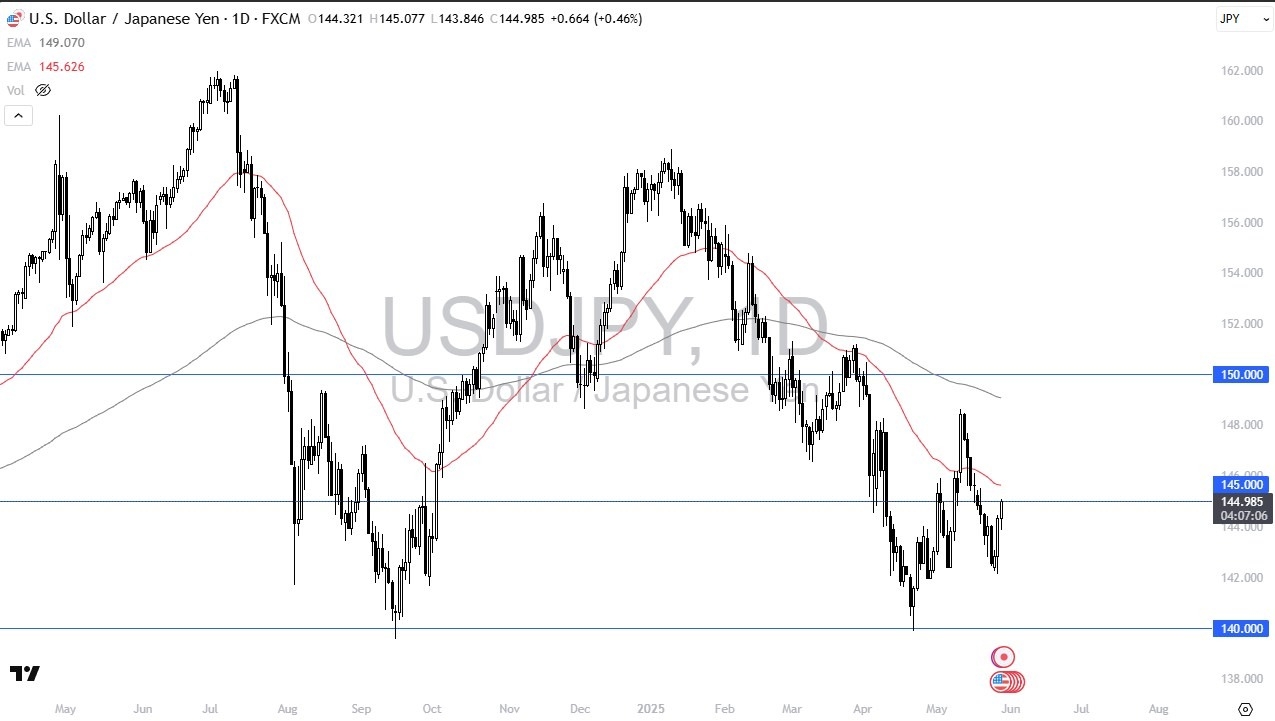

- The US dollar initially did dip against the Japanese yen but has turned around to show signs of life during the session on Wednesday.

- All things being equal, I think this is a market that continues to see a lot of questions asked of the 145 yen level which obviously is an important large round, psychologically significant figure.

- With that being the case, I think you need to look at this through the prism of whether or not we can break above there.

- If we can in fact break above the 145 yen level, at least cleanly, then we have a situation where we will test the 50-day EMA and then perhaps continue to go higher.

Ultimately, this is a market that I believe remains sketchy and noisy, but I do favor the upside overall. If we break above the 50-day EMA, then it's likely that we will go looking at the 148 yen level, an area that previously had been significant resistance and where we are hanging around and watching the 200-day EMA appear.

Top Regulated Brokers

Obviously, the 200-day EMA will continue to attract attention in and of itself. And with that, I look at this market as one that is trying to get there. Whether or not we can get there quickly is a completely different story, but I do recognize that we are at least in the process of trying to form some type of double bottom, if you will. And as we have exploded to the upside from the 142 yen level in the last couple of days, I am starting to look at the 142 yen level as your floor in the market, at least at the moment.

On a Break Lower

If we were to break down below there, then you have to look at 140 yen, which has been important multiple times in the past. So, it's not a huge surprise to see a significant amount of bullish pressure at these very low levels. The question now is, will the interest rate differential continue to favor the green back over the Japanese yen, at least as far as market action is concerned, because the interest rate differential is very large between these two currencies.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.