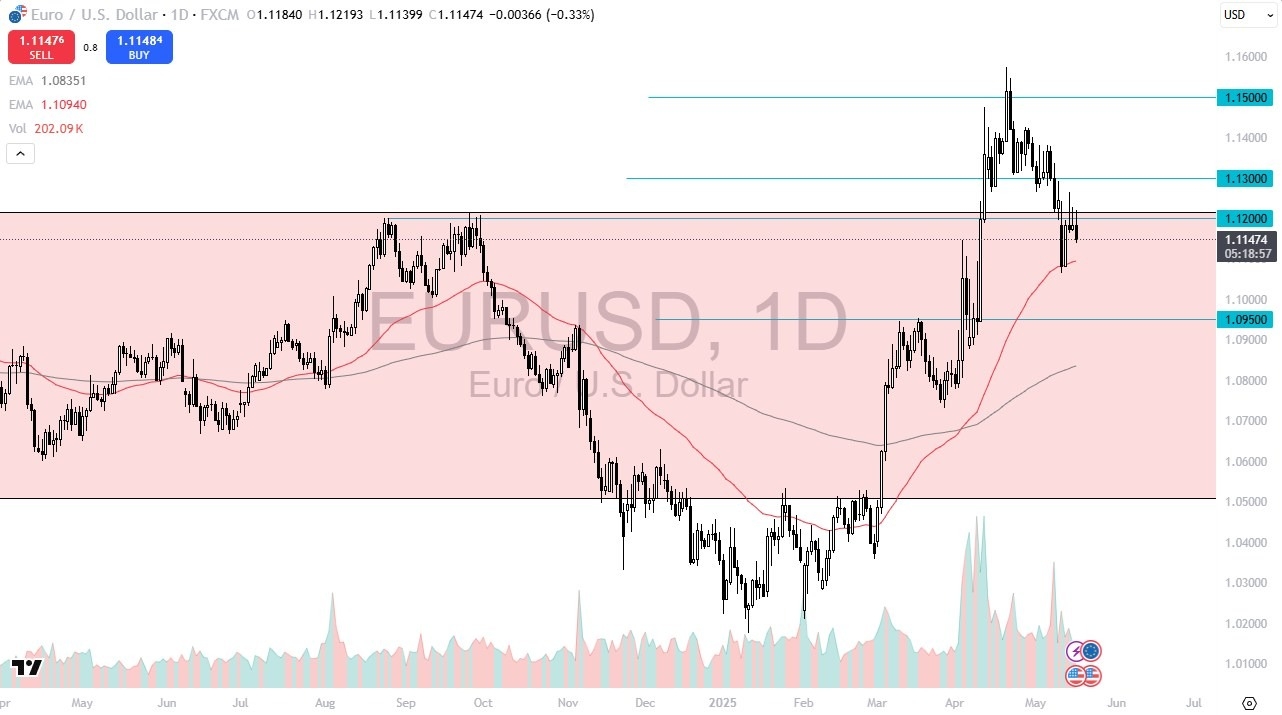

- As you can see the euro initially did try to rally against the US dollar but has since given up the gains as it looks like we are going to continue to struggle with that being said I believe this is a market that remains very noisy and of course is focusing on a lot of different things at the same time not the least of which would be the trade war situation and the fact that interest rates in America are climbing.

- That is something that obviously moves the US dollar more than anything else. With that being said, I think you have a situation where the 1.12 level makes sense as resistance, as it had been a major barrier at the top of a consolidation region.

We Have Returned

Top Regulated Brokers

We broke back into it. So, the question is, are we going to go back to the middle of the range, which is closer to the 1.0950 level? At this point, I really don't see any reason why we may not.

So, with that, I like the idea of shorting this pair. But I also recognize that if we break back above the 1.13 level, we could see a lot of short covering. And that of course would be very bullish, at least in the short term, I think we're just kind of somewhat just looking for some type of directionality in risk appetite, the US dollar was oversold. So now I think it makes a lot of sense that we recover a little bit, all things being equal. I do not like the idea of getting too big in this particular currency pair, because it does tend to get choppy, but I do like the US dollar overall interest rates climbing US dollar oversold it just sets up for a pro dollar environment.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.