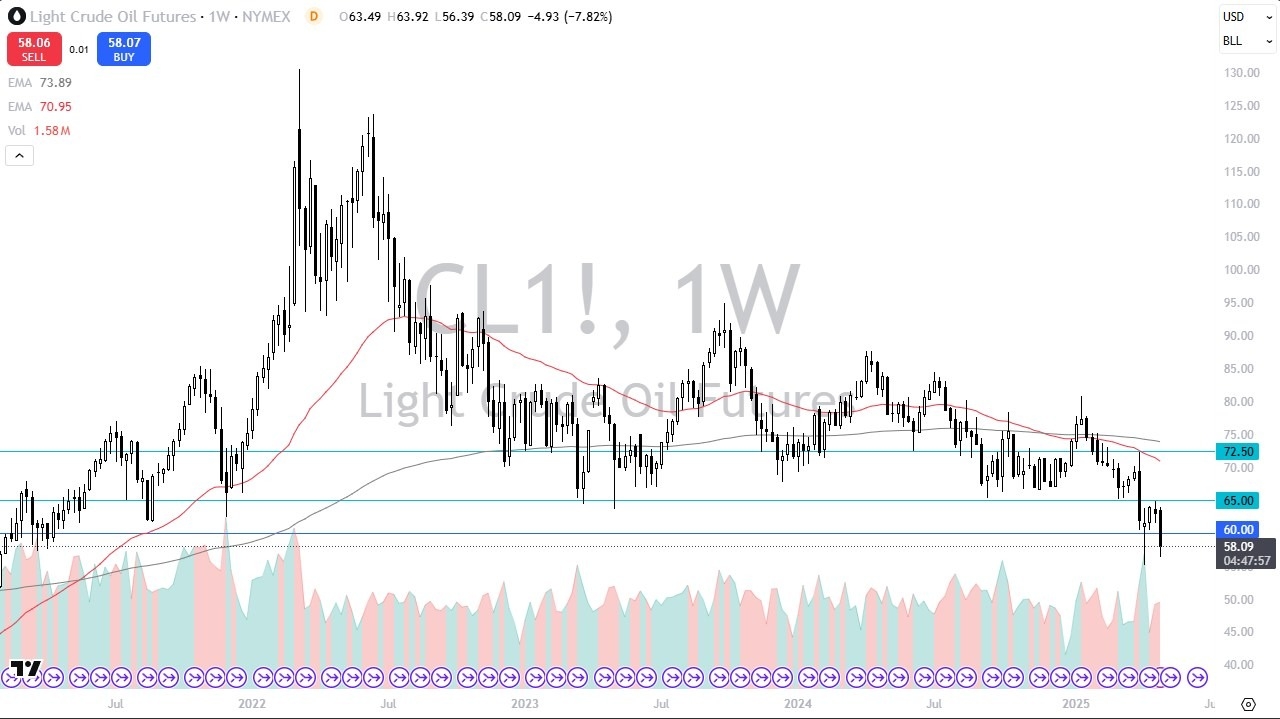

WTI/CL Crude

The West Texas Intermediate Crude Oil market fell pretty significantly during the trading week, as we are looking to close below the $60 level. This is an area that I think attracts a lot of attention, mainly due to the fact that we had bounced so significantly from there previously. That being said, the market is closing below the $60 level, so we do need to be somewhat cautious at this point in time. All things being equal, this is a market that I think will continue to see a lot of volatility as traders are worried about demand. Ultimately, this is a sideways market at the moment, leading to the downside.

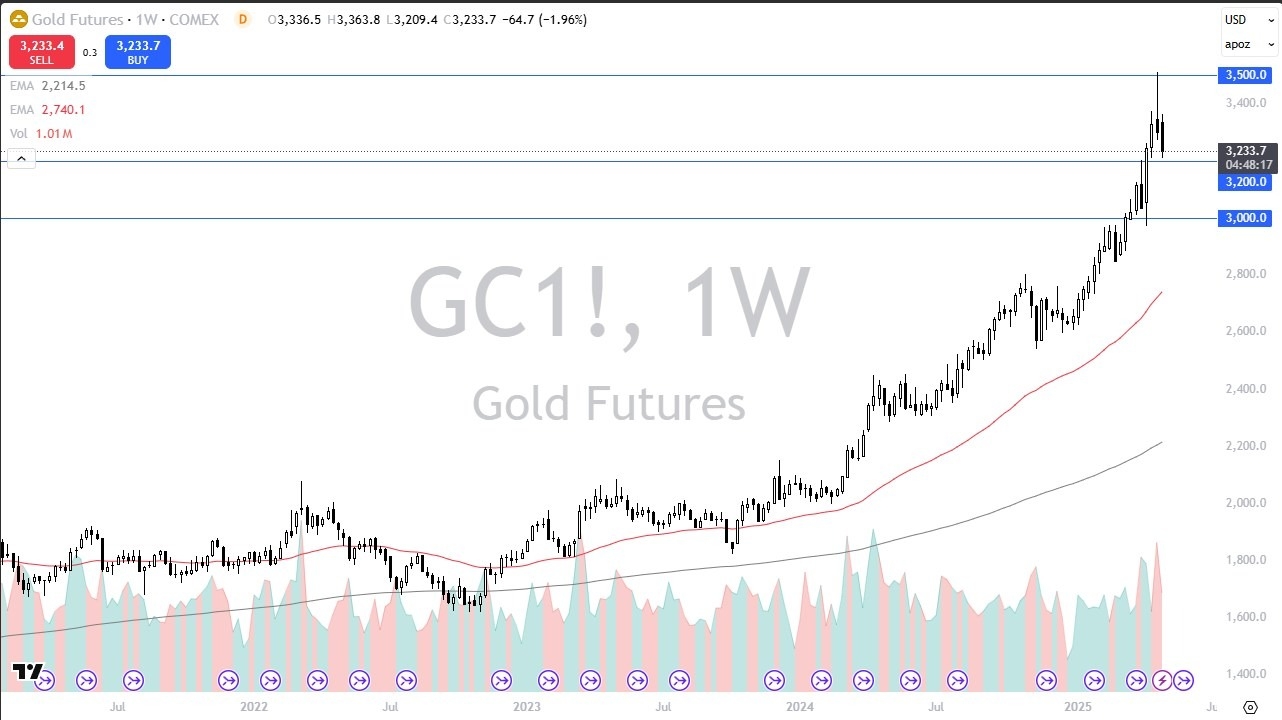

Gold

The gold market initially tried to rally for the week but then fell rather hard. It’s interesting to see that the gold market is falling while the stock market is rallying. We have had a major negative correlation between gold and stocks as of late, so I’m paying close attention to the $3200 level, and then again, I would be watching at the $3000 level for some type of bounce that I can start buying again.

AUD/USD

The Australian dollar has a positive week, as we are now breaking above the 50 Week EMA. By doing so, the market looks as if it is ready to continue going higher, perhaps looking to the 200 Week EMA near the 0.67 level. Ultimately, this is a market that is probably getting some benefit from the idea of China quietly looking for a trade deal with the United States, which would have a major influence on the Australian economy as they are a major supplier of raw materials for China and of course the overall economic engine that drives the rest of the world as far as manufacturing is concerned.

Top Regulated Brokers

EUR/USD

The euro has been all over the place during the course of the week, as we continue to look for some type of directionality. It’s interesting to see that we have gone sideways for 3 weeks now, after shooting straight up in the air. What I find interesting is that the previous week ended up forming a massive shooting star at the crucial 1.15 level, which is an area that has been important multiple times in the past. It’s a large, round, psychologically significant figure as well, so that is also something you need to pay close attention to. If we were to break down below the 1.12 level, then the market could drop.

GBP/USD

The British pound initially tried to rally during the course of the trading week but gave back gains in order to form a bit of a shooting star. The shooting star was preceded by another shooting star the weekly timeframe, and it looks as if the 1.34 level is going to continue to be a major barrier. The fact that we formed to shooting stars is of course a very ugly turn of events for the British pound, so all be looking to see whether or not we can drop down below the 1.32 level, because if we do that could lead to more downward pressure.

NASDAQ 100

The NASDAQ 100 initially fell a bit during the course of the trading week but found enough support near the 19,100 to turn things around. We broke above the 50 Week EMA, and what has been a very bullish week. I think at this point in time, short-term pullbacks more likely than not will present buying opportunities in the NASDAQ 100 unless of course we get some type of very negative headlines out there. On the other hand, if we end up breaking above the 20,350 level, the NASDAQ 100 almost certainly will go looking to the highs again.

USD/JPY

The US dollar initially fell against the Japanese yen but has turned around to show signs of life. We even tried to break above the ¥145 level, a large, round, psychologically significant figure, and an area that has been important a couple of times in the past. It week just formed a massive “triple bottom” on the weekly chart, so it’ll be interesting to see how far we can bounce from here, but it looks as if the “risk off behavior” of the markets is starting to chill out.

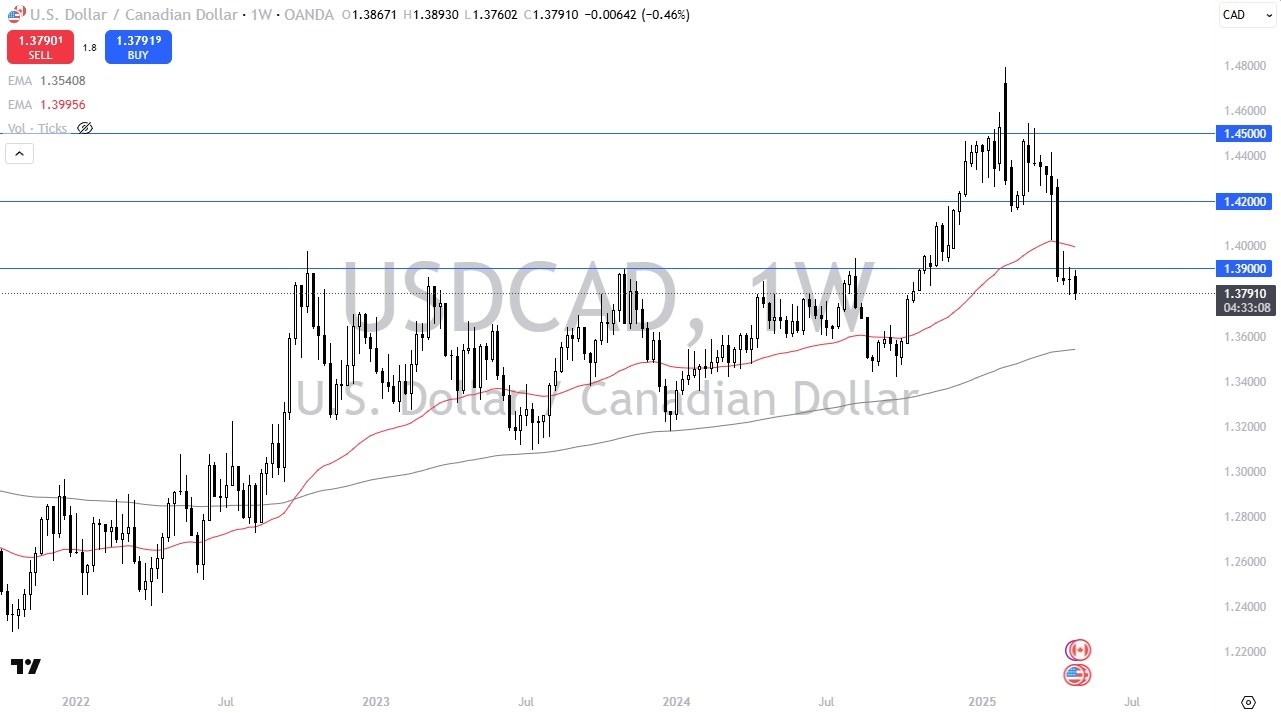

USD/CAD

The US dollar has dropped during the week against the Canadian dollar, as we continue to see more of a drop overall. That being said, the area that we are entering is very noisy when you look to the left on the chart, so even if we do continue to drop from here, it’s not necessarily a market that I’m looking to get short in. That being said, if we could get a weekly close above the 1.39 level, then I might be tempted to start buying.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.