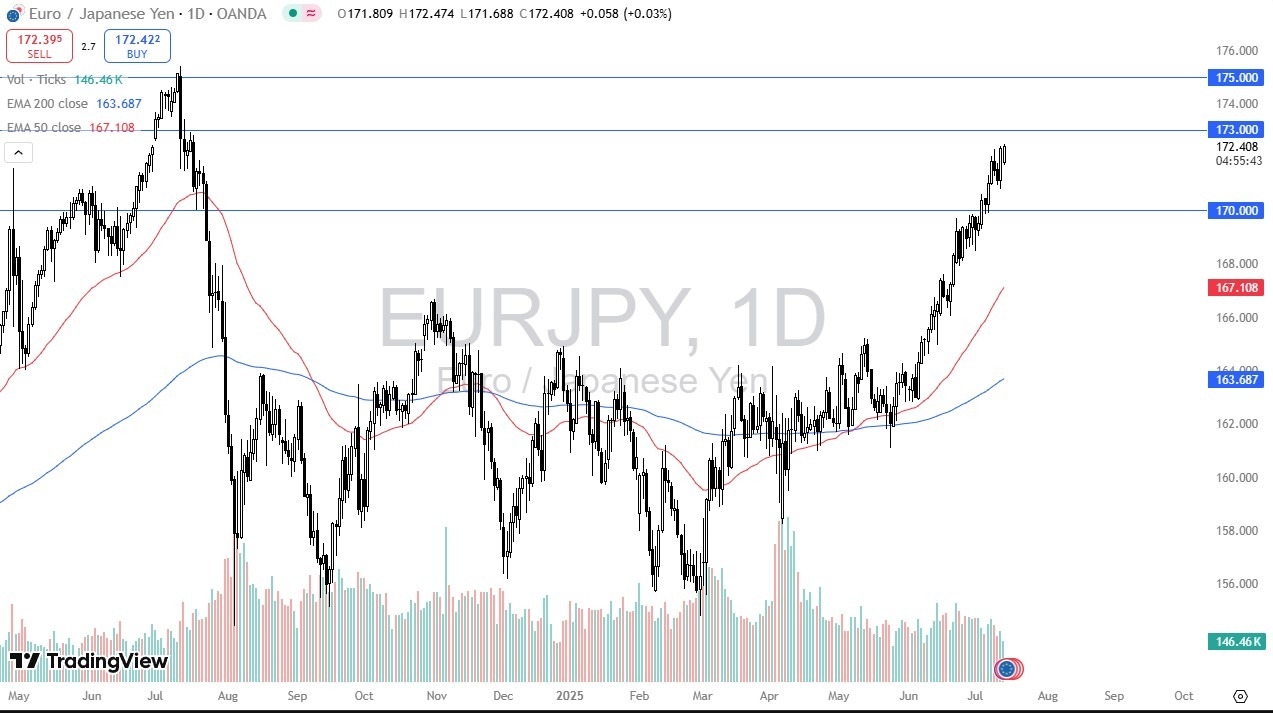

- The euro initially drop against the Japanese yen at the open, gapping lower, only to turn around and show signs of life again.

- By doing so, the market looks as if it is going to continue to find plenty of buyers on dips, and I think ultimately, we are going to go looking to a couple of different levels.

Levels to Watch

A couple of levels that I will be watching above is the ¥173 level, which is an area of significant supply. If we can break above there, then the market is likely to go looking to the ¥175 level, which was another major area of supply. On the other hand, if we do drop from here, I would anticipate that the ¥171.50 level might be a short-term support level, followed by the more significant ¥170 level. With that being the case, I would be very interested in trying to buy some type of bounce that occurs in that general vicinity. On the other hand, if we were to break down below that region, then I think it suggests that there is a much bigger move at play.

Top Regulated Brokers

Keep in mind that the Bank of Japan has a serious problem with the bond market right now, as there have been a couple of days where there have been no bids for Japanese debt whatsoever. That is a horrific situation that almost certainly will have the central bank buying bonds before it is all said and done. This may be part of what we are seeing here, as traders continue to attempt to get in front of the Bank of Japan and the quantitative easing it may end up having to do in this environment.

On a pullback from here, then I would take a look at the Japanese yen around the world, as well as the euro itself. It probably will have more to do with the euro than the yen, but it is possible that perhaps the yen find some type of strength in a major “risk off move.” I have no interest in shorting this pair at the moment.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.