- The Nasdaq 100 rallied rather nicely during the trading session on Thursday as headlines continued to fly.

- The first thing, of course, is that the United States and the United Kingdom have reached a trade agreement, which is something, ironically enough, we didn't have before the trade tariff situation.

- So, with that being the case, the market celebrated because it shows that there is some momentum in this trade negotiation situation.

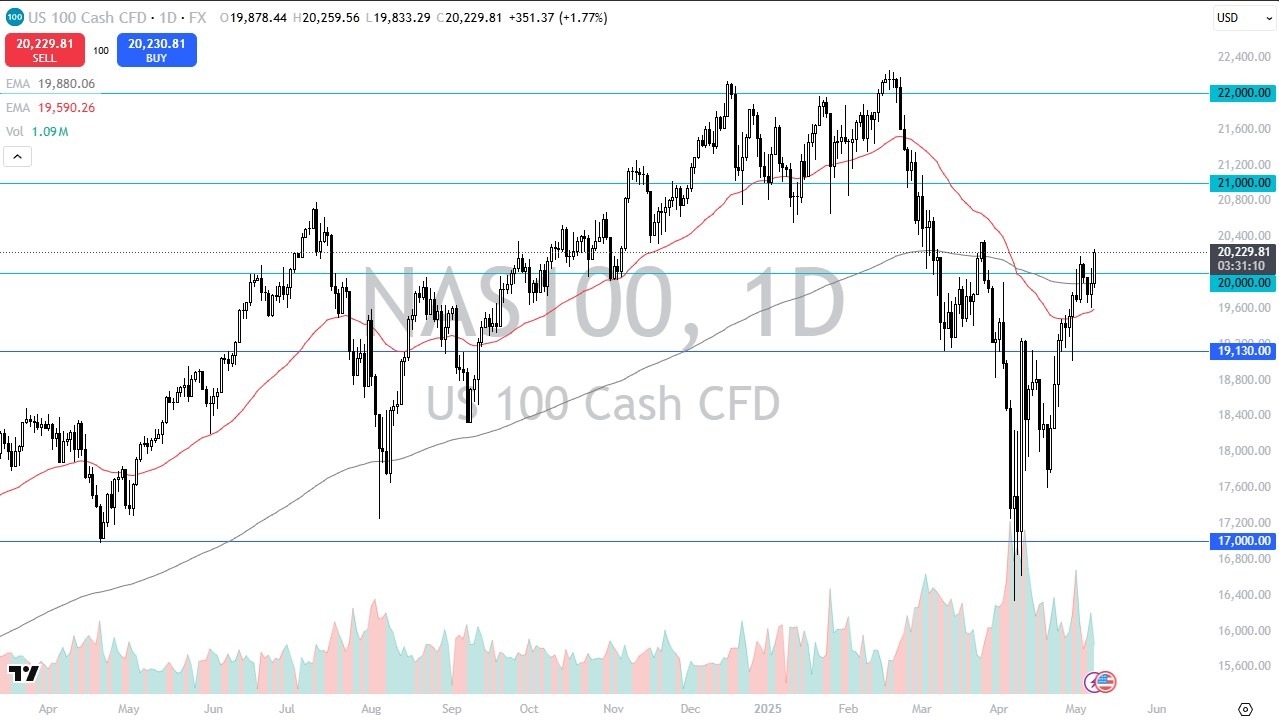

The market is reaching the 20,400 level above and a significant resistance. And if we can break above there, we will probably go looking at 21,000. The momentum has been something to behold. And we also have the United States and China meeting over the weekend. And if they can make progress on a trade deal, that will launch Nasdaq 100. And in fact, there's a certain amount of front running that I think has been going on.

Top Regulated Brokers

Tariffs and Trump

Beyond that, Donald Trump came out and said that China could see tariffs cut, and traders went with that as a sign that perhaps this weekend could bring good headlines. He also said it was a great time to buy stocks, and the Nasdaq 100 just launched after that as well. So, with all of that being said, we are getting close to a significant area as far as technical analysis is concerned in the form of the 20,400 level. So, I'll be watching that very closely.

The 20,000 level seems to be a bit of a magnet for price. I don't think it's resistance or support at this point. We slice through it four out of the last five trading sessions, five out of the last six. So really at this point in time, I think maybe the 50 day EMA right around the 19,600 level is your short-term floor. That being said, keep in mind that all you have to really understand is that the next headline could move the market 300 points in one direction or the other. That is the regime that we are dealing with. So, position sizing is crucial.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.