- The Euro rallied significantly against the Japanese yen during the trading session on Wednesday as we continue to see more of a move into risk appetite in what was an overall volatile market in various markets.

- All things being equal, keep in mind that the Japanese yen is considered to be a “safety currency”, one of the euro, although not necessarily a Third World currency, is considered to be a little bit “riskier” than the Japanese yen.

In other words, if we start to see more risk taken in the market, then it makes a certain amount of sense that this market would take off from here. All things being equal, this is a situation where traders will continue to pay close attention to the trade war, and of course the normally is around tariffs. Ultimately, we had seen a comment on social media by Donald Trump that the United States and China may have come to an agreement, and that may have helped this trade peripherally.

Top Regulated Brokers

Technical Analysis

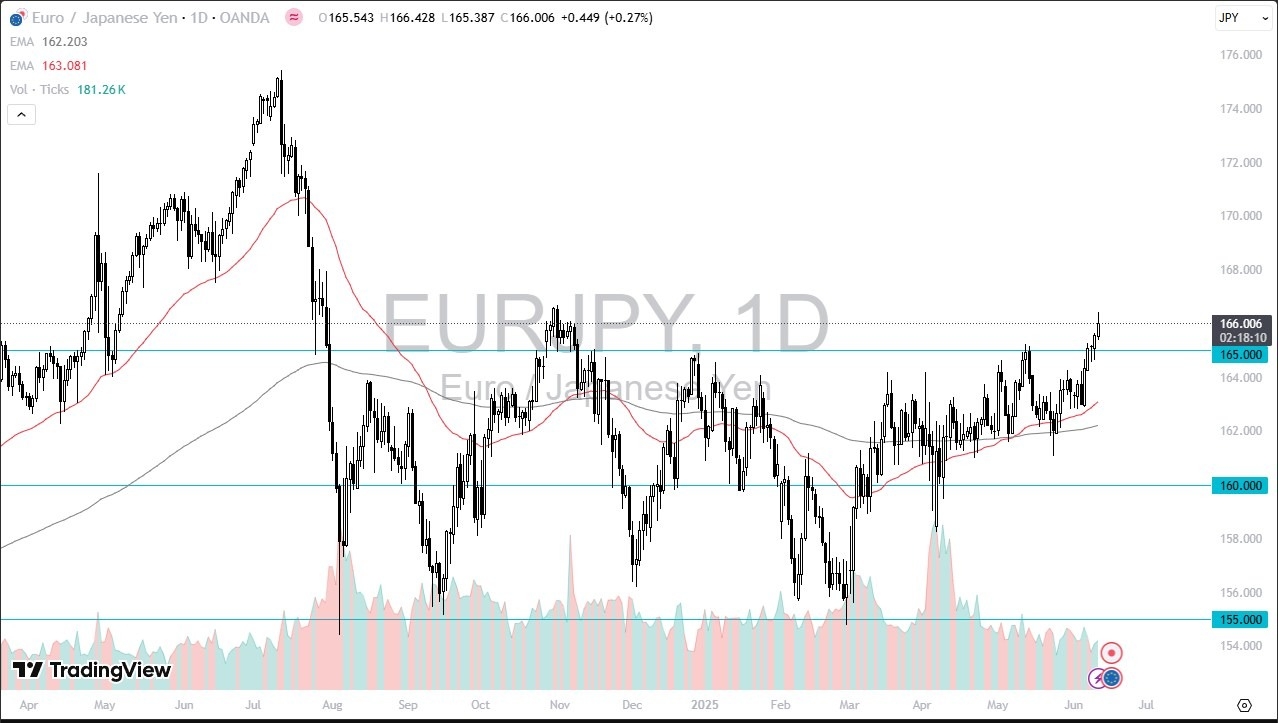

The technical analysis for this pair is bullish, and I look at the ¥165 level as a potential support level. The ¥165 level is an area that has been rather important as resistance previously, so I think you’ve got a situation where there should be a certain amount of value hunting in this general vicinity, and I think that will continue to support the market. On a breakdown below the ¥165 level, then I would be looking at the 50 Day EMA near the ¥163.11 level as the next major support level.

Ultimately, I think one of the things that traders will be paying attention to is the fact that the Bank of Japan has to keep monetary policy rather loose, and therefore the Japanese yen will continue to be somewhat damaged. Ultimately, I think this is a market that remains very much “buy on the pullbacks.”

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.