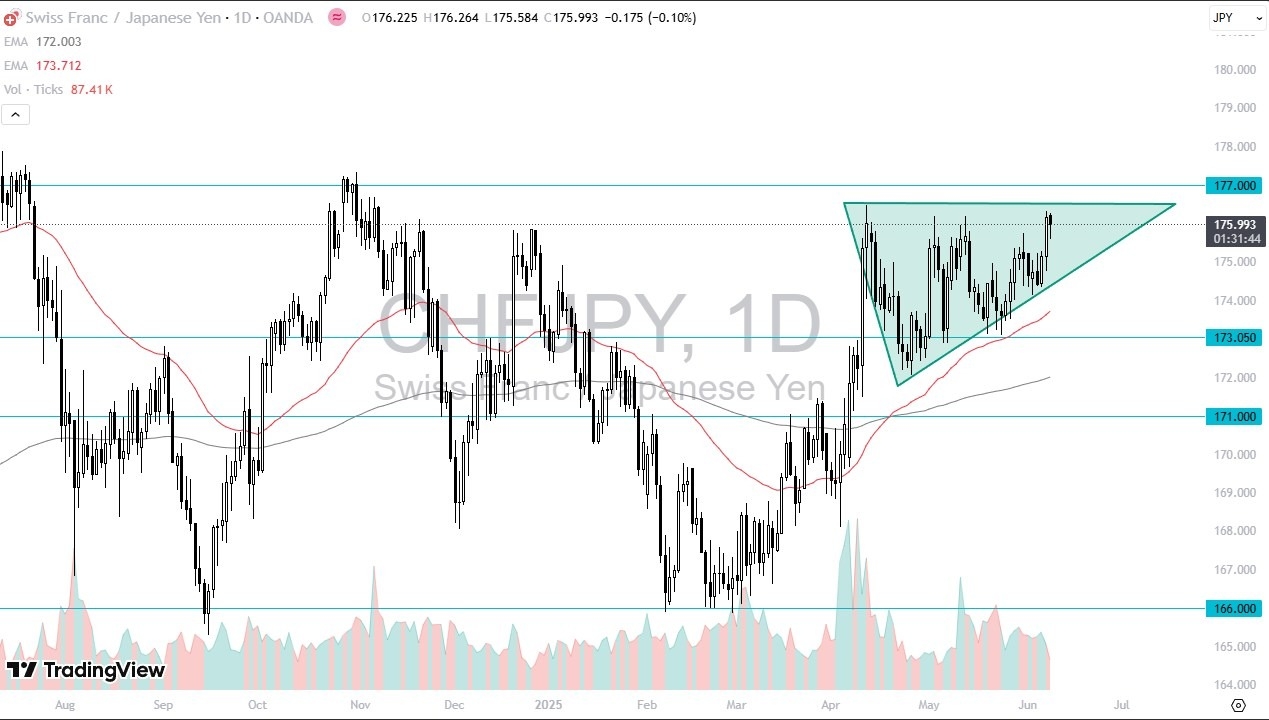

Potential Signal:

- If we can break above the ¥177 level, I think at that point in time you could see the Swiss franc jump to the ¥180 level, and I would short the Japanese yen against most other currencies.

- During the trading session on Monday, we seen the Swiss franc drop a bit against the Japanese yen, only to turn around and show signs of life again.

- While I don’t know many traders who like this pair itself most of the time, the reality is that it is very important to pay attention to.

This is because it is a comparison of 2 funding currencies, as carry traders like the idea of picking a currency to fund another one with and collect swap.

For ages, it’s been the Japanese yen and the Swiss franc that were the most shorted currencies, as the central banks of both countries are extraordinarily loose with their monetary policy.

Japanese Bonds

Top Regulated Brokers

One of the things that you will have to pay attention to is the fact that the Japanese Government Bond market has had a couple of days that saw no bids in the market. In other words, nobody wants to buy Japanese debt, and this is exactly what started the last wave of quantitative easing in Japan. This is a scenario that might have the Bank of Japan stepping into the market to lift government debt. If that’s the case, then it will drive rates even lower, and as a general rule, people will not want to own the Japanese yen. This makes perfect sense, because despite the fact that the Swiss franc is backed up by the Swiss National Bank, which of course is very loose with its monetary policy, but there is demand for Swiss debt.

Top Regulated Brokers

Technical Analysis

The technical analysis for this pair is pretty straightforward as well, as we have seen a massive amount of resistance near the ¥177 level, which is just above the ascending triangle that we had formed. If we can break above that level, then I think the Swiss franc takes off against the Japanese yen, but the biggest signal here would be to buying other currencies against the Japanese yen, not just this one.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.