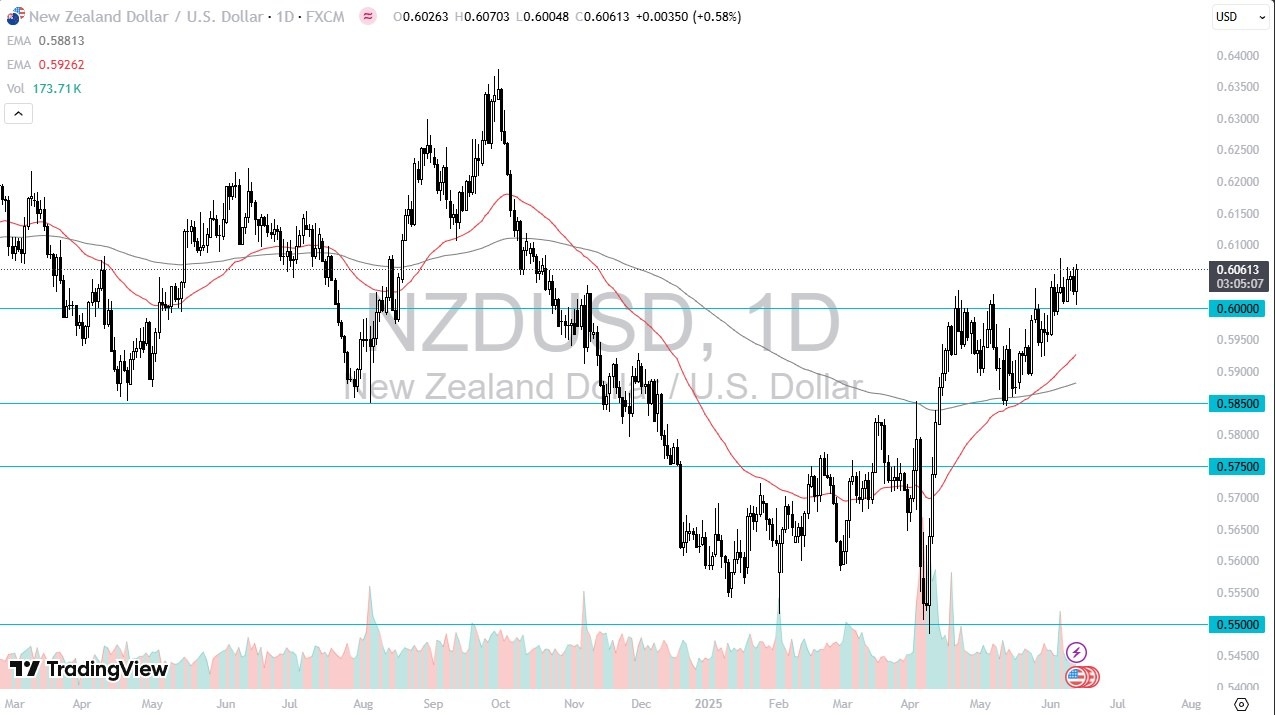

- The New Zealand dollar initially fell during trading on Thursday to reach the 0.60 level, only to turn around and show signs of life again.

- By doing so, it confirms that we are in fact in a little bit of a consolidation area, just above 0.60 and just below 0.6075.

- The CPI numbers on Wednesday were anemic and the PPI numbers on Thursday were as well in the United States.

So, we are seeing some negative bias towards the US dollar overall. And that of course is showing up in this currency pair as well. That being said, it looks like we don't have quite enough momentum to break out yet, which is a little bit interesting.

Top Regulated Brokers

But if and when we get that signal, we could go all the way to the 0.6350 level. Currently, the 0.60 level is massive support, and you'll just have to look at it as an important level, not only due to the action of the last couple of days, but the fact that it is a large round psychologically significant figure. Ultimately, this is a market that recently has seen the gold cross which longer term traders like, and it does look like we are trying to stair step our way higher.

Inflation in the USA

The inflation numbers being so weak in the United States does at least give traders the hope or the idea that maybe the Federal Reserve will loosen monetary policy later in the year. And that's part of what you're seeing.

Furthermore, if we get some type of trade deal between the Americans and the Chinese that benefits Asian currencies as obviously it will spur more economic movement in that part of the world and New Zealand will see a little bit of a knock-on effect. So, with all things being equal, we're sideways at the moment but you have to at least think more bullish than bearish.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.