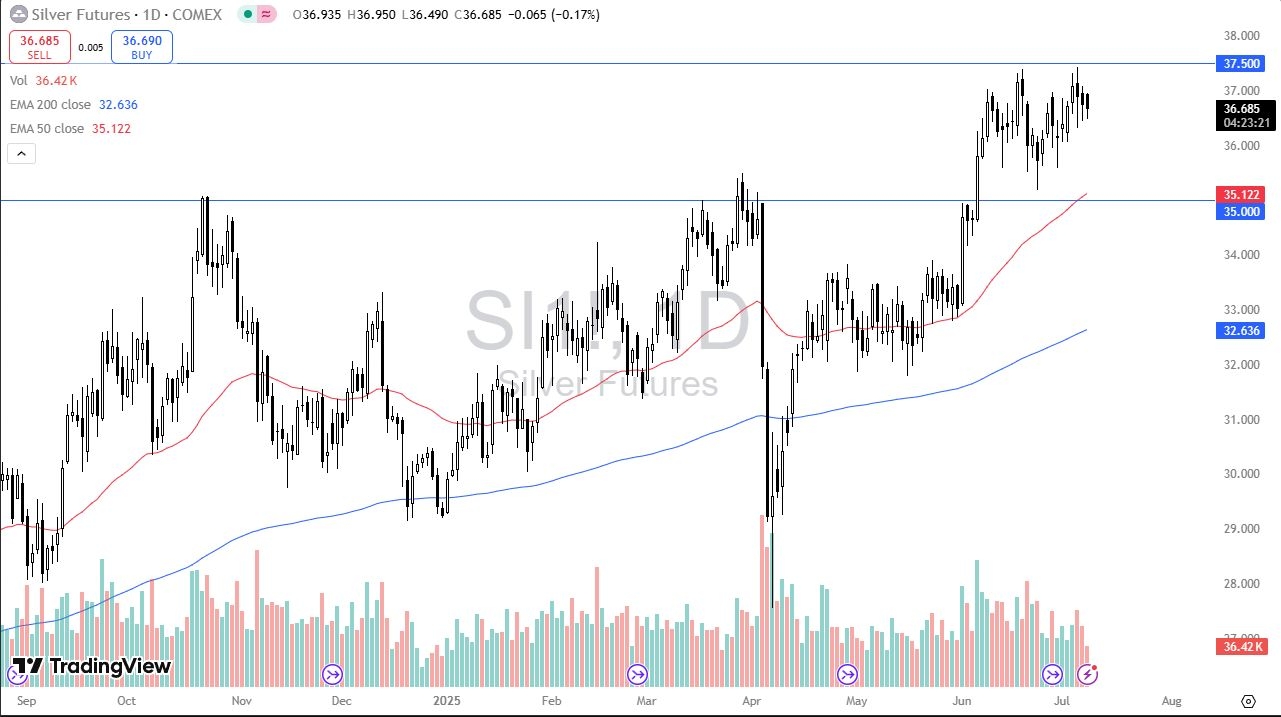

- Silver initially fell during trading on Wednesday, but we can clearly see that there is a significant amount of support near the $36.50 level.

- And even if we were to break down below there, we are in the larger consolidation area that we have been in for about two months.

- The silver market had initially shot much higher to get to this area.

Now I think we're just working off a lot of the exhaust broth in the market due to the fact that we got here too quickly. The 50 day EMA is breaking above the $35 level, which also happens to be the bottom of the overall consolidation area. So, I think it all works together to provide a little bit of a floor in the silver market.

Top Regulated Brokers

On a Break Lower

If we were to break down below the $35 level, that would be a fairly negative turn of events. On the other hand, if we can break above the top of the consolidation, which I presently see at the $37.50 level, then you just extrapolate out with a $2.50 consolidation measured move, and you're looking for a move to $40. As a general rule over history, the $35 level has been the gateway to much higher pricing. But we'll have to see how this plays out because the US dollar is fighting back a bit at the moment. And that does tend to put a bit of a drag on the silver market. Keep in mind that silver is also an industrial metal.

The fact that the jobs market in the United States continues to look at least reasonably well, reasonably strong, it does suggest that there might be more industrial demand. Regardless, the most obvious thing on this chart is that we had melted down in the initial tariff announcements and we have wiped those losses out. We are higher now than we were then. This tells me that you want to be a buyer. I like buying dips. have no interest whatsoever in selling silver at the moment.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.