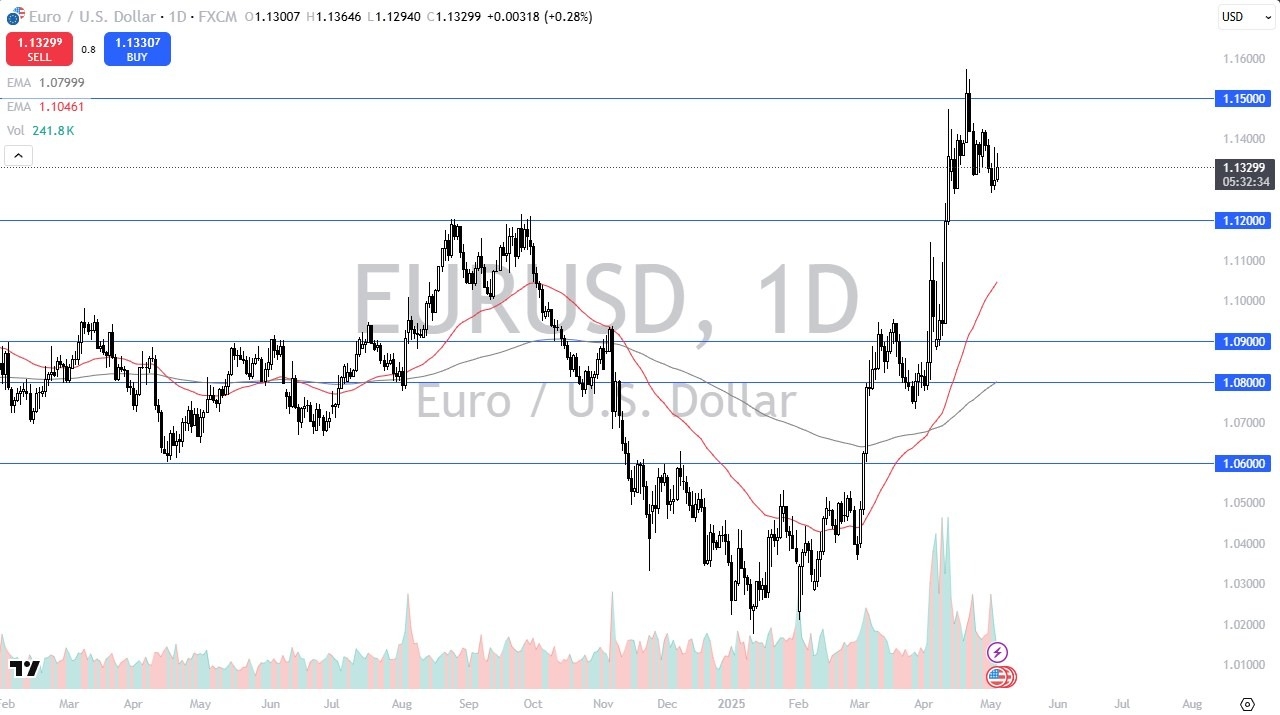

- The Euro initially rallied during the trading session on Monday but then came back gains to show signs of exhaustion, maybe a little bit of confusion in this area as we have been trading between the 1.13 level on the bottom and the 1.15 level at the top.

- The market has been very noisy.

- I think ultimately you have to look at this through the prism of a market that if it does break down, then the 1.12 level comes into the picture. The 1.12 level is an area that we’ve seen a lot of action previously.

On a Rally and Breakout…

Top Regulated Brokers

On the other hand, if we rally from here, the 1.15 level, I think it is very difficult to get above. And we will have to watch that very closely. Ultimately, this is a market that if we can break above there, then that really unleashes a lot of upward momentum. On the other hand, though, if we break down below the 1.12 level, then I suspect we have a scenario where we drop down to the 1.09 level.

Keep in mind that the Euro itself has seen a lot of inflows and now you have to ask the question whether or not we have just gotten so exhausted. The market has been very noisy. I think it will continue to be one that you have to focus on short-term shop and also these levels. Now, having said that, this is a very important market to watch as if we do break to the upside, that's probably negative for the U S dollar everywhere, not just here.

If we break down below the 1.12 level, then it's probably very positive to the U S dollar, not just here as well. Use this essentially as a signal for not only this particular market, but other ones as well.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.