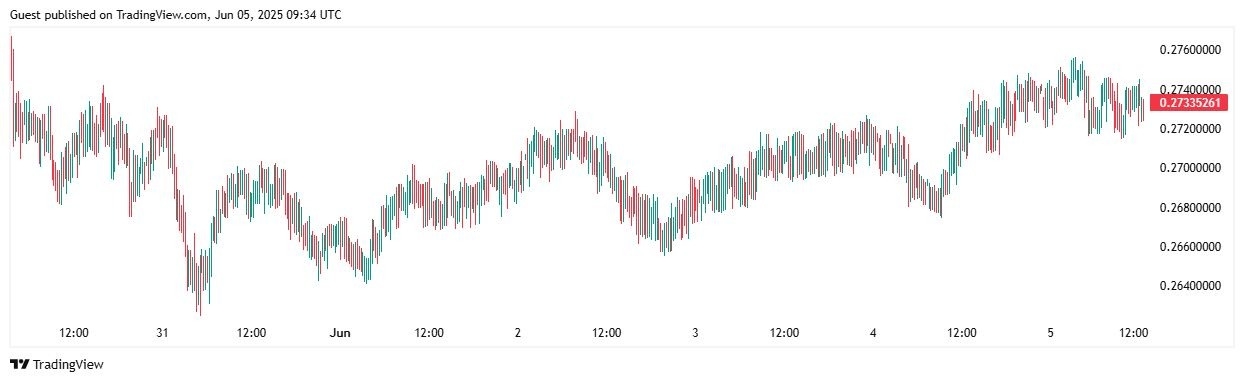

TRON (TRX) has been oscillating within a tight range, with intraday highs reaching $0.2748 and lows dipping to $0.2715.

Technical Indicators Signal Potential for Movement

Tron Price Chart | Source: TradingView

TRX's current price behavior indicates a consolidation near the $0.27 mark. The Relative Strength Index (RSI) stands at approximately 59.7. This suggests neutral momentum, with no clear overbought or oversold conditions.

The Moving Average Convergence Divergence (MACD) has shown a slight bullish crossover, hinting at a potential upward trend. However, the Balance of Power (BoP) remains choppy and reflects an ongoing tug-of-war between bulls and bears.

The 50-day and 200-day moving averages are trending upwards, with the current price trading above both, indicating a bullish long-term trend.

The 50-day moving average is approximately $0.2592, while the 200-day moving average is around $0.2215.

These levels could act as support in case of a price pullback.

On-Chain Metrics Reflect Robust Network Activity

TRON's network activity has reached new heights, with daily active addresses and transaction volumes hitting all-time highs.

In May 2025, the network processed over 490 billion TRX, equivalent to $121.2 billion, which marks a significant increase in user engagement. This surge is attributed to the growing demand for TRON's decentralized infrastructure and attractive yield-generating services.

Additionally, TRON leads in weekly fee income among blockchains, surpassing competitors like Solana and Ethereum, with $13.3 million in earnings.

The protocol's revenue reached an all-time high of $343 million in May, driven by genuine user activity rather than speculative trading.

Whale Activity and Institutional Interest

On-chain data indicates that large traders are accumulating TRX, betting on further upside. Institutional interest is also on the rise, with significant holdings increasing in recent weeks.

This accumulation suggests confidence in TRON's long-term potential and could provide the necessary momentum for a price breakout.

Support and Resistance Levels Worth Monitoring

For traders and analysts observing TRX, key support and resistance levels are crucial. Immediate support lies around $0.2670, with stronger support at $0.2494.

On the upside, resistance is observed at $0.2747, with a significant psychological barrier at $0.30. A decisive break above $0.30 could open the path toward $0.3265, as indicated by Fibonacci extension levels.

Final Thoughts: Awaiting a Decisive Move

TRON's current consolidation pattern around $0.27, coupled with robust on-chain activity and growing institutional interest, sets the stage for a potential breakout. While technical indicators present a mixed picture, the underlying fundamentals suggest a bullish outlook.

Traders should monitor key support and resistance levels, as well as on-chain metrics, to gauge TRX's next move.