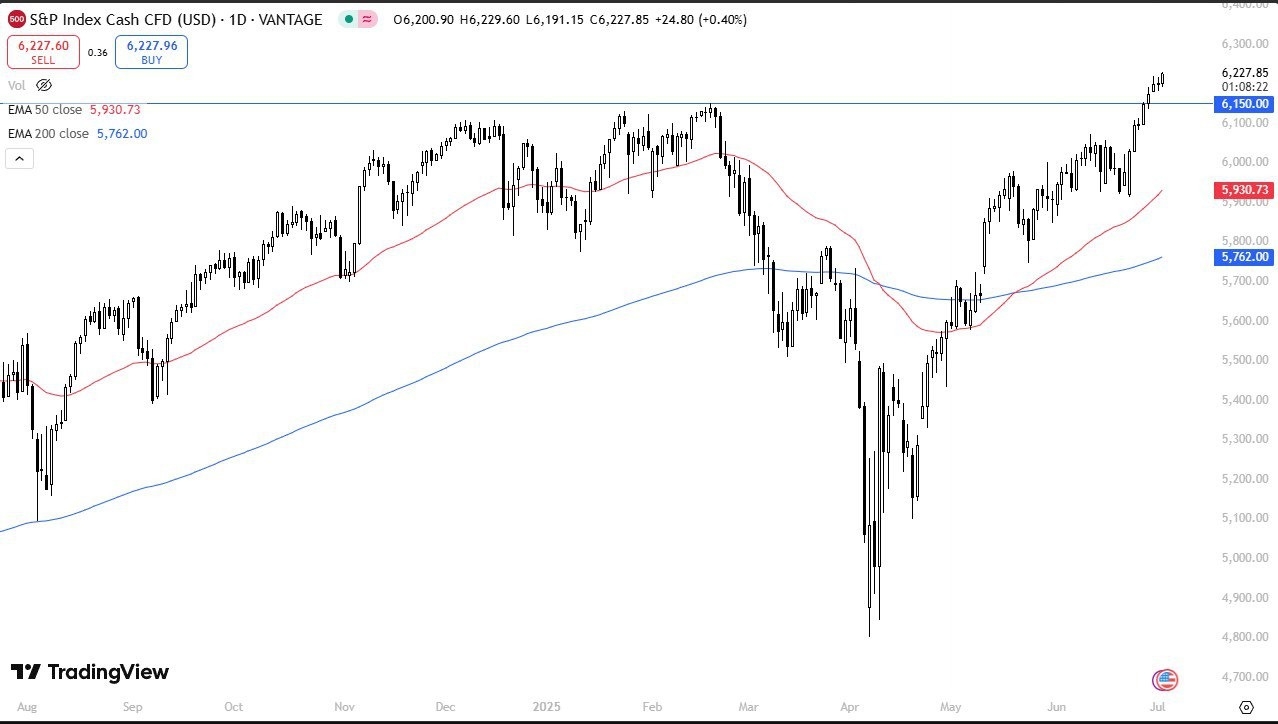

- The S&P 500 has broken just a little bit higher than the highs of the last couple of days on Wednesday, as we continue to see an overall bullish tint on the market.

- But at the same time, you also have to keep in mind that we have the jobs number coming out on Thursday instead of Friday this week because of the Independence Day holiday.

- So, what I would anticipate is a ton of volatility in this market, which isn’t anything new with the USD/JPY pair.

Caution Needed

Top Regulated Brokers

With that being the case, I would be very cautious with this market, but I do look at it as one that you want to be a buyer of, not a seller of, and a pullback anywhere near the 6,150 level would almost certainly have me buying on the dip, as it were, at the first signs of a bout. Perhaps getting on the right-hand side of a V pattern might be the way forward. If we were to break down below there I really wouldn't worry about it too much.

At that point, I'm starting to look for somewhere near $6,050. And then, of course, $6,000. To the upside, I do think that we will do everything we can to finally get to the $6,300 level. But we're going to have to wait and see whether or not that can actually happen. After all, this is a market that has been a little overextended here recently. So, I think with the ADP numbers coming out lower than anticipated on Wednesday, traders are getting excited again about the idea of cheap money coming out of the Federal Reserve. I don't know if that happens, but I do recognize that the market certainly thinks it will. So, this remains a very bullish market.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.