Potential signal:

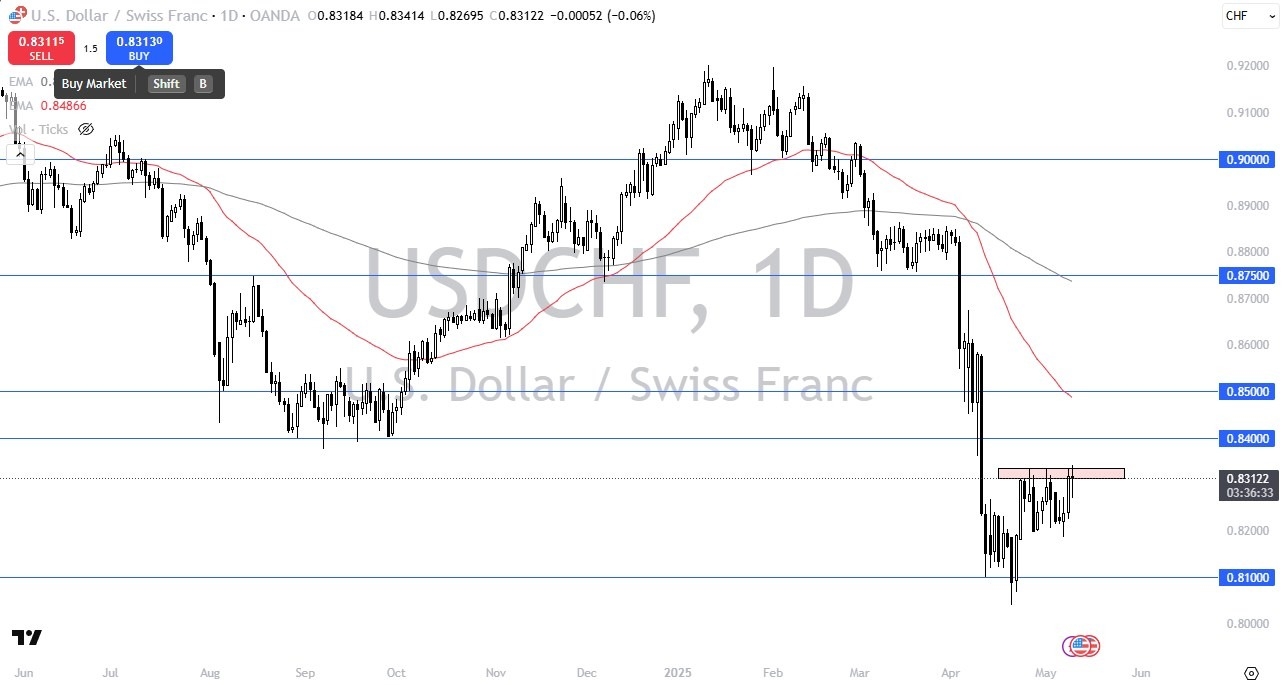

- I’d be a buyer of the USD/CHF pair at the 0.8360 level with a stop loss at the 0.8310 level.

- I’d be aiming for the 0.8490 level.

During the session on Friday, we have seen the US dollar go back and forth against the Swiss franc, but it is interesting that he continues to pressure the resistance, suggesting that perhaps we are starting to see a little bit of buying pressure here. If we can break out above the 0.8350 level, then it could very well lead to a more aggressive move to the upside buying the US dollar.

Top Regulated Brokers

US Dollar Oversold

The US dollar is most certainly oversold around the world right now, and the Swiss franc will be any different. That being said, you should keep in mind that the Swiss franc is considered to be a safety currency, so it is very likely to be a place where people will run to if we get bad news over the weekend between the Americans and the Chinese did the trade talks. I don’t necessarily think anybody is expecting a trade deal, but any signs of moving forward would probably have people looking to take advantage of a recovery with the US dollar against multiple currencies, not just this one.

When you look at the charts around the world, you can see that the US dollar has been sold aggressively, and it does look like we are doing everything we can to turn things around against multiple currencies such as the Canadian dollar, the British pound, etc. The Swiss franc will be any different, because the interest rate differential most certainly favors the US dollar, as the Swiss have almost no interest attached to their currency, and of course you get paid to hang on to this pair.

This isn’t to say that it’s a shot straight up in the air, because quite frankly I don’t think it will be. We would need to see a massive shift in attitude to make that happen, and I think it’s more likely that we will see the occasional pullback offering opportunities. The 0.82 level below could be an area of interest, followed most certainly by the 0.81 level, which was the swing low. On the upside, I’d be watching the 0.85 level for potential trouble if you are in fact buying.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.