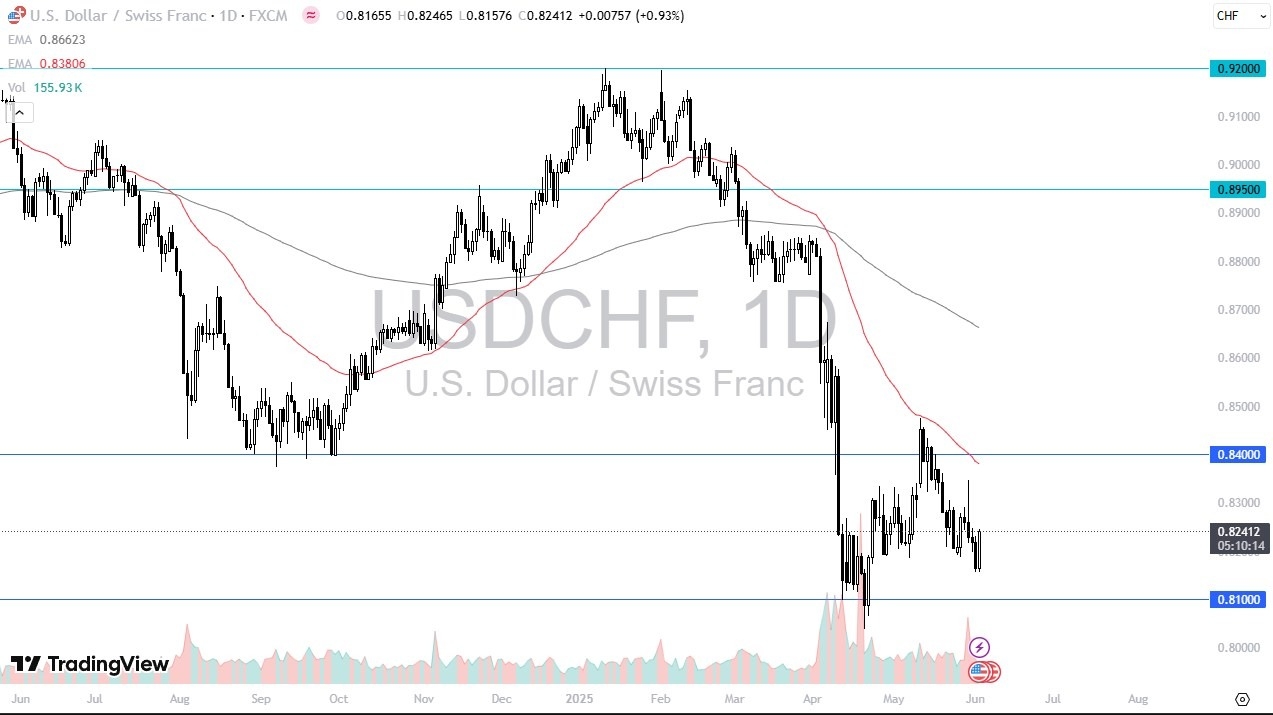

- We have seen the US dollar rally pretty significantly during the course of the trading session on Tuesday as we have wiped out and engulfed the Monday candlestick.

- This suggests to me that we could have further to go to the upside, but whether or not we break out above massive resistance is a completely different conversation.

- I think you've got a situation where the 0.84 level is going to be very difficult to overcome.

That's especially true now that we have the 50 day EMA there and of course market memory. However, if we do clear that area, then I think the 0.8550 level gets targeted followed by the 0.8850 level.

Top Regulated Brokers

More likely than not, I think what we get are occasional pullbacks that people try to buy in and get long the dollar against the Swiss franc. And of course, you have to keep in mind that the interest rate differential does get you paid at the end of every day. So, hanging on to the trade can be a strategy if you're not over levered, obviously. If we were to break down below the 0.81 level, that opens up a move to the 0.80 level. I think at this point in time, it mainly comes down to concerns about global trade, which the Swiss franc is a little bit of a buffer from.

Dollar is Noisy Overall

But also, the situation with the US dollar being so noisy in general. As long as that's the case, I think it'll be difficult for this market to take off, but I also recognize that around the world, the US dollar is starting to fight back. If that is in fact the case, the Swiss franc won't be any different.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.