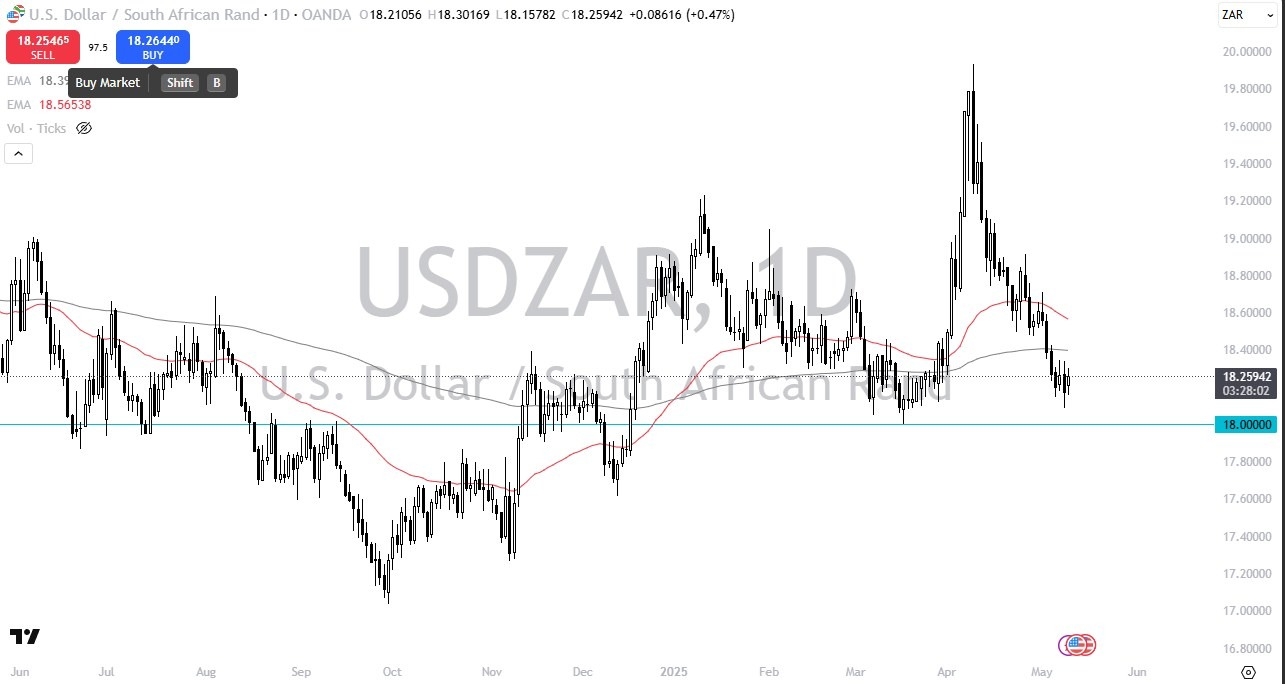

- During Friday trading, we have seen the US dollar rallied slightly against the South African Rand, as we continue to pay close attention to a major support level just below.

- Furthermore, we are also paying close attention to the idea of risk appetite, and while risk appetite is a little bit shaky at this point, the reality is that we need to pay close attention to how the overall world is behaving.

- This is due to the fact that the tariff wars continue to cause chaos, and of course we have to pay close attention to whether or not trade is going to flow freely, or if we are going to continue to struggle.

This is where South Africa comes in, as it is a major commodity exporter. Furthermore, the United States seems to be less than pleased about the political leanings of the South African government, and as a result there is the possibility that sanctions continue to be a major theme of life for South African traders. All things being equal though, when you look at the technical analysis, there is a very clear line in the sand if you will, sitting just below where we are right now.

Top Regulated Brokers

Technical Analysis

The support level at the 18 ZAR level is a major point of control in the market, and I think a lot of people will be watching it very closely. When you look at this chart, you can see that we are below the 200 Day EMA, which sits at the 18.40 level, so a break above that would be the first real sign of strength. If we break down below the 18 level, then things get ugly, and we could drop down to the 18.60 level.

Keep in mind that the US dollar is considered to be “safer” than the South African Rand, although at this point in time the reaction to fundamentals is completely backwards from what we are used to, mainly due to the fact that the biggest problem that we have right now is whether or not the United States is going to be trading with other countries. If and when the United States starts signing other deals, it’s very likely that the buyers will jump back in.

Ready to trade our daily Forex forecast? Here’s some of the best trading platforms in South Africa to check out.