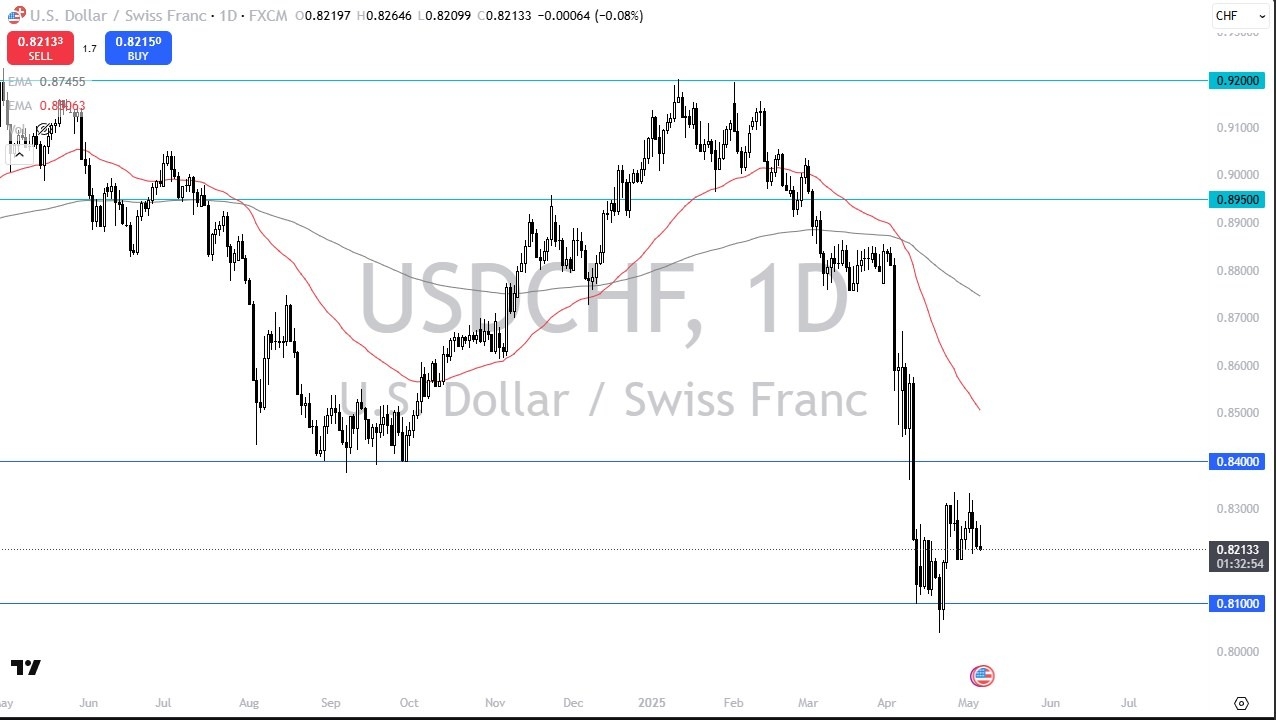

- The US Dollar initially rally during the trading session on Tuesday but gave back gains rather quickly against the Swiss franc.

- That being said, we have a situation where the market is doing everything it can to fill this area and form some type of base, but keep an eye on the 0.81 level, because that’s an area that has been very important more than once.

- It could serve as a little bit of a floor at the moment, but I think ultimately you need to recognize that the US dollar is going to move in the same direction against almost everything.

Technical Analysis and Jerome Powell

Top Regulated Brokers

The technical analysis for this USD/CHF pair is obviously very negative, but the 0.81 level did bring in value hunters. If we can turn around and break to the upside, the 0.84 level is an area that I think could cause a little bit of resistance. If we can break above that level, then the market is likely to continue going much higher, perhaps reaching the 50 Day EMA, presently sitting at the 0.8515 level. Nonetheless, we also have to keep in mind that the market is going to have to pay close attention to the FOMC meeting and perhaps more importantly, the FOMC press conference. While there is no serious concern about the FOMC raising rates, the reality is that markets are going to continue to see a lot of questions about the forward guidance of the Federal Reserve.

I suspect that this is going to be a very US dollar centric move during the trading session on Wednesday, and if this pair starts the selloff early, if you see US dollar strength, this might be the sneak play for those wanting to get involved in some type of “value trade.” With that being said, the market continues to see a lot of volatility, and I do think that we have a scenario where the market is still in the process of at least trying to find the bottom.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.