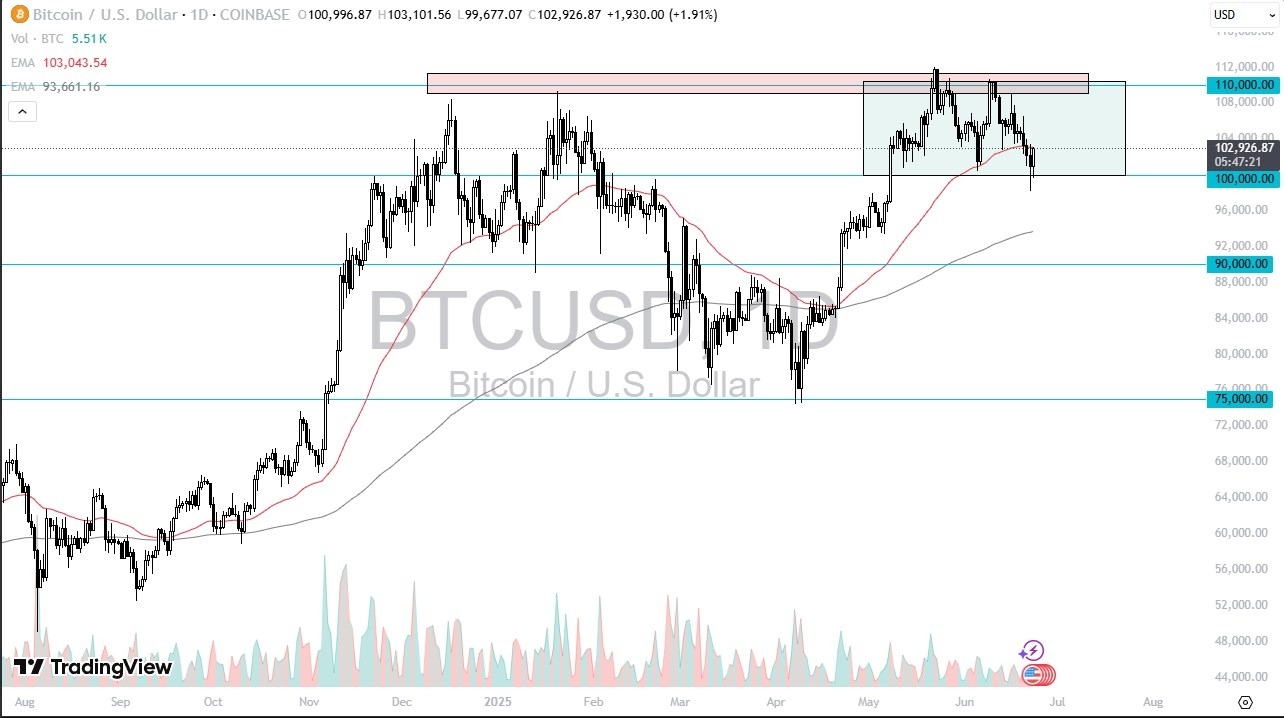

- Bitcoin has shown its resiliency during the trading session on Monday, as we initially dipped below the $100,000 level on Sunday, but Monday retested that big figure only to turn around and start rallying again.

- And with that being the case, I think you have a situation whereas we challenge the 50 day EMA, I don't know that anything has changed.

- Despite the fact that escalation in Iran obviously has a lot of traders out there worried about risk appetite and whether or not they should put on these riskier trades.

I think $100,000 continues to be pretty supportive. If we can continue higher, then I anticipate that Bitcoin will go searching for the $110,000 level yet again. We are still very much in consolidation after a big move higher and we are trying to work off some of that excess froth. This is very typical in bullish markets. You don't go straight up in the air forever. You go higher and then you work off some of that and then you have to convince other people that it's okay for Bitcoin to be at this price and they start buying and pushing it to the upside.

Still Plenty of External Risks

Top Regulated Brokers

There are a lot of geopolitical risks out there right now. So, it's not necessarily an environment where I would expect Bitcoin to rally massively, but you never know. Something could come of it. One thing I do see though, is that Bitcoin is very resilient at the moment. It has been a while. There have been plenty of things out there to make Bitcoin absolutely crater from a risk appetite perspective.

Remember, this is a popular Wall Street ETF now. This is not cryptocurrency anymore, at least not the way it's traded. So, with that, the institutions have a certain amount of incentive to keep this market afloat.

Ready to trade Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.