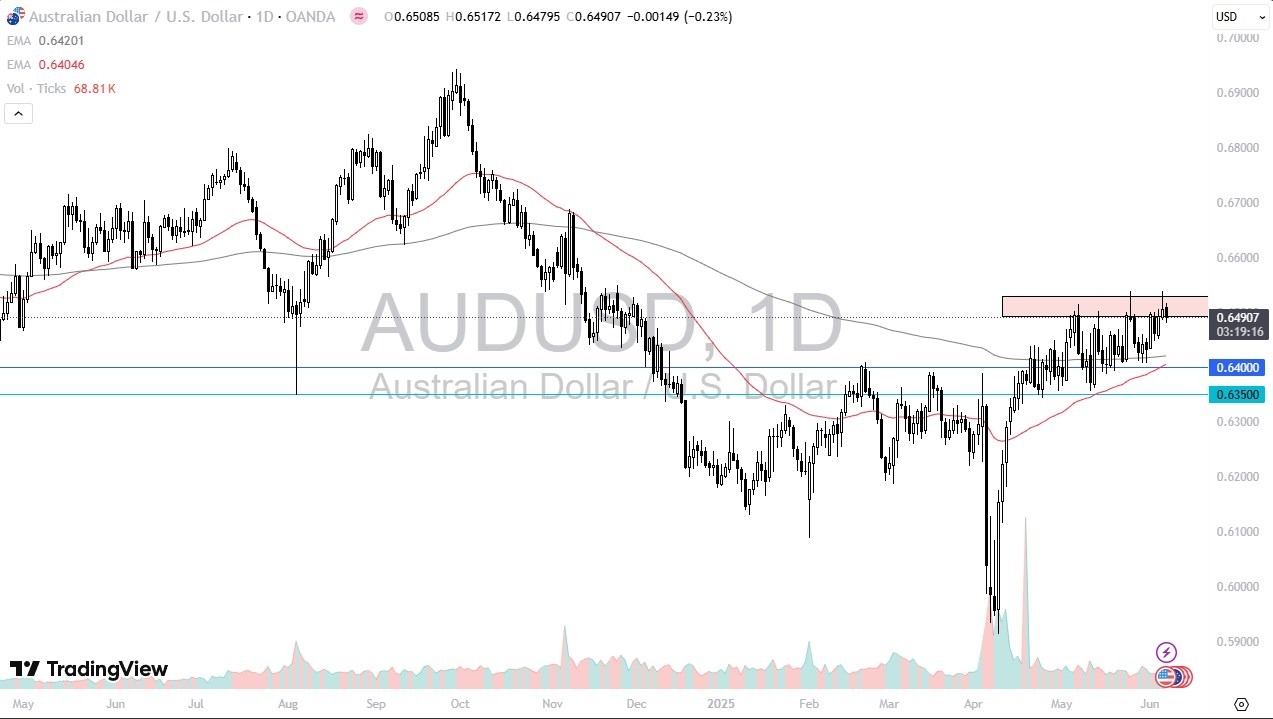

- The Australian dollar drifted a bit lower during the trading session on Friday as we continue to see a major barrier in the neighborhood of the 0.65 level.

- This is more or less a 50 pip range that offers a bit of a ceiling.

- The fact that we fell is not a huge surprise considering that the Non-Farm Payroll announcement came out hotter than anticipated during the Friday trading session, and of course we were at the top of the overall range that we have been stuck in for a while.

- Because of this, it makes a certain amount of sense that we would see the market try to return to it.

That being said, the market is still “lean to the upside”, so I am watching very closely the shooting star from the Thursday session, because I think if we break above there, we could see this market really start to take off to the upside, perhaps reaching toward the 0.66 level, or maybe even as high as 0.67 level over the longer term.

Top Regulated Brokers

Australia and China

The Australian economy is highly levered to the Chinese economy, so therefore you need to keep an eye on what’s going on over there as well. China is a bit of a mess at the moment, and quite frankly that’s surprising considering that most of the data coming out of China is questionable at best. Even in this environment, a lot of the data has been a little bit tricky to get excited about. Furthermore, we also have the talks between the Americans and the Chinese that will cause a lot of headlines going forward.

If we drop from here, then I think we could see this market drop down to the 200 Day EMA, just above the 0.64 level. Anything below there then becomes rather toxic for the Australian dollar, which might be attached to the situation in China, depending on whether it gets better or worse.

Ready to trade our Forex AUD/USD analysis and predictions? Check out the best forex trading platform Australia worth using