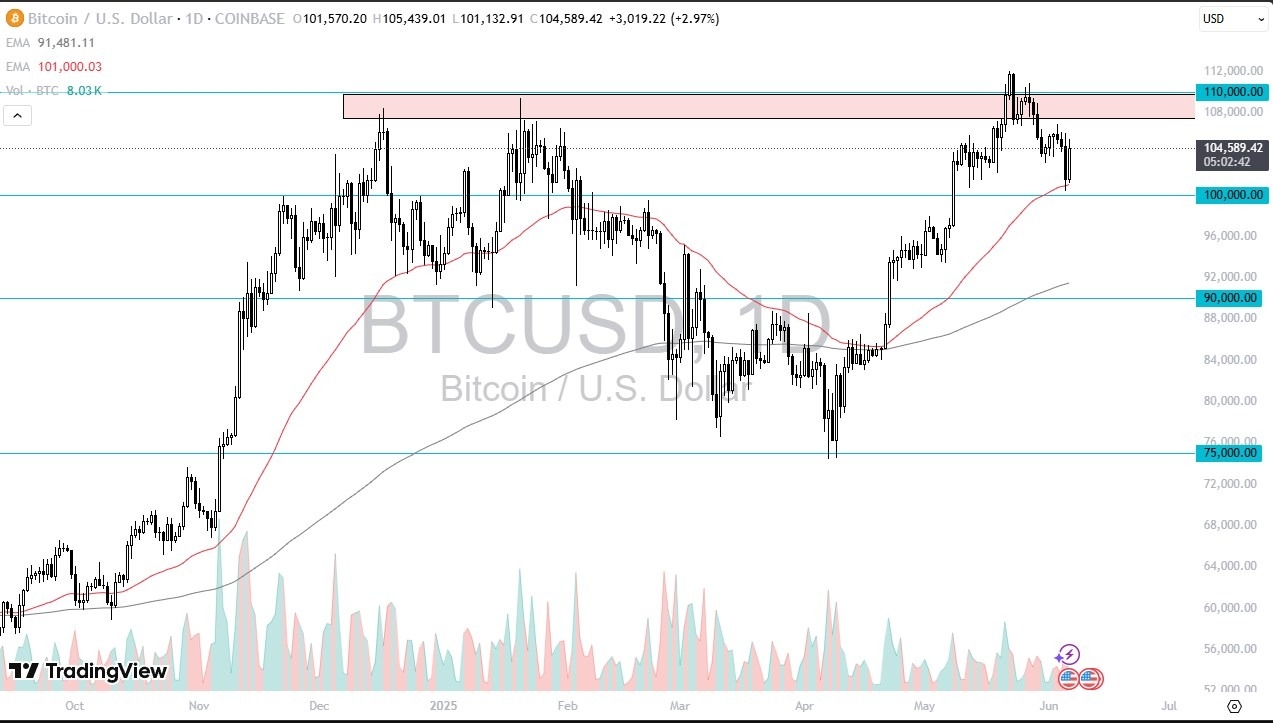

- During the trading session here on Friday as we have bounced from the 50 day EMA.

- This is a bit interesting. I think part of it may have been in reaction to the better than expected jobs number.

- Although I'm seeing headlines that like the one that just popped up on the chart that part of this was due to Trump and Elon arguing online. That sounds like nonsense to me. It sounds like analysts are trying to figure out a reason for the move. Sometimes there is no reason. Sometimes it's just people who are collecting profit.

The 50 day EMA offered support right along with the $100,000 level. Now that to me, makes quite a bit of sense. It's a large round psychologically significant figure that would attract a lot of options traders and a lot of retail traders as they like these big figures. Whether or not we can break out to the upside remains to be seen, but I do think it's more likely than not. The question isn't so much as to whether or not we can do it, but how long it's going to take. If we can clear that $112,000 level, then it's possible that Bitcoin goes looking for a move to the $115,000 level followed by the $120,000 level.

On a Move Lower

On a breakdown below the $100,000 level, then we have the potential to move down to $95,000. And then finally the 200 day EMA. I don't think that's the most likely a pass, but it is something you need to keep in the back of your head.

Top Regulated Brokers

We are in an uptrend, but we did just hit an all-time high and we've kind of pulled back. Looking at the chart, there's really nothing over the last, say, two and a half years that has me even thinking about selling.

And now, I think we've got a situation where we’re going to try to break out. It may take some time, but I think we will get there eventually.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.