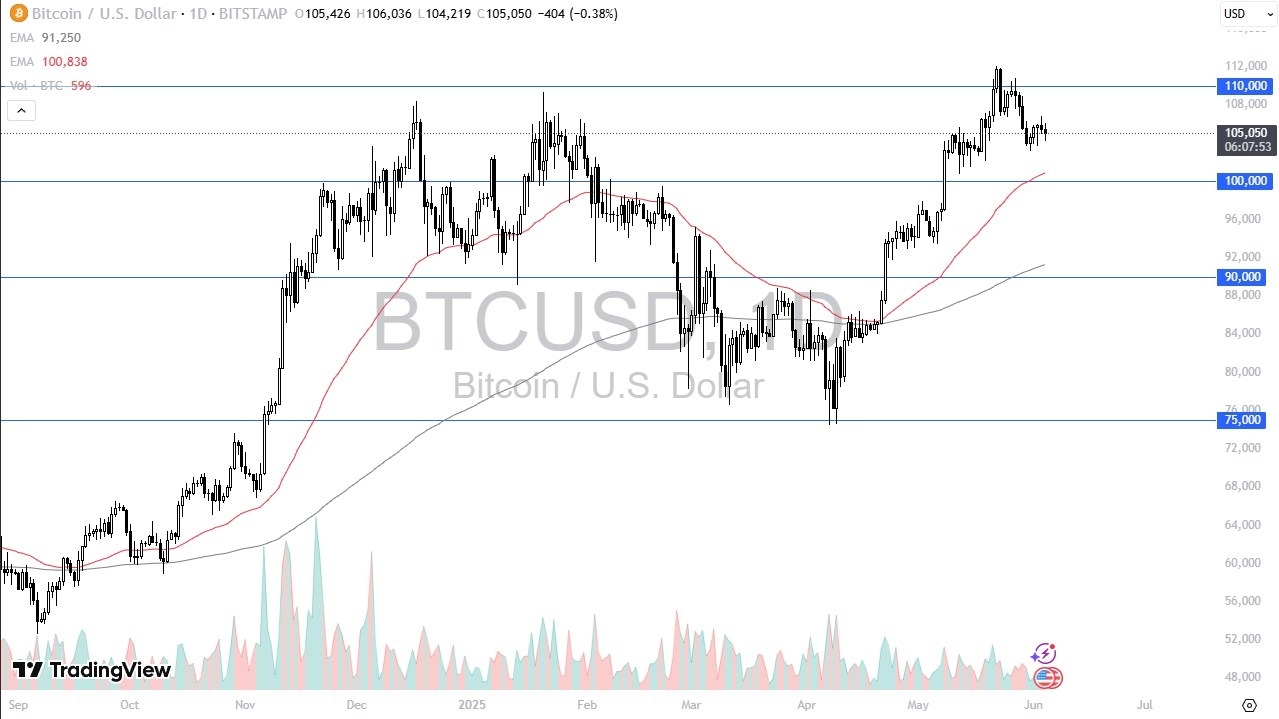

- We've gone back and forth during the session on Wednesday as the Bitcoin market doesn't really know where it wants to go yet, but it is in a range, if you will, as we continue to hang around the $105,000 level.

- The $105,000 level, of course, being halfway between the psychologically crucial $100,000 level, and the psychologically crucial $110,000 level, area that had been a double top previously.

- I'd also point out that the 50-day EMA currently sits just above the $100,000 level, so I think that makes it even more interesting.

When you look at Bitcoin, over the course of about six weeks, we gained about 40%, and that, of course, is a big problem. You need to be able to digest all of those gains, as they came really fast this time.

Top Regulated Brokers

You Have Two Possibilities

And with that being the case, you can either go sideways, which is what really strong trends will do, or you'll pull back. The question is how wide is the consolidation area going to be? I could see the $10,000 gap between $100,000 and $110,000 level being where we trade for a while.

Short-term pullbacks should continue to attract value and buyers, especially longer term ones, but don't be surprised if things get a little bit noisy and difficult to deal with for a minute. If we can break above the $112,000 level, then it opens up the possibility of a move to the $120,000 level, possibly even higher than that over the longer term.

I don't really have any concerns about the overall uptrend in this market, at least not until we break down below the $90,000 level, and even then, I will have to assess all of the fundamental drivers. At this point, the market looks bullish, but also a bit tired at the moment.

Ready to trade Bitcoin forex forecast? Here’s a list of some of the best crypto brokers to check out.