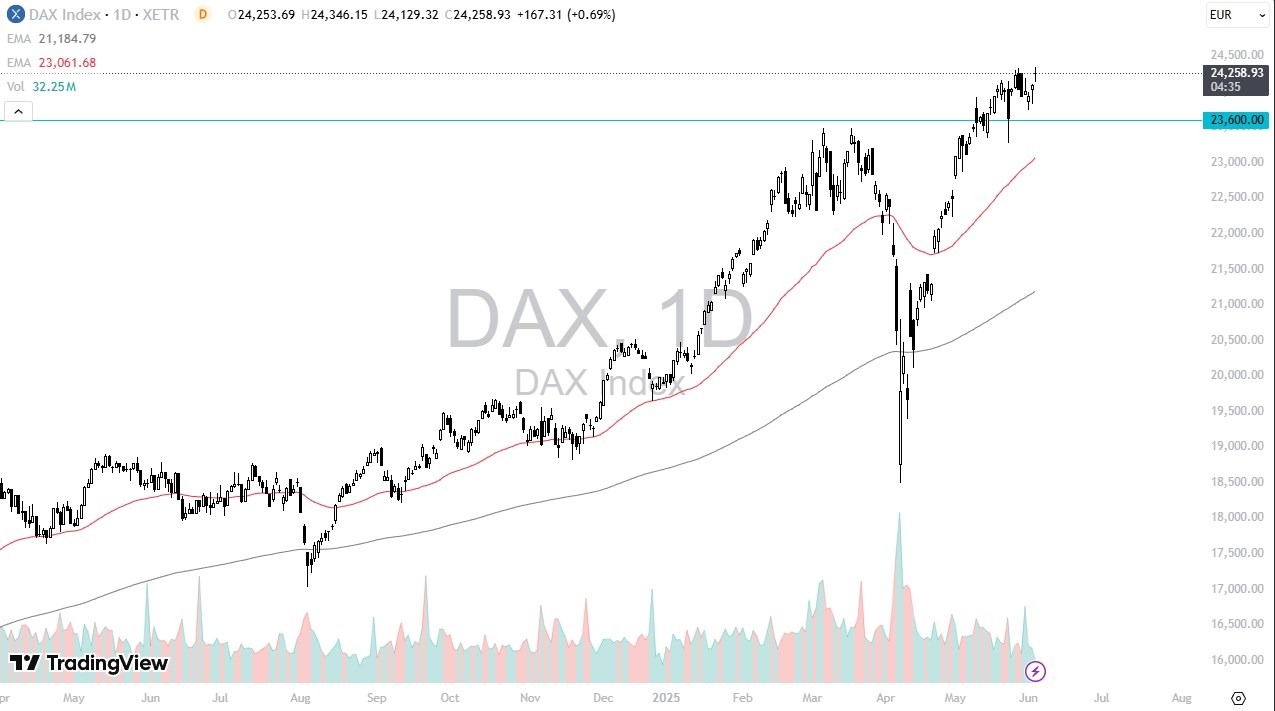

Potential signal:

- If the DAX can close above the €24,300 level on a daily close, I’m a buyer.

- I would have a stop loss at the €23,900 level, and aim for the €25,000 level.

The German DAX rallied right off the bat at the open on Wednesday, to significantly higher, only to turn around and show signs of hesitation. While this isn’t necessarily the type of momentum you want to see with the gap, the reality is that it did not break down from there, and that is a good sign in and of itself. Ultimately, this is a market that’s been very bullish for some time, and it does make a certain amount of sense that we may have to go sideways for a little while in order to work off some of the excess froth that has been part of this market since the early part of April.

Top Regulated Brokers

Technical Analysis

The technical analysis for the German DAX in the altar short-term is somewhat sideways with a slightly positive tilt, whom you look at the longer-term perspective, this is a market that is obviously very bullish. I don’t have any interest in trying to fight the overall trend, and therefore I’ll be looking at short-term pullbacks as a potential buying opportunities in a market that has a history of being rather bullish and volatile.

Underneath, I believe that the 23,600 level is an area that a lot of people will be paying close attention to, as it has offered a bit of support recently. As long as we can stay above that level, then I will consider any pullback at this point in time a potential buying opportunity in a market that is very range bound. If we were to break down below there, then you have to look at the 23,000 level as a potential support level, especially now that the 50 Day EMA is in that same neighborhood. Taking down below then opens up a much deeper correction, but right now I think that seems very unlikely in this type of environment.

On the upside, if we were to break out above the consolidation area, rallying above the €24,300 level, then I think we go to the €24,500 level, followed by the €25,000 level from a psychological standpoint. I do believe that the DAX remains to be a very bullish market overall.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.