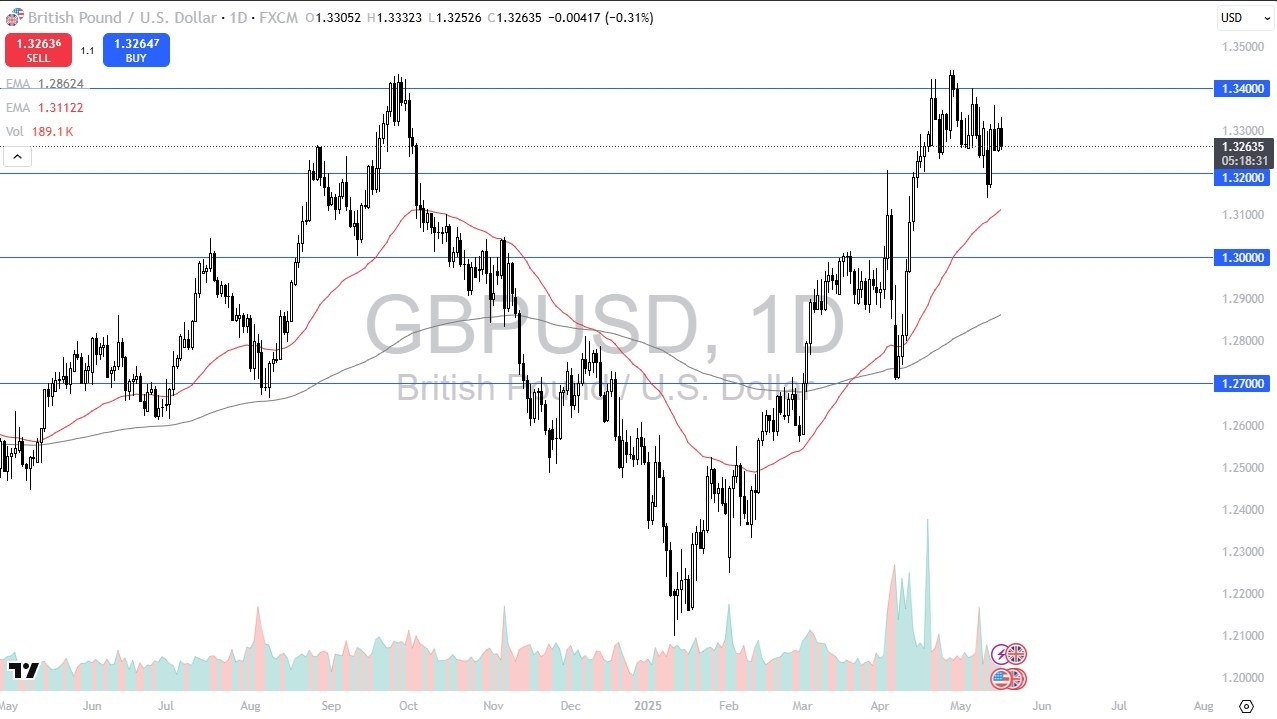

- The British pound initially did try to rally a bit during the trading session on Friday but then gave back gains to show signs of weakness. At this point in time, we are in the midst of a bit of a topping pattern.

- And don't forget that the previous three weeks ended up forming a shooting star. This is a neutral candle, and therefore you have to look at it as a potentially important candlestick. And if we break down below the swing low, I think that's a very negative sign.

Top Regulated Brokers

- This is just below the 1.32 level. But right now, I think you have a scenario where the market is just killing time trying to determine which direction it goes next. Granted the US dollar is oversold. That doesn't mean it can't get more oversold. When you look at the longer term charts, this is an area that's been important many times, so I also recognize that it's going to be difficult to break above there.

Below the Weekly Candle

Breaking down below the bottom of the week, which is basically the 1.3140 level, it's likely that the market tests the 50-day EMA and then eventually the 1.30 level. I do not want to buy the British pound but if we were to turn around and break above the 1.35 level then you have to suggest that maybe, just maybe it's time for the market to go much higher.

Expect noisy behavior, but I still think at this point we're leaning towards the US dollar. This will be a US dollar based move. So, if you see the dollar strengthening elsewhere and we are starting to see that, the British pound probably falls right along with the others. Keep in mind though, the interest rate differential between the United States and Great Britain isn't as wide as some other currency pairs, so this may be a little slower moving, like it was last time we broke down.

Ready to trade our GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.