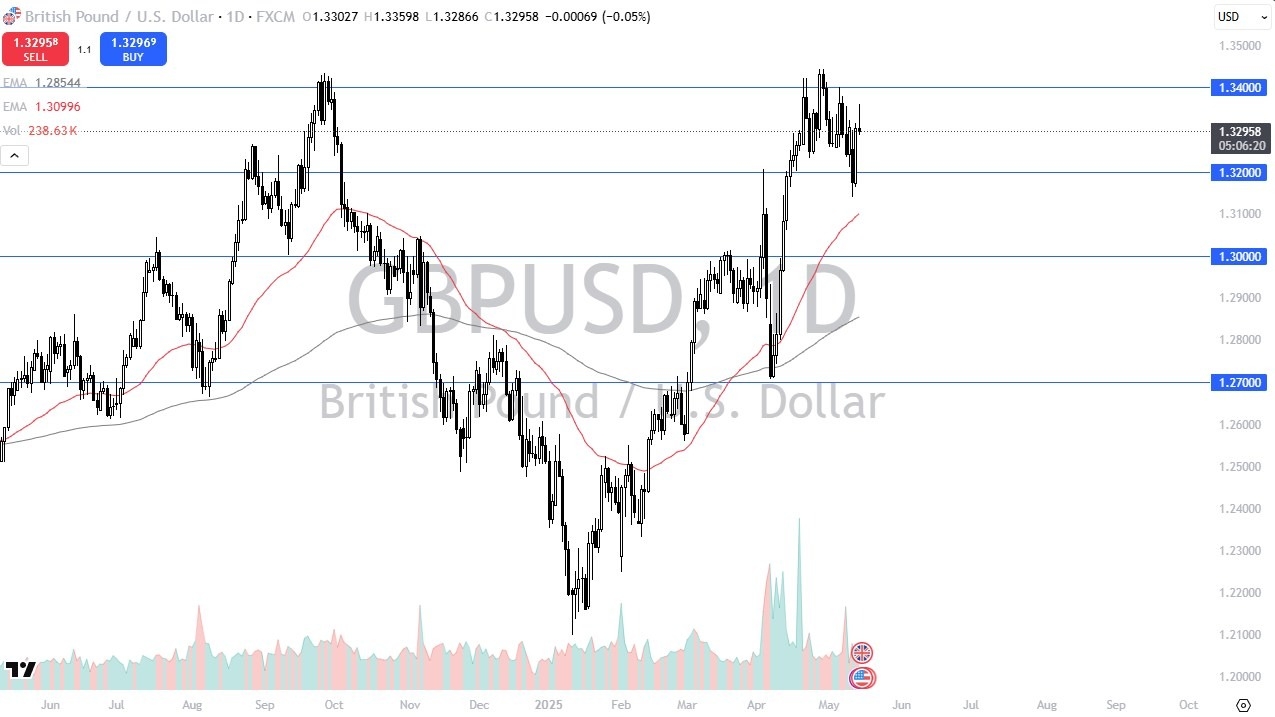

- The British pound initially did spike against the US dollar on Wednesday but has given back those gains as we continue to see a lot of resistance near the 1.34 level.

- The 1.34 level is an area that's been important on multiple long-term charts.

- So, I think it's probably only a matter of time before the sellers step back in.

It's also worth noting that we have formed three shooting stars in a row on the weekly chart in that vicinity. So, this sets up an interesting situation for traders. Either you see a lot of selling, which would be the most natural assumption, and you eventually break down. Or if you break higher here, that's an extraordinarily bullish sign.

If We Break 1.34…

Top Regulated Brokers

And in that environment, you would have to be a buyer. So, it makes the analysis of this pair relatively simple. You have to assume that we are going to struggle anywhere near the 1.34 level when we approach it. If we can break down below the lows of the last couple of days, that could send the British pound screaming back down to the 1.30 level.

But if we break above the last couple of weeks, that opens up a much bigger move in the British pound. We're talking about probably a swing trade that you can hang on to for a while. Interest rates in America have climbed a bit during the day. So, with that being the case, it does make a certain amount of sense that the US dollar has become more attractive.

At this point in time, it's probably also worth noting that we are in an area that has historically been very important. So, to pull back from here would not be a huge surprise at all. With that being said, I do anticipate that it will be very choppy, as per usual, but I am starting to look to the downside now.

Ready to trade the GBP/USD Forex analysis? Check out the best forex trading company in UK worth using.