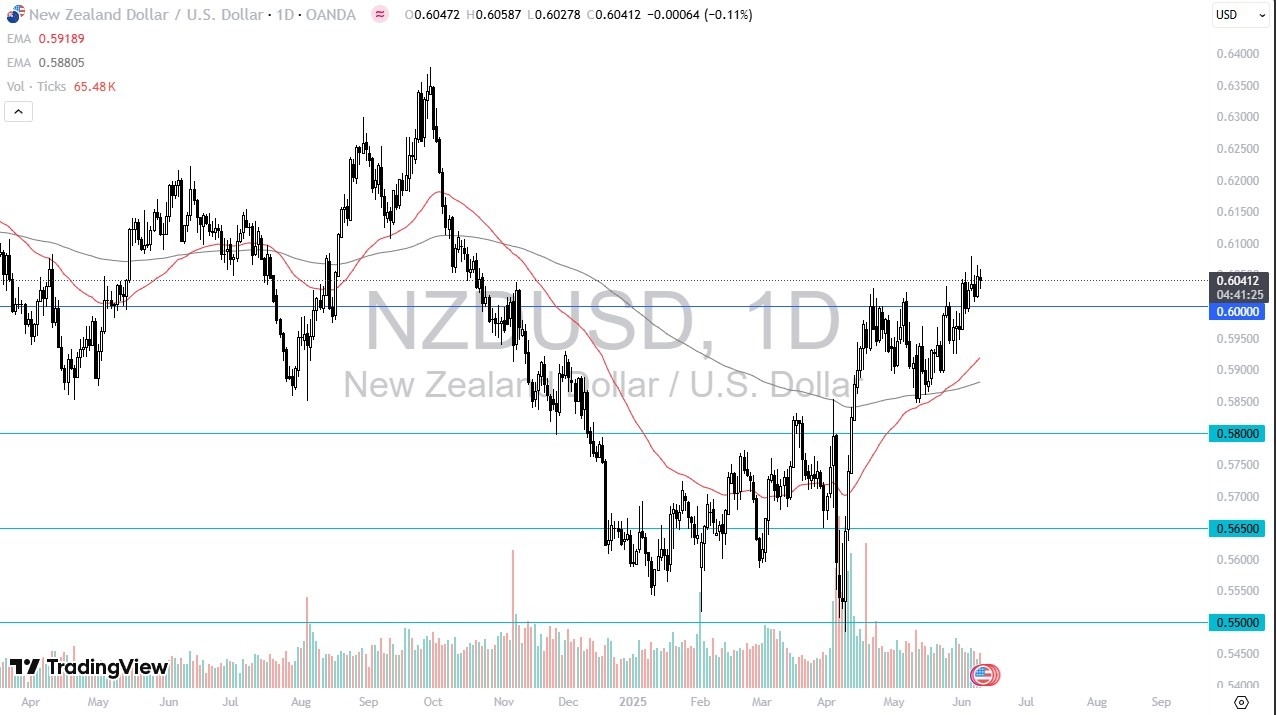

- The New Zealand dollar has shown itself to be rather sideways and confused at the moment as traders continue to ask questions of where the next move is coming from and where we are going.

- So, with that, I think you've got a situation where we're just waiting for CPI numbers to come out on Wednesday, and that will have a great influence on how the markets treat the US dollar.

- The US dollar, being the main driver, I believe at least in the overall direction of most pairs right now.

This is a situation where the Kiwi dollar has broken above a fairly significant level in the form of 0.60. But this is a lot like the Aussie dollar, which had broken out a little bit and is just sitting here at the last vestiges of resistance with CPI coming out during the session here on Wednesday.

Top Regulated Brokers

CPI? Maybe.

I think that could be your catalyst or maybe it's not, maybe it comes in as anticipated. And if that ends up being the case, then we don't know what the next move relates to probably China.

The Chinese and the Americans are in the middle of trying to hash out some type of trade deal and that could push the US dollar lower against Pacific currency such as the Kiwi dollar and the Australian dollar, the Chinese Yuan, et cetera. So, there's a lot going on here, but I look at this as a market where if we break down below the 0.5950 level, then we go back into this range.

If we break above the shooting star from last week, then we probably go looking to the 0.63 handle on a more extended move. This is a bullish looking market with the exception of the hesitation that we currently have.

Ready to trade our Forex daily analysis and predictions? Check out the most trusted forex brokers NZ worth using.