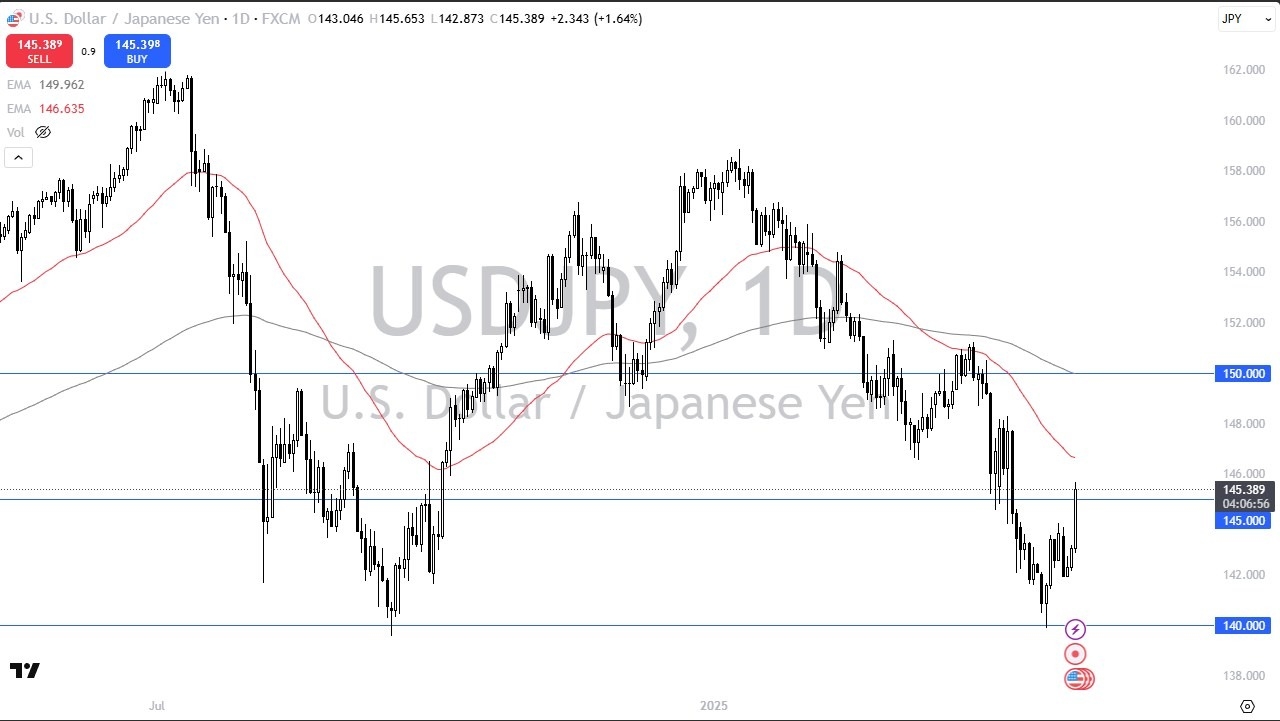

- It's been an explosive move to the upside for the dollar against the Japanese yen during trading on Thursday after the Bank of Japan chose to do nothing.

- They don't really have enough clarity due to the tariffs to tighten monetary policies.

- So, it looks like we may be back to the old correlation.

- We'll just have to wait and see as interest rates most certainly favor the United States dollar.

Ultimately, I think you've got a situation where traders will look to take advantage of short-term pullbacks that show signs of support. And now that we're clearing the 145 yen level, the next focus will be on the non-farm payroll announcement on Friday. That of course could have a major influence on what happens next, but we'll have to pay close attention because if it shows that the jobs market in America is not slowing down, that could very well put more pressure on the Fed to stay tighter for longer, which should, in theory, send this market to the upside.

Volatility Ahead

Top Regulated Brokers

That being said, anything's possible and you have to be careful with this type of volatility on Friday. So, I would be more apt to trade this at the close once we know what the truly thinks of what everything's doing. If we do pull back, I think somewhere near the 144 yen level, we have a very real possibility of a support level that could come into the picture as we formed that V pattern underneath.

Everything being equal, I do like this pair for a longer term trade, but I recognize it's going to take a lot of work to get back to the highs again. But this could be one of those things where you just invest, you hang on to it and you collect the swap at the end of the day and take the appreciation over time.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.