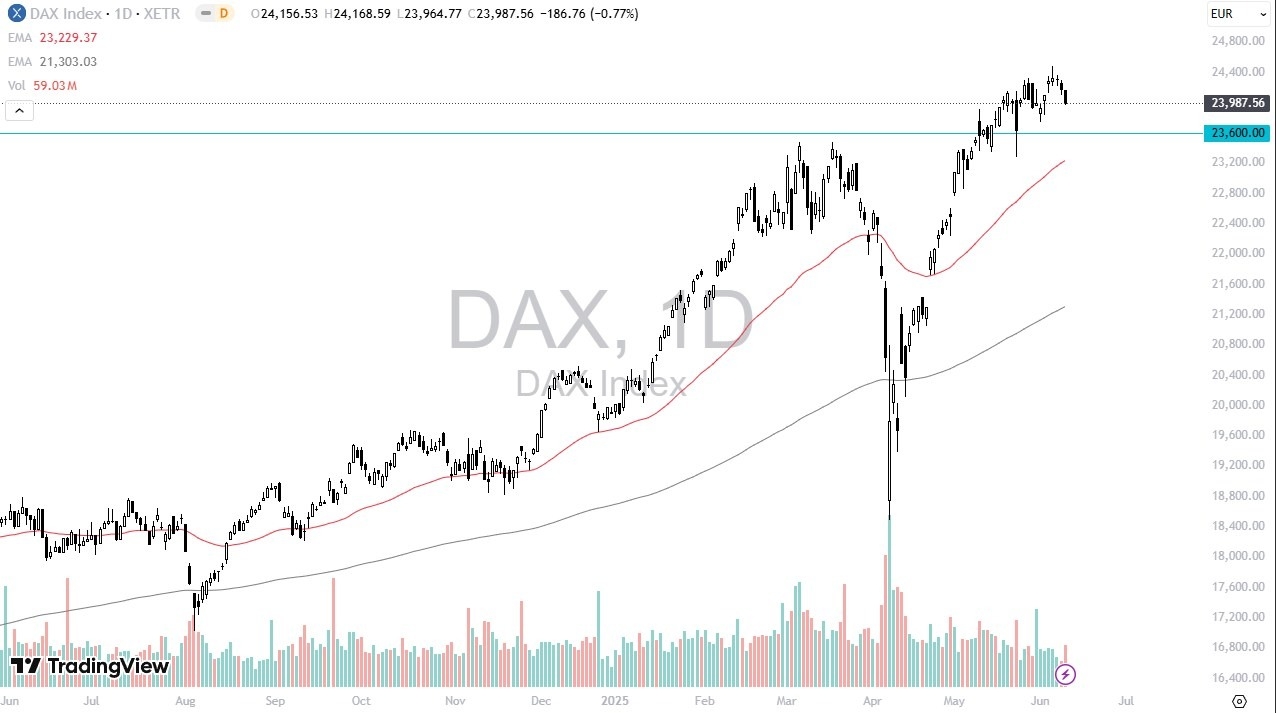

- The DAX has fallen a bit during the trading session on Tuesday as we continue to see a lot of noisy behavior overall.

- At this point, the DAX looks a little bit tired, but I think this makes a certain amount of sense because we have exploded to the upside since the 7th of April.

- We started near the 18,500 euro level and rose all the way to the 24,500 euro region.

So, a little bit of a pullback certainly does make a bit of sense. If we do pull back from here, the 23,600 area is basically where I think we could see buyers come back in. If we can break above the highs of the previous week, then we could go to the 25,000 Euro level, which I do believe is the target longer term. The DAX is a representative of Germany and therefore one of the more important indices in the European union. With that being said, most traders will jump into the DAX first and then start looking around for the possibility of trading the rest of Europe.

Top Regulated Brokers

DAX Leads Europe

So even if you are not a DAX trader per se, you're watching this with great interest because of the DAX rallies quite a bit. It typically will help other indices in places like Spain, the Netherlands, Italy, etc. I do like buying the dip here in this market, we have plenty of momentum, there's really nothing out there that tells me the market is going to collapse. But I also could be convinced that we might go sideways for a while in a market that's just going to have to digest some of this excess momentum to the upside. Again, there's just no interest whatsoever on my part to short this market. And I think it's probably only a matter of time before we go looking to that crucial 25,000 euro level.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.