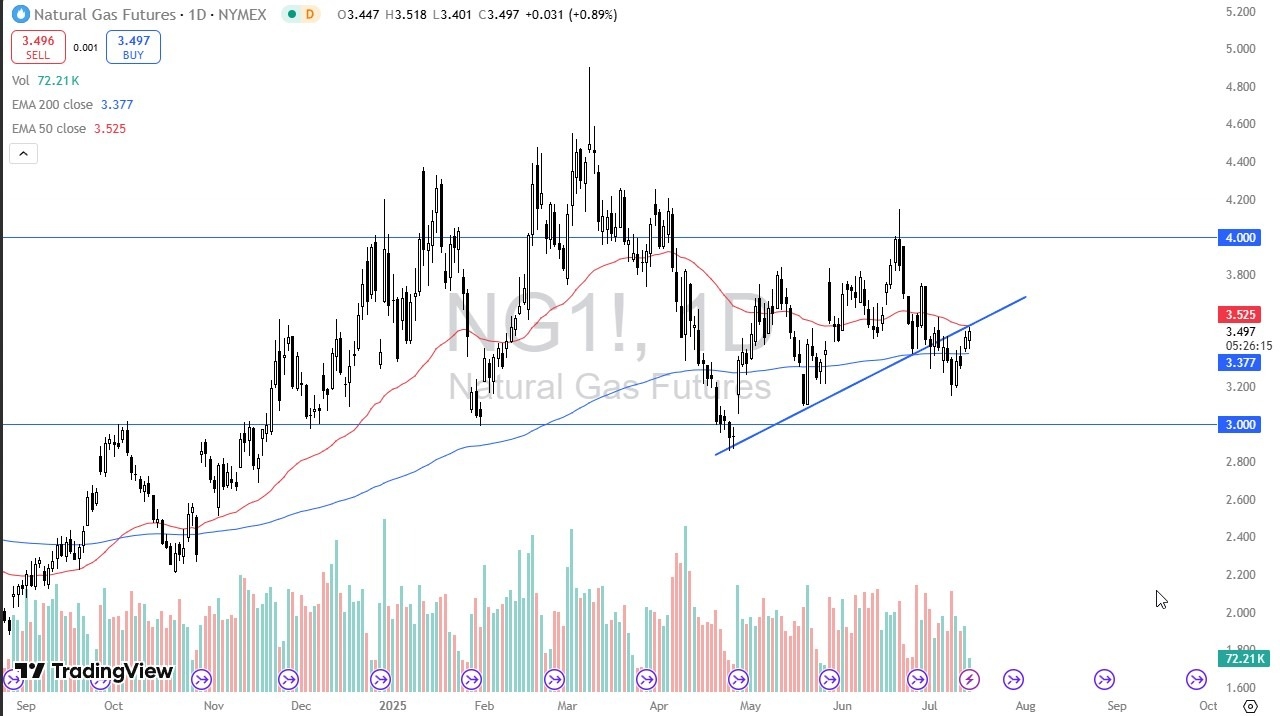

- As you can see, the natural gas market has been a little bit positive, but all things being equal.

- This is a market that I think continues to see a lot of volatility.

- The market is now testing the previous uptrend line and there should be a little bit of resistance there, but I also recognize that we are right around the 50 day EMA and that does offer a certain amount of resistance.

If we can break above the 50 day EMA, then that's obviously a very bullish sign. But I also recognize that market participants are swimming upstream here due to the fact this time of year is typically very poor for natural gas. It is a little bit different this year in the sense that the European Union continues to import natural gas due to the lack of Russian gas that is available.

Is Natural Gas a Bit Lost?

Top Regulated Brokers

With that being the case, I think you look at this through the prism of a market that just continues to bounce around really somewhat lost. I do think that the lack of demand coming out of the United States due to a lack of need for heating, and the fact that we are not in a heat wave will eventually put a little bit of weight upon this market. And I still like the idea of fading short-term rallies. I don't necessarily look at this as a market that you want to short and just hang on to that position. I think it's just more of a fade the rally type of environment. If we do break above the 50 day EMA, we could go looking at the $3.77 region.

On other hand, we break down below the 200-day EMA, which sits just below the candlestick for the last couple of days, we could see natural gas drop down to the $3.20 level, followed by the $3 level.

Ready to trade daily Forex forecast? Here’s a list of some of the best commodities brokers to check out.