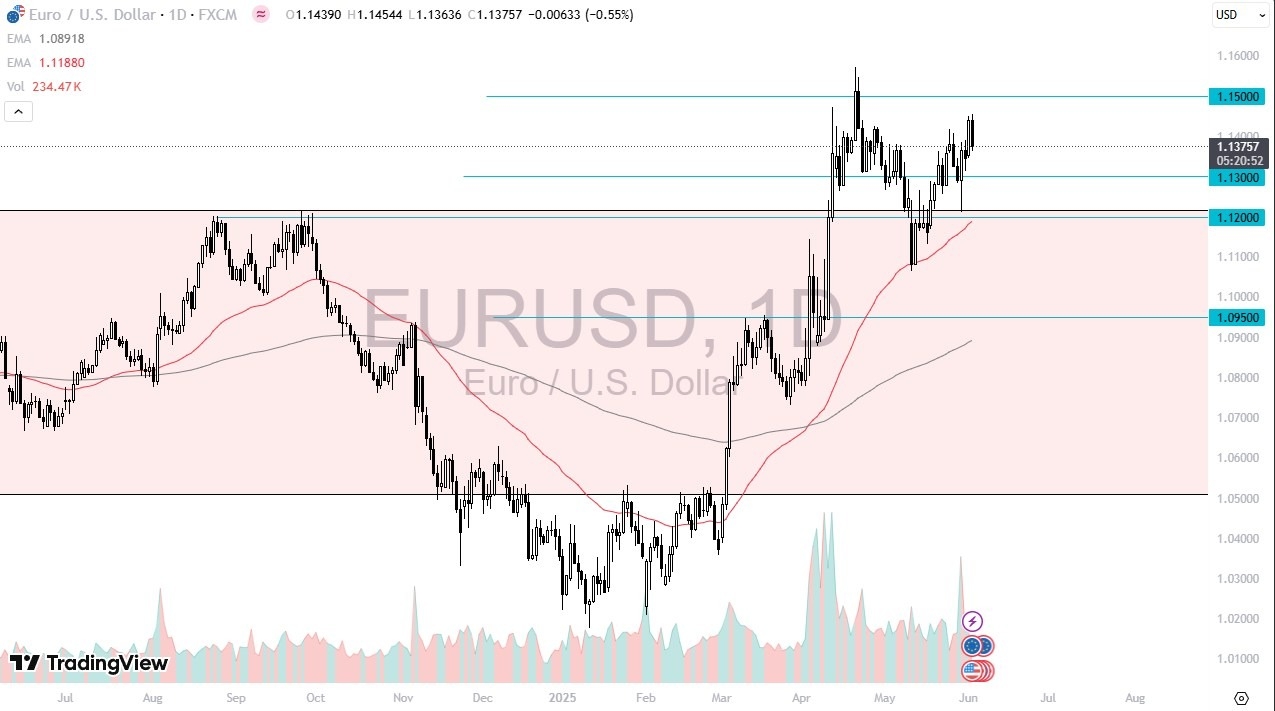

- The euro has initially tried to rally during the trading session on Tuesday, but gave back gains as we have fallen rather significantly.

- By doing so, it looks as if the market is trying to sort out whether or not we have any real shot at breaking out to the upside, or are we going to continue to see more sideways range bound trading?

- I suspect it is a situation where we probably go more sideways than anything else over the long term.

Now that doesn't mean we can't trade within it. It just means that we have a definite range between the 1.12 level and the 1.15 level. This is a market that I think is trying to sort out whether or not we are about to roll over. And today's action on Tuesday does suggest that maybe we could, but it's a little bit early to get aggressively short of the Euro, despite the fact that is looks “suspicious.”

On a Move Lower

Top Regulated Brokers

A breakdown below the 1.12 level would be extraordinarily negative as it would break down below a swing low over the last couple of weeks. And then the 50 day EMA breaking down below the 50 day EMA opens up the possibility of 1.0950 being targeted where the 200 day EMA presently resides. If we can take out the high, then it's very possible that the euro goes to looking to the 1.18 level based on the measured move of 300 points that we are trading in right now.

For what it is worth, it does look a lot like the gold market right now. So, you may be watching both at the same time, as the correlation between the US dollar and Gold is strongly negative at the moment, at least for the last few weeks.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.