EUR/USD Analysis Summary Today

- Overall Trend: Strongly Bullish

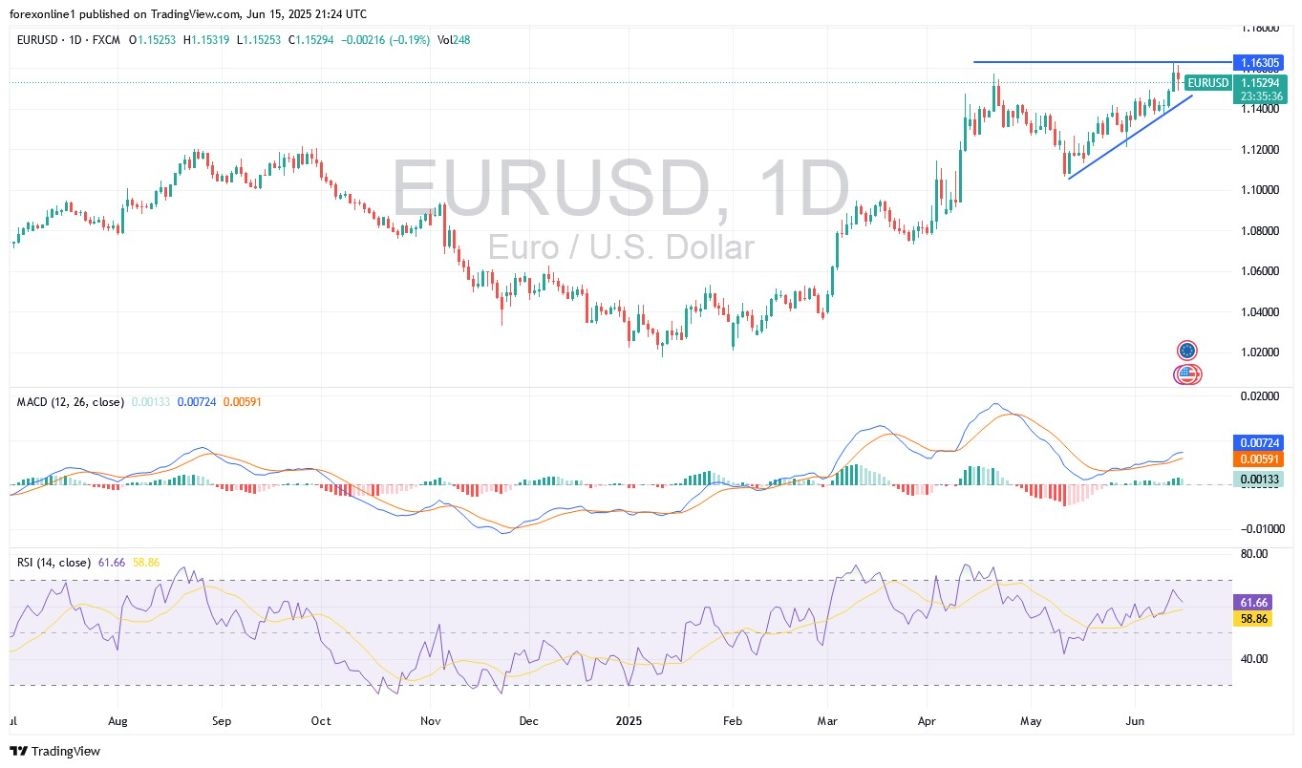

- Today's EUR/USD Support Levels: 1.1480 – 1.1400 – 1.1320

- Today's EUR/USD Resistance Levels: 1.1600 – 1.1680 – 1.1770

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1370 with a target of 1.1520 and a stop-loss at 1.1260.

- Sell EUR/USD from the resistance level of 1.1630 with a target of 1.1300 and a stop-loss at 1.1700.

EUR/USD Technical Analysis Today:

Ahead of significant economic events this week and the escalation of global tensions over the past weekend, we anticipate strong and exciting volatility in forex markets this week. According to licensed trading platforms, the EUR/USD pair jumped to the 1.1632 resistance level, its highest in three and a half years, before experiencing a swift sell-off last Friday. This moved the pair towards the 1.1488 support level before it closed the week settling around 1.1550. This bullish movement in the EUR/USD pair may react to geopolitical tensions in the Middle East in the new trading week, following the Israeli attack on Iranian nuclear facilities, raising fears of a broader regional conflict.

Also, financial markets will closely monitor any progress in trade negotiations between the United States and its major partners. Meanwhile, attention turns to the G7 summit in Canada, where leaders of the world's largest economies will meet to discuss major global challenges. It's also a busy week for monetary policy decisions from global central banks. The US Federal Reserve, the People's Bank of China, the Bank of Japan, and the Bank of England are all expected to keep interest rates unchanged.

Top Regulated Brokers

Trading Tips:

The Euro's gains may be vulnerable to collapse if investor risk aversion increases amid successive global tensions.

Will the EUR/USD Continue to Rise in the Coming Days?

Technically, the overall outlook for the EUR/USD price remains bullish so far. Its recent gains and the breach of the 1.1600 resistance have pushed some technical indicators, led by the 14-day RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) lines, to the brink of overbought readings. I anticipate that the EUR/USD will be a target for selling from above the 1.1600 resistance, especially if forex investors turn to buying the US Dollar as a safe haven amid global trade and geopolitical tensions. The nearest targets for the bulls are currently 1.1660, 1.1720, and 1.1800, respectively. These levels are sufficient to push all technical indicator readings into overbought territory.

Renewed selling of the Euro against the US Dollar is the more likely forecast given events in the Middle East and concerns about the military conflicts expanding to other countries. This threatens crude oil sources, leading to a setback for the future of global economic recovery, which would significantly harm the Euro. Based on the daily timeframe chart, the 1.1370 support level will remain a technical threat to the EUR/USD's upward movement, as it could increase selling pressure towards the psychological support of 1.1200. At the start of this trading week, the EUR/USD is not anticipating any significant economic releases from either the Eurozone or the United States.

Impact of the Iranian/Israeli Conflict on EUR/USD Trading:

According to forex market experts, Israel's strikes on Iran are stimulating a US Dollar rebound, causing the Euro to retreat against the US Dollar from its 43-month high. However, the EUR/USD pair saw a sharp decline to below 1.1520 on Friday, following the Israeli strike on Iranian nuclear facilities, amid escalating geopolitical tensions, a sharp rise in oil prices, and a decline in stock markets. According to trading experts at ING Bank, "We believe the starting point was already quite extended for this EUR/USD pair, and a return to the 1.14-1.15 range seems perfectly appropriate."

Danske Bank noted that "the attack adds significant uncertainty to diplomacy, as US officials deny direct involvement and warn that it could hinder, or unexpectedly force, Iran into discussions."

Overall, the Israeli strikes have added to the underlying trade and economic uncertainty. There is inevitably concern about any escalation as markets remain closed and safe-haven assets are increasingly sought. According to currency trading experts, “The geopolitical turmoil could temporarily distort the US dollar’s downward trend and weigh on risk indicators.” They also point out that “the main difference from previous confrontations between Israel and Iran is the targeting of nuclear facilities, and while crude oil production does not appear to have been affected so far, markets must add a higher risk premium given Iran’s pivotal role in global oil supplies.”

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.