While Bitcoin volatility remains elevated, the flagship cryptocurrency has formed a classic bullish continuation pattern backed by high network growth and optimism around the second round of US-China trade talks.

US-China Trade Talks Raise Hopes for Market Calm

Fresh US-China trade talks, which kicked off in London on Monday, Junce 9, 2025, have sparked optimism for de-escalating tensions, boosting global market sentiment. The talks, involving key officials like US Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng, aim to reduce tariffs, previously 145% on Chinese goods and 125% on US exports—that have disrupted supply chains and raised recession fears.

A potential deal could stabilize equities, increase risk appetite, and drive capital into assets like Bitcoin, seen as a hedge against economic uncertainty.

Reduced tariffs could also weaken the US dollar, enhancing Bitcoin’s appeal as a store of value. Additionally, positive trade outcomes may counter inflationary pressures from upcoming CPI data, reducing fears of tighter Federal Reserve policies that could dampen crypto markets.

Top Regulated Brokers

The US Consumer Price Index (CPI) for May is due for reading on Wednesday, June 11, with markets fearing that a negative outcome of the US-China talks could add pressure on market prices.

Market analysts project the US CPI to rise 0.3% month-over-month and 2.3% year-over-year. Core CPI, excluding food and energy, is forecasted to increase 0.3% month-over-month and 2.9% year-over-year.

A CPI reading showing increasing inflation could reduce Fed rate cut possibilities, potentially adding headwinds to BTC price.

If talks produce positive outcomes, increased investor confidence could propel Bitcoin higher to new all-time highs, aligning with forecasts of a broader crypto market surge.

High Network Growth Backs BTC Price Upside

Bitcoin’s potential to rise from the current levels to new all-time highs is backed by increasing network growth.

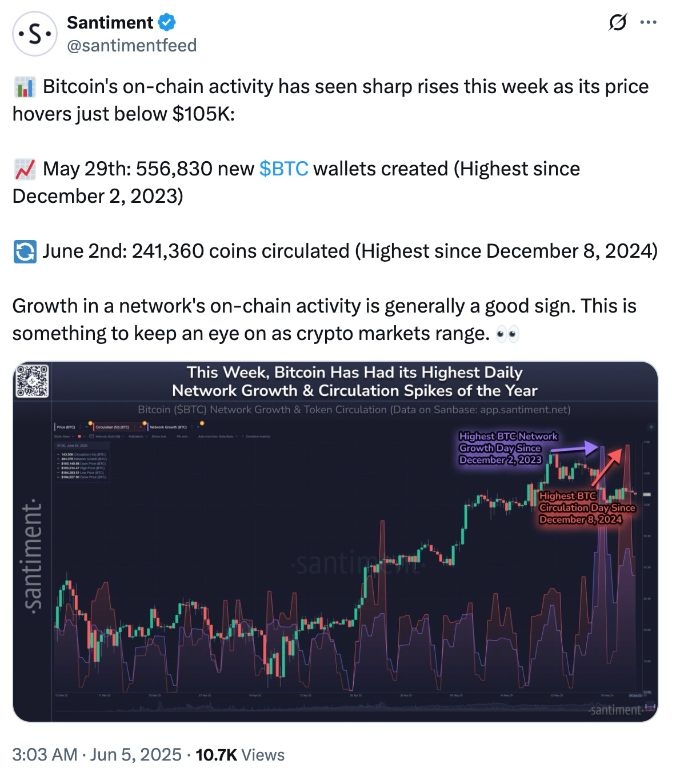

Data from market intelligence firm Santiment reveals a significant surge in Bitcoin's network activity over the last week, with 556,830 new wallets created on May 29, 2025, the highest since December 2023, and 241,360 coins circulated on June 2, 2025, the most since December 2024.

Bitcoin Network Growth

This heightened activity signals robust network engagement, often a precursor to price appreciation. New wallet creation reflects growing investor interest, potentially from retail or institutional players, and increasing demand. High coin circulation indicates active trading or repositioning by large holders, tightening supply as coins move off exchanges.

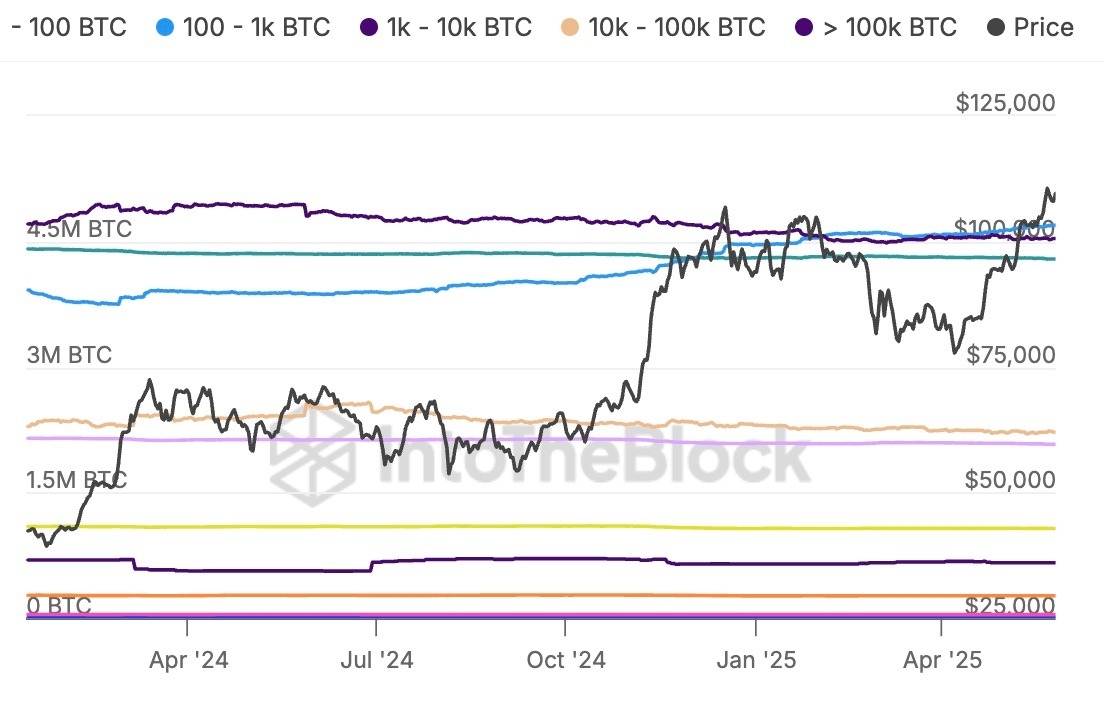

Additional data from IntoTheBlock shows a 145% increase in whale inflows and 79,244 BTC accumulated by mid-tier holders (10-10,000 BTC) in a week, reducing available supply. This supply squeeze, coupled with strong accumulation, supports bullish momentum.

Bitcoin balance by holdings. Source: IntoTheBlock

A low Network Value to Transactions (NVT) ratio of 45 on June 2 suggests Bitcoin is undervalued relative to transaction volume, reinforcing upward potential. These metrics, alongside technical patterns like the bull-flag formation, align with projections of Bitcoin reaching $160,000, as increased adoption and reduced sell pressure drive the price toward new all-time highs.

Bitcoin Bull Flag Targets $160,000

From a technical perspective, the Bitcoin price action has led to the formation of a bull flag pattern in the daily timeframe, projecting a massive move upward for the biggest cryptocurrency by market capitalization.

A bull flag is a bullish technical chart pattern signaling a potential price continuation upward after a strong rally. It forms when the price consolidates in a downward-sloping channel or range, resembling a flag, following a sharp upward move (the flagpole).

The pattern indicates buyers are pausing before resuming the uptrend. It resolves when the price breaks above the upper trendline of the flag, typically with increased volume, confirming the continuation.

BTC/USD Daily Chart

The bull flag resolved after the price broke above the upper trendline at $105,300 on Sunday, June 8, 2025. Bitcoin could now rise by as much as the previous uptrend’s height. This puts the upper target for BTC price at $160,000. Such a move would represent a 49% price increase from the current levels.

Additionally, Bitcoin’s daily relative strength index is positive at 57. This suggests that the market conditions still favored the upside, boosting BTC’s chances of reaching its bull flag target.

Conversely, if the asset turns down from the current price to produce a daily candlestick close below the flag’s upper trendline at $105,300 could suggest the inability of the bulls to sustain higher levels.

The price could continue consolidating with the flag for a few more days, with traders keeping an eye on the key level at the $100,000 psychological level.

Ready to trade our technical analysis on Bitcoin? Here’s our list of the best MT4 crypto brokers worth reviewing.