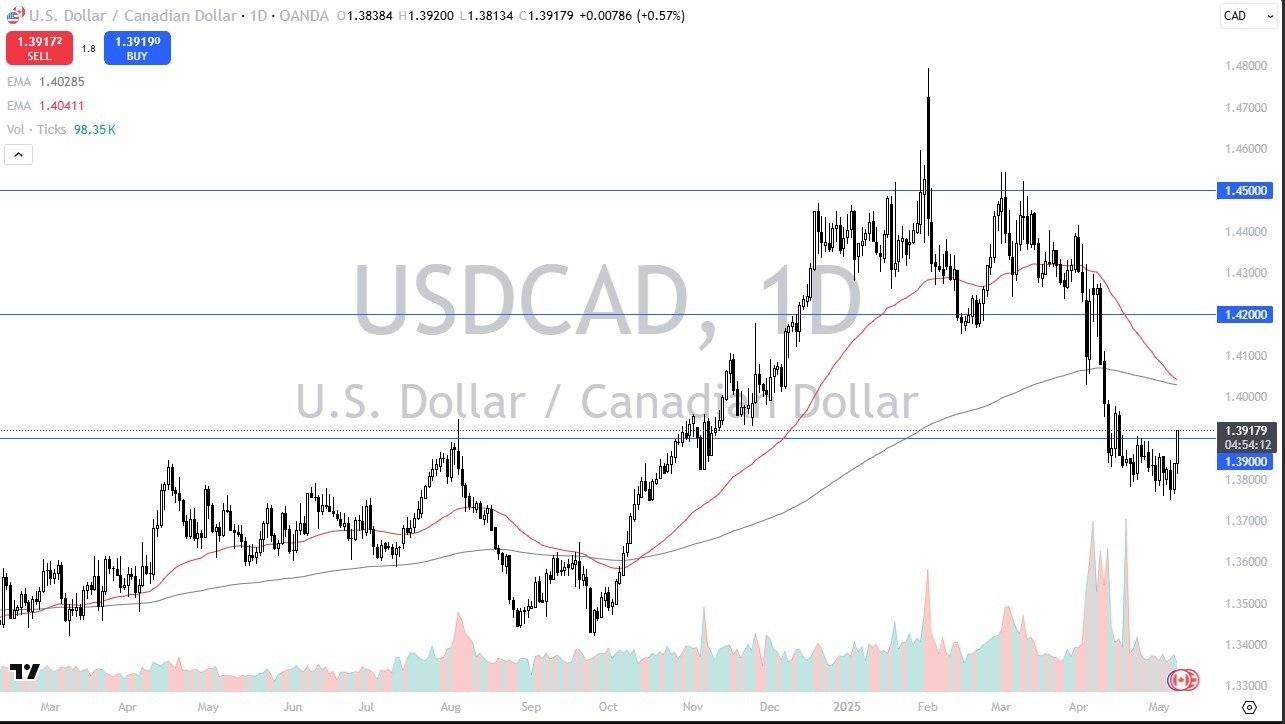

Potential signal:

- If the market closes above the 1.39 level at the close on Thursday, I am long with a stop loss at 1.38 below.

- I would be aiming for the 1.4150 area.

The US dollar has seen a lot of volatility during the trading session on Thursday, which of course was increased as it looks like the idea of dropping tariffs against the Chinese is possible this weekend, kicking off a major “risk on” type of move. While this normally would potentially favor the Canadian dollar, with interesting is that the US dollar has spiked against most currencies. With that being said, it does make a certain amount of sense that we may get a little bit of follow through, mainly due to the fact that the US dollar has been punished by the markets for tariffs.

That being said, I do think this is a market that is in the process of bottoming, and it is probably worth noting that we are in the region of the major area of previous resistance. Furthermore, we have to keep in mind that the Canadian economy itself isn’t necessarily doing as well as the American economy, and this will only add more pressure on the Canadian dollar.

Top Regulated Brokers

Technical Analysis

The technical analysis for this USD/CAD pair is a bit of a “2 speed market.” What I mean by this is that the recent trading has been very negative for the pair, but when you look at it from a longer-term standpoint, it’s somewhat obvious that we have been fairly bullish. Most of the destruction of the pair has been done over the last month and ½ or so, but when you look at it over the last couple of years you can see just how strong the US dollar has been. I suspect we may see that come back into play again.

Top Regulated Brokers

What I find particularly interesting is that while oil spiked during the comments coming from Pres. Trump, the Canadian dollar did not take advantage of that. In fact, we saw the exact opposite of the longer-term correlation, which does make a certain amount of sense considering that we have seen the Americans increase production quite wildly over the last several years, so the benefit of oil in this pair for the Canadian dollar is all but gone. Having said that, the Canadian dollar may fare better against other currencies, but it won’t be the US dollar.

Ready to trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.