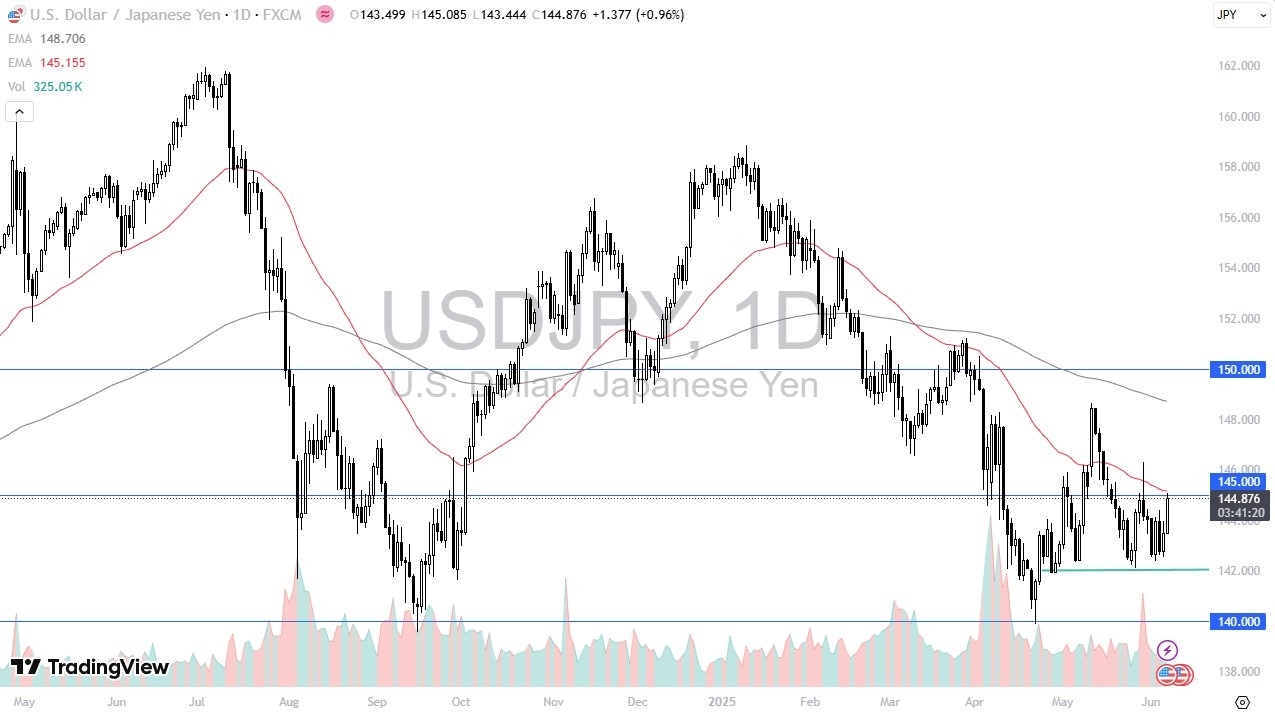

- The US dollar rallied rather significantly during the trading session on Friday as we continue to see a lot of noisy behavior.

- With this being the case, the market is likely to continue to see a lot of opportunity, but you will have to be very quick to take advantage of it.

- After all, this is a very noisy pair most of the time, and when we just had a Non-Farm Payroll announcement that surprised the market, and therefore it’s not a huge surprise to see the US dollar take out the Japanese yen as the market is likely to continue to pay close attention to the bond markets.

With Bond yields rising in America, it makes the US dollar much more attractive, and then you also have to pay close attention to the fact that the Japanese bond market is an absolute disaster. We’ve had a couple of days recently that the Bank of Japan was unable to find buyers of government debt, and if that’s the case, the Bank of Japan will more likely than not have to step in and start buying bonds, which is essentially the same thing as quantitative easing.

Top Regulated Brokers

Technical Analysis

The technical analysis for this market is obviously somewhat noisy, as we are going sideways in general, but we are testing the crucial 50 Day EMA. The 50 Day EMA is of course an indicator that a lot of people will pay close attention to as it is a major trend defining indicator most of the time. This is a market that I think given enough time will probably break out to the upside I have been suggesting that for a while, and the Friday candlestick might be the beginning of chewing through the massive resistance. This of course opens up the possibility of a move to much higher levels, and if we do have that happen, I would anticipate that the ¥148 level would be the target. On the downside, as long as we can stay above the ¥142 level, I think you have a real shot at continuing to consolidate overall with more of an upward bias.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.