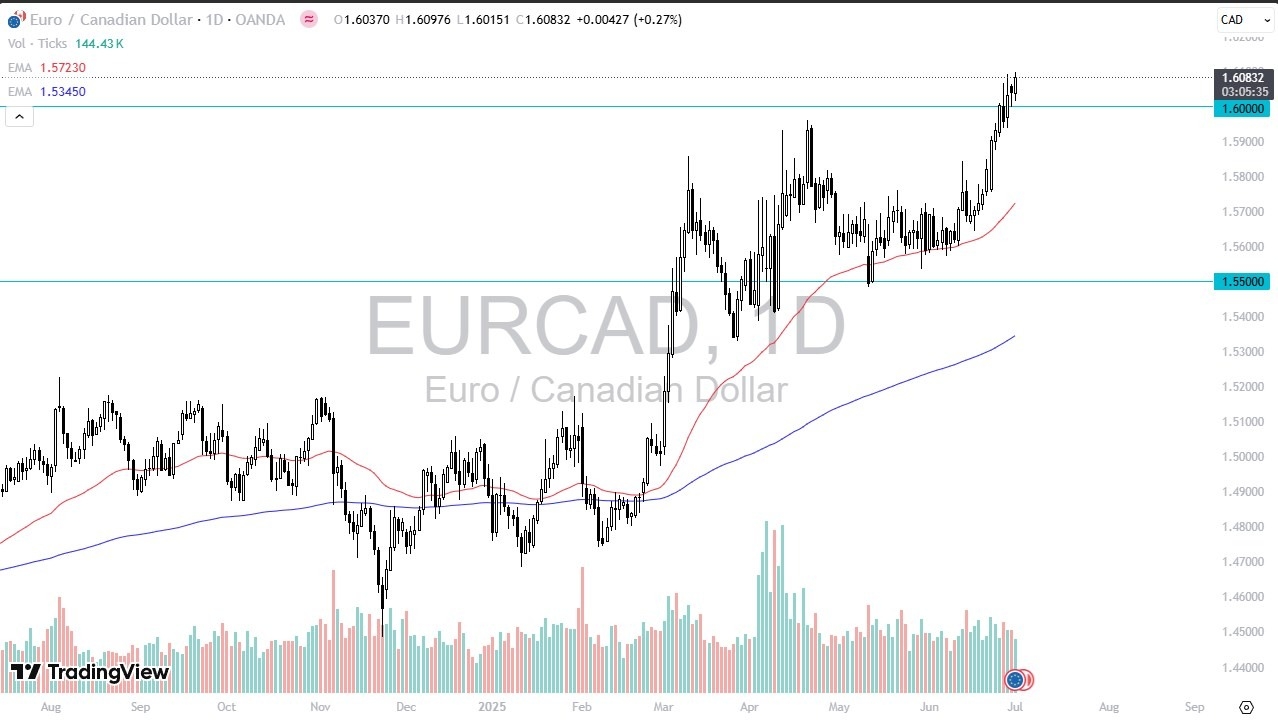

- The euro initially pulled back just a bit during the trading session on Tuesday but continues to see the 1.60 level as an area of interest.

- We rallied from then, breaking above the high of last week, suggesting that we are ready to continue to go higher.

- Ultimately, we are a little stretched at this point in time, but it certainly looks like it is going to continue to be a “buy on the dips” type of scenario.

This makes a certain amount of sense, because the euro has been strong for some time, while the Canadian dollar has to deal with an economy that has a lot of problems with its largest trading partner.

Top Regulated Brokers

Technical Analysis

The technical analysis for this market is obviously very bullish, and the fact that we broke above the 1.60 level suggests that we have cleared up yet another major psychological level. Psychologically important levels are worth paying attention to, and I think that’s especially true in this market, as it has so clearly reacted to every 500 pips level. The euro currently has been attracting a lot of inflows against the US dollar, so it does make a certain amount of sense that it would be the same thing with the Canadian dollar, as it is the lesser of the 2 major North American currencies.

That being said, I think that if we were to break down below the 1.59 level, this would be a negative turn of events, and we could go looking at the 1.5750 level, where the 50 Day EMA currently resides and is climbing. Anything below that level could be rather negative, perhaps sending the euro down to the 1.55 CAD level, but I don’t think that is very likely. More likely than not, we continue to break to the upside and go looking at the 1.62 level, possibly even higher than that. That being said, we are a little overextended and stretched, so expect a little bit of volatility.

Ready to trade our CAD Forex forecast? Here’s some of the top trading account in Canada to check out