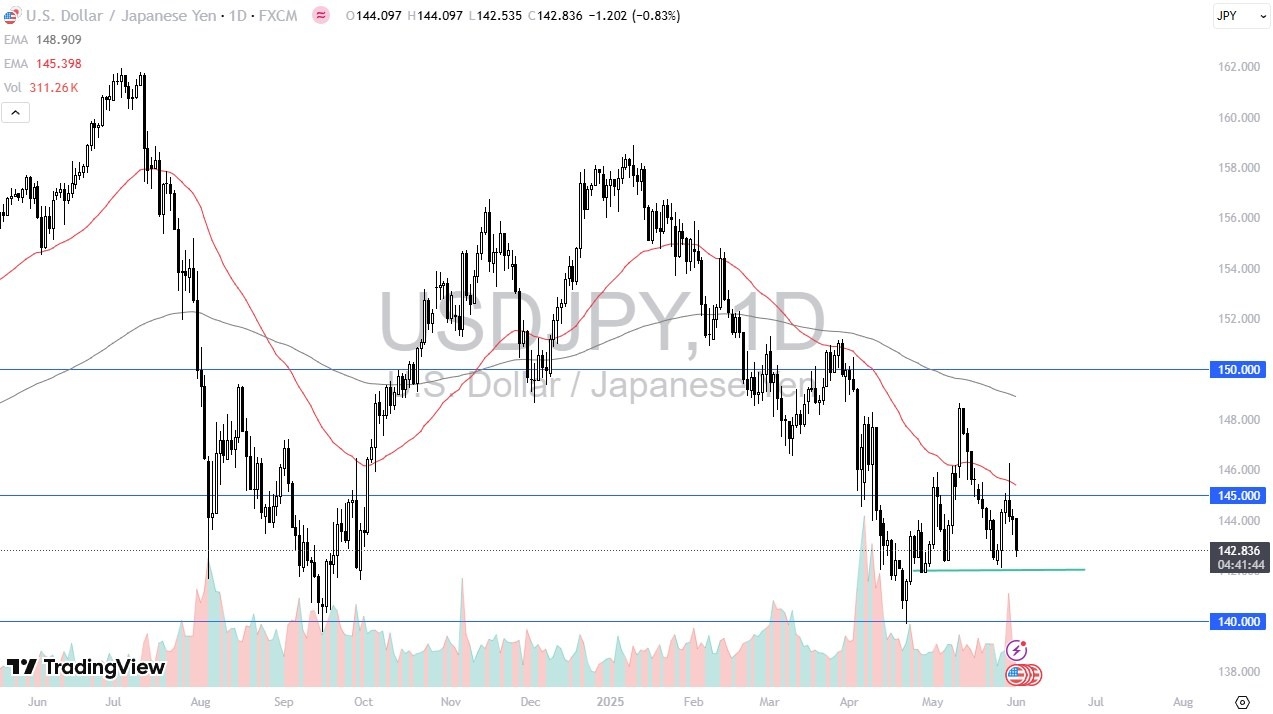

- The US dollar has fallen a bit during the trading session here on Monday as the manufacturing PMI numbers came out weaker than anticipated.

- All things being equal, this is a market that I think continues to see a lot of noisy trading overall as the Japanese yen, of course, is considered to be a safety currency.

But at the same time, you have to understand that the US dollar is as well. Now, with the manufacturing PMI numbers coming out weaker than anticipated, obviously people ran from the greenback. But I think ultimately, we are going to be looking at this as a market that remains somewhat tight and rangebound.

The 142 yen level is very supported, while the 145 yen level above is significant resistance. Once we break above the 50 day EMA, which is just above the 145 yen level assuming that we do, that would be a very bullish sign for the greenback. If we break down below the 142 yen level, then we could go looking to the 140 yen level, which has been massive support a couple of times in the past.

Top Regulated Brokers

Interest Rate Differential

Interest rate differential does favor the US dollar overall, and I would keep that in the back of my mind as you do get paid to hang on to this pair. And over the longer term, that can really add up. Furthermore, we've had some problems in the Japanese government bond markets as there's been two or three days that I know of in the last 10 days that there's been no bids, meaning the Bank of Japan is probably going to have to step into the market, and buy bonds and that's the same thing as quantitative easing. So, we'll have to wait and see how that is going to affect this pair but right now I still think we have a much more likelihood of going higher than lower but right now we're in a very noisy area that will continue to favor short-term range bound trading.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.