- We have seen US dollar strength across the board and the Swiss franc of course will be no different at this juncture.

- It looks like we are trying to do everything we can to rally a bit.

- But when you think about it, it does make a certain amount of sense that maybe a little bit of short covering is going on during the Thursday session as Friday has the non-farm payroll announcement coming, which will move the markets pretty significantly.

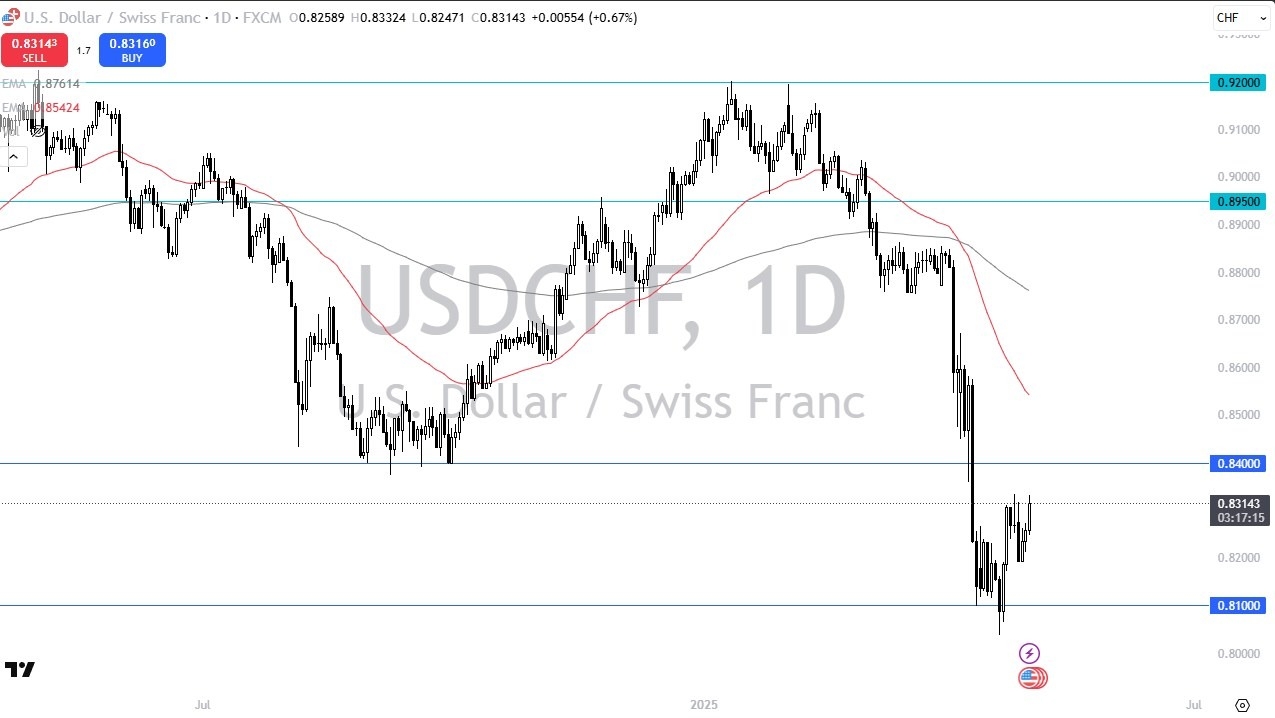

The 0.81 level underneath is significant support. And therefore, I think you need to pay close attention to that as we have bounced so hard from that level. That being said, the 0.84 level above is a significant barrier. And I do think that the 0.84 level is an area that previously had been support. And I do think that it becomes resistance on the way back up.

That doesn't necessarily mean that I think we have to worry about that as a shorting opportunity. Rather, I would watch very closely as to how things behave. Keep in mind that the Swiss franc is considered to be a safety currency. And while the US dollar is as well.

Top Regulated Brokers

Dollar is a bit “Riskier” than the Franc

You also have to keep in mind that the US dollar is a little riskier than the Franc, especially these days. So, with that being said, I would look at this as a potential trade setting up.

We'll just have to see if we can continue to go above 0.84 or if we show exhaustion. It's most certainly in a downtrend and you should keep that in the back of your mind. So ultimately, I am looking forward to seeing if we wick here. And if we don't, and we just go higher, then we could go as high as 0.86.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.