Potential signal:

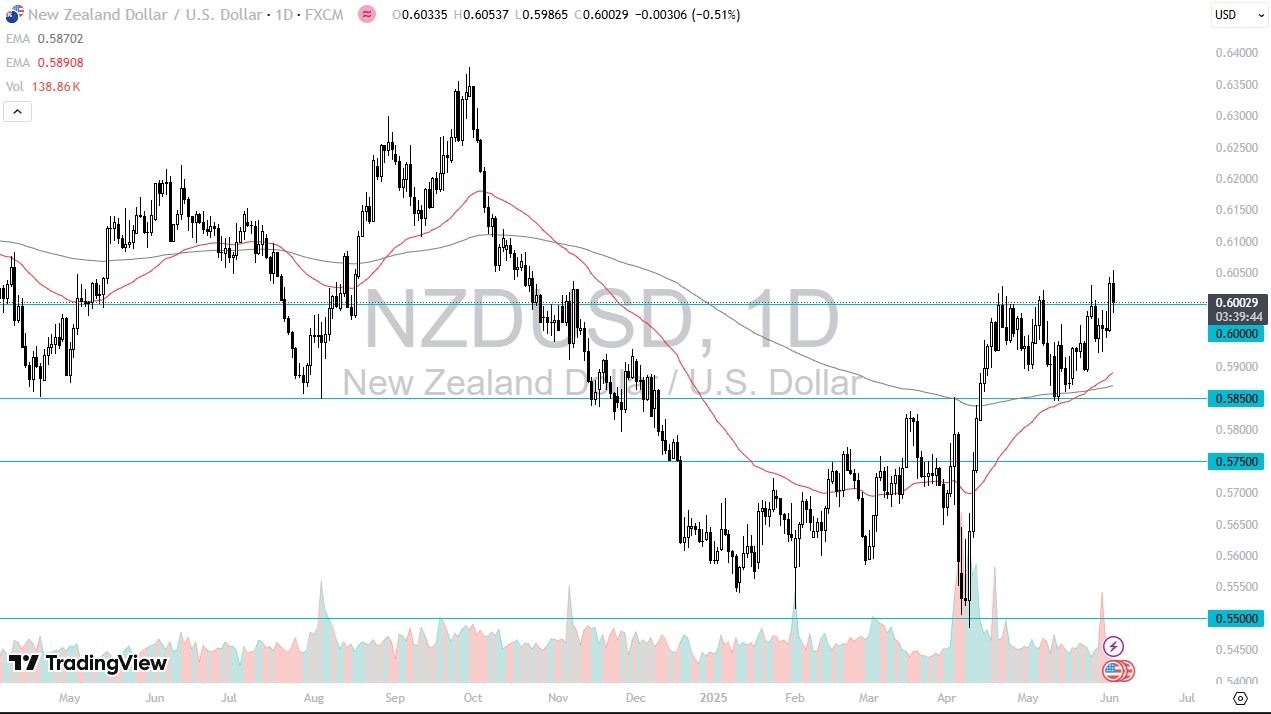

- If we get a daily close above 0.6060, I’m a buyer of the New Zealand dollar against the US dollar, with a stop loss at 0.5880 level below.

- I aim for a move to the 0.6350 level.

The New Zealand dollar initially tried to rally during the trading session on Tuesday, to continue the overall upward pressure that we had seen during the Monday breakout session. However, we have turned around quite drastically, and it now looks as if the New Zealand dollar is not quite ready to take off to the upside, at least not as drastically as the initial move suggested.

Top Regulated Brokers

Potential Breakout

This is a potential breakout, as we’ve seen the 0.60 level offer so much in the way of resistance that breaking above there is a significant turn of events. We have fallen during the session to test that area, but we have also bounced a bit, so I think the next candle or 2 will be crucial as to where we go next. It is worth noting that recently we had seen the so-called “golden cross”, when the 50 Day EMA crosses and breaks above the 200 Day EMA, showing that momentum is starting to speed up to the upside. That being said, it’s just one thing to look at and it’s not necessarily something that has have a major influence on the market.

If we do fall from here, I think there’s plenty of support to be found at multiple levels underneath, extending all the way down to the 0.5850 level. While a breakdown could present a shorting opportunity, the reality is that there are probably other currencies out there that you might have a little bit more luck with this far as making a larger profit due to a longer runway for sellers to truly take off from. Rather than being bothered with that, if the US dollar starts to really lose strength across the board, this could be one of the best places to play US dollar weakness. I would be very interested in buying this pair on that type of scenario, because not only do you have a much larger area to trade, but you also have seen the New Zealand dollar beaten down rather drastically over the last couple of years, meaning that this could be a nice longer term trade.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.