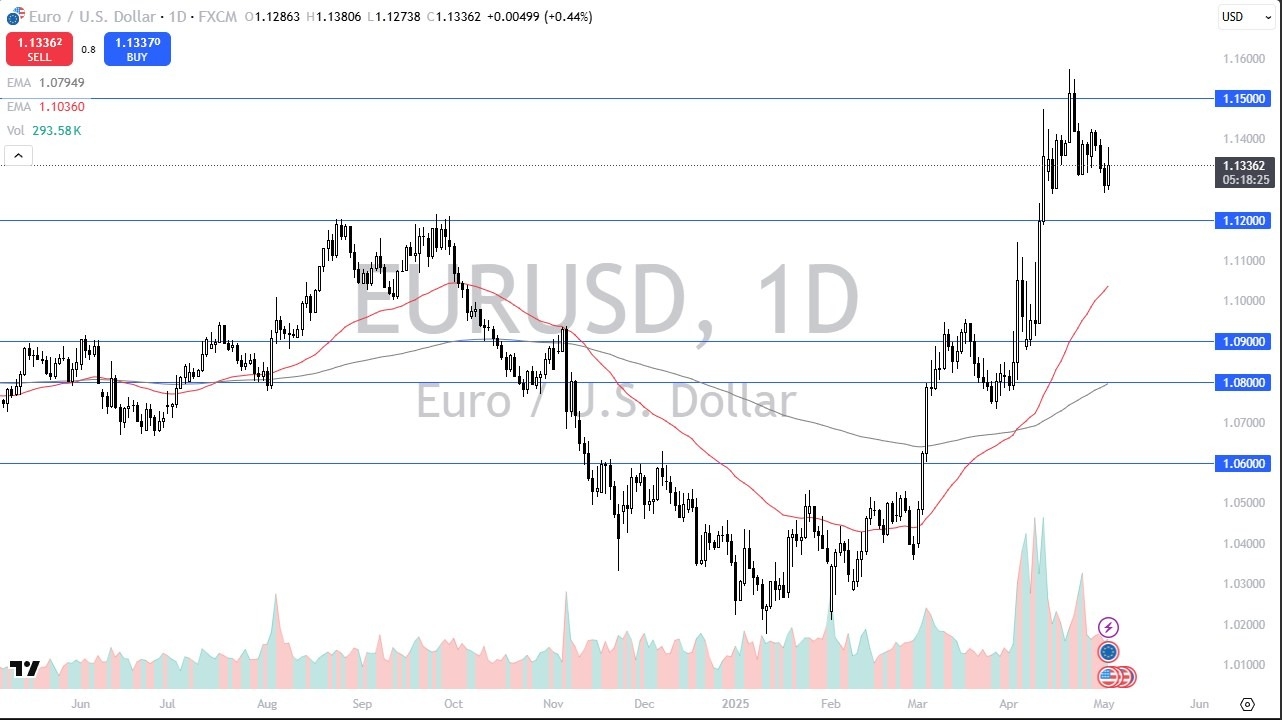

- The Euro rallied a bit during the trading session on Friday to reach toward the 1.14 level but gave back quite a bit of the gains to show signs of hesitation.

- All things being equal, this is a market that has been very bullish, but quite frankly I do think that the euro is getting a little bit tired, and the US economy seems to be stronger than the market may have thought, as the jobs number was a little bit cooler than anticipated but it is still seen quite a bit of hiring in the United States.

Top Regulated Brokers

Support Below

Ultimately, this is a market that has a lot of support just below. The 1.12 level is an area that is very important as it was a major resistance barrier previously. Because of this, I would anticipate that there is a certain amount of “market memory” in that area, so with that being said the market is likely to continue to pay close attention to that. If we break down below that level, then the market could go down looking to the 50 Day EMA underneath, near the 1.1050 level and rising. On the other hand, if we turn around and break above the 1.14 level, then we go looking to the 1.15 level as a major barrier. The 1.15 level is of course a large, round, psychologically significant figure and an area where we have seen a lot of action and resistance in the past. Because of this, I think we’ve got a situation where this will be a major barrier.

If we were to break above the 1.15 level, then you could see a bigger move, perhaps the euro driving all the way to the 1.18 level over the longer term. While that certainly would make sense from a longer-term standpoint due to the fact that we shot straight up in the air, it does look as if the overall momentum in the US dollar is starting to shift, and if that’s the case, the euro will be a victim.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.