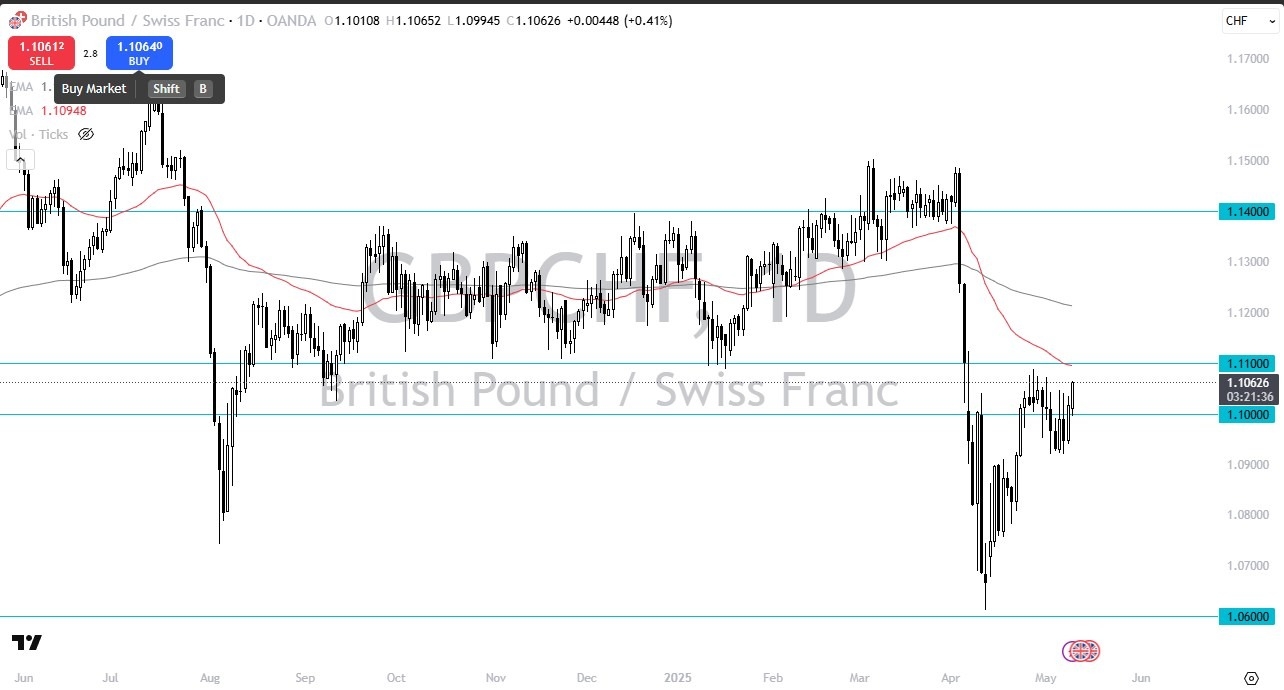

- During the trading session on Friday, we have seen the British pound gained 0.4% against the Swiss franc, as we continue to power higher.

- All things being equal, this is a market that we need to pay close attention to because it is a great way to gauge overall risk appetite.

- The Swiss franc is considered to be one of the safest currencies around the world, while the British pound is a little bit more volatile.

Keep in mind that you get paid to hang on to this pair, and it is worth noting that we have recently seen a lot of noisy behavior, after an initial push higher. You could make a little bit of an argument for a bullish flag, but I think the technical analysis is a little bit more interesting than just calling out that particular shape. I think there is a lot going on in this chart that should be paid close attention to.

Top Regulated Brokers

Technical Analysis

The technical analysis over the last couple of months has been very bullish but we are starting to approach a very significant level in the form of the 1.11 CHF level. This is an area that not only has been a major source of selling pressure previously, but it’s also where we see the 50 Day EMA. That suggests that there could be quite a bit of selling pressure in this neighborhood, but if we were to break above the 1.11 level on a daily candlestick, then I think at that point in time we could see a massive recovery, because when you look at the chart, there seems to be a lot of “dead air” between that level in the 1.14 level. This would also move right along with risk appetite picking up, which we have most certainly seen that happened recently.

Don’t forget that you get paid to hang on to this pair, as most institutional traders will be paying close attention to the swap that they get at the end of every day. Short-term pullbacks should offer buying opportunities, unless of course we break down below the 1.09 level, then we might have to “reset” our expectations in this market.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.