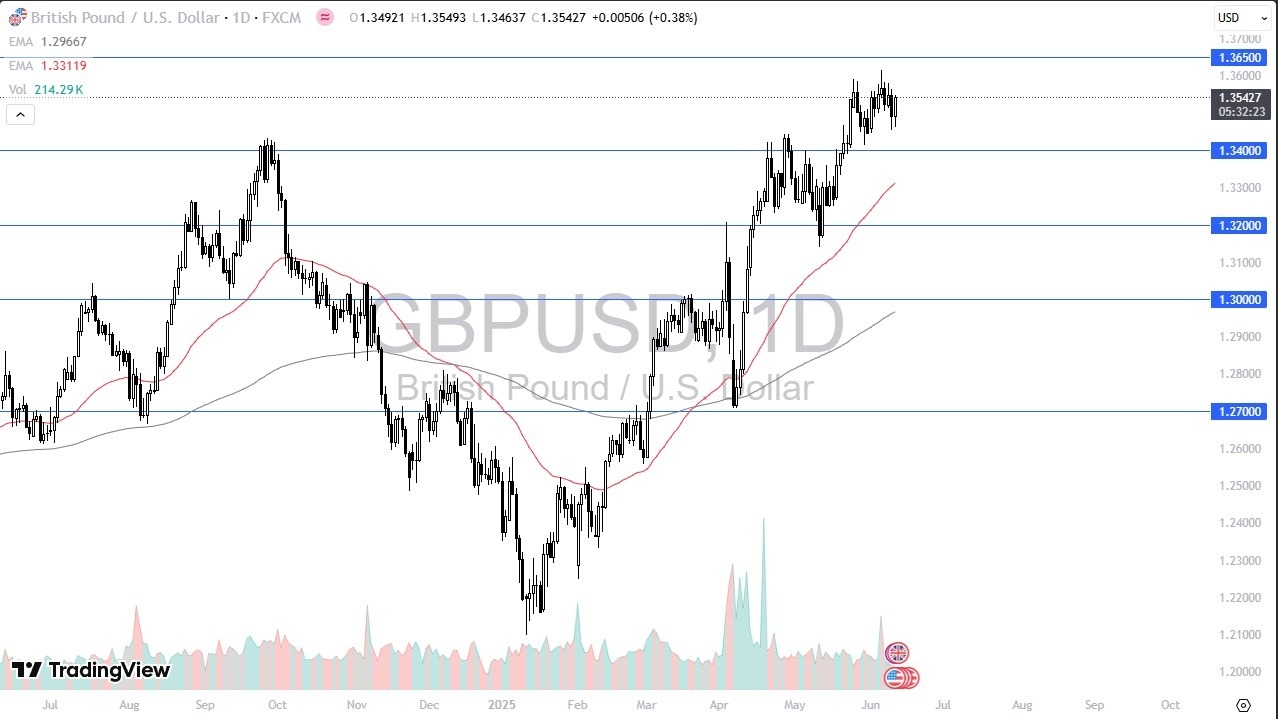

- We initially fell during trading on Wednesday only to show signs of strength yet again as CPI in the United States came out weaker than anticipated.

- Ultimately, this is a market that I think is in the midst of trying to consolidate and sort out where we go next with the 1.3650 level above being significant resistance and the 1.34 level underneath significant support.

- We have seen nice pop, but quite frankly, we just don't have enough momentum, at least for me, to get excited about a potential bigger move.

I think if you're a range bound trader, you probably favor buying the dip, but I don't necessarily think that you have something massive coming in the short term. It is possible that we will get in, but I'm not holding my breath for it. Because of this, I suspect that this is a market that will be difficult.

Short-Term Trading

Top Regulated Brokers

Because of this, I am more or less going to be a trader that looks at this from a very short term chart. But if we were to break down below the 1.34 level, then we would go looking to the 50 day EMA underneath there. A break above the 1.3650 level opens up the possibility of a move to the 1.40 level, which has been important multiple times in the past. So, it does make for a nice target.

Right now, there's a lot of confusion in the Forex markets because quite frankly, the British pound itself has done well, but the US dollar has been very stubborn against other currencies. So, we'll have to wait and see how that plays out, whether or not that translates to some type of movement over here. As things stand though, it looks steady as it goes sideways up in this currency pair.

Ready to trade our daily Forex GBP/USD analysis? We’ve made this UK forex brokers list for you to check out.