- The euro initially spiked against the Australian dollar in a risk off type of move after the Israeli airstrikes in Iran.

- But we have since seen the euro give up some of its gains.

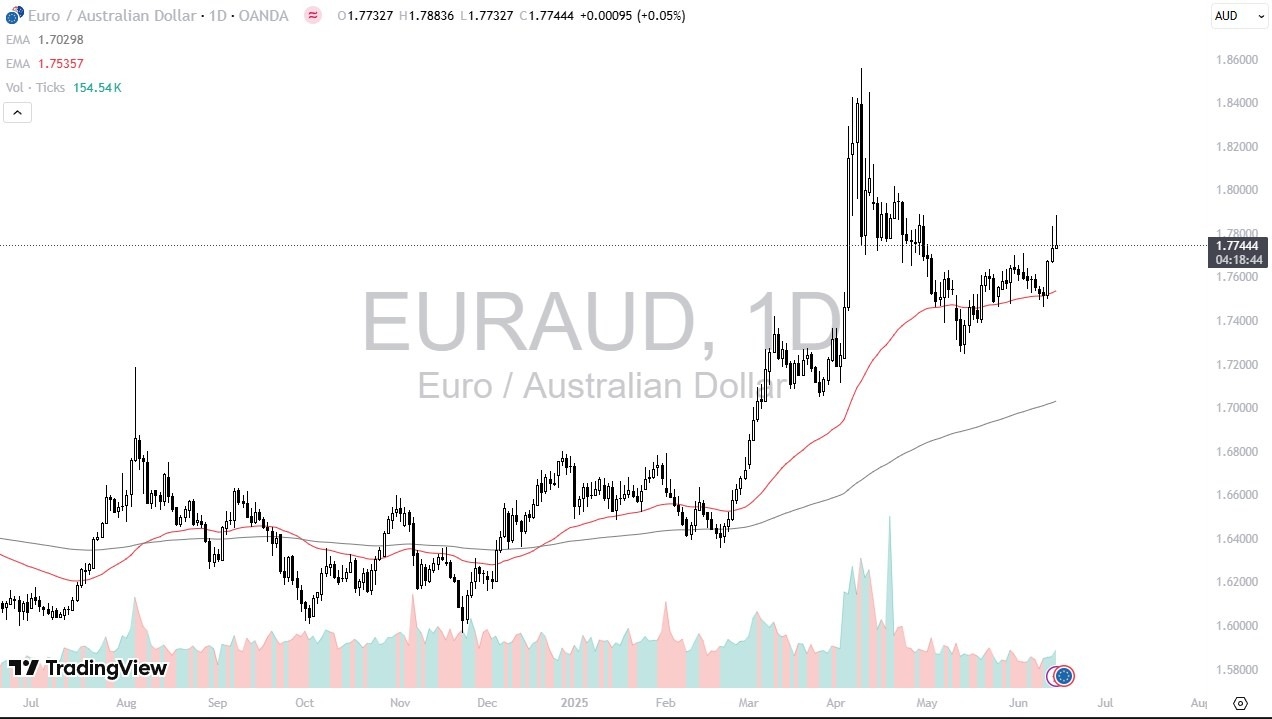

- In fact, it looks like we are closing with a shooting star right in an area that had been pretty significant supply previously.

So, while I'm not ready to start shorting this pair, it certainly looks as if it is one that could be sold given enough time. It'll be interesting to see how this plays out. We had recently seen a little bit more of a lean towards the Australian dollar and that is more risk on behavior.

Top Regulated Brokers

We're seeing this across the board when it comes to risk appetite as risk appetite got absolutely crushed overnight, but all day, we've worked our way back towards taking on riskier positions. In theory, that's what this would be, although it’s a relative comparison, it's not necessarily a statement on the euro or the Aussie itself. It's just that the Australian dollar is a little further out on the risk spectrum due to its exposure to commodities and Asia, etc.

On a Break Lower

If we do fall from here, the 50 day EMA is something that I would watch just above the 1.75 level. And if we can break down below there, then the euro is likely to drop toward the 1.7233 level. On the other hand, if we break to the upside, it's not really until we break above the 1.80 level that I'd be convinced in follow through, despite the fact that it would be part of the longer term uptrend. This is a market though, I think is probably going to continue to be very noisy and unfortunately will probably move on the latest headlines coming out of the Middle East or random tweet or you name it. It's a market that is basically in the middle of Bitly | Link Managementthrowing tantrums right now, not only in the euro against the Australian dollar, but all markets. So, position sizing should be small.

Ready to trade our daily Forex analysis? Here's a list of the best licenced forex brokers in Australia to choose from