Long Trade Idea

Enter your long position between 68.84 (yesterday’s intra-day low) and 70.48 (yesterday’s intra-day high).

Market Index Analysis

- Cognizant (CTSH) is a member of the NASDAQ 100 and the S&P 500

- Both indices push higher and hover near record highs, but cracks in the rally exist

- The Bull Bear Power Indicator of the NASDAQ 100 shows a negative divergence

Market Sentiment Analysis

Equity markets recorded new intra-day and closing highs yesterday amid optimism about an interest rate cut next month. Many investors are bullish enough to expect interest rate cuts at the remaining three central bank meetings this year. They argue that the US Federal Reserve can relax its stance on inflation, rather than worrying about a faltering job market. Two Federal Reserve officials have warned against the euphoria surrounding interest rate cuts. They cite tariff uncertainty as their reason. Celebrating premature interest rate cuts due to weak economic data is a dangerous trade.

Cognizant Fundamental Analysis

Cognizant is an IT consulting and outsourcing company. Its vertical business units focus on banking and financial services, insurance, healthcare, manufacturing, and retail. Its horizontal business units specialize in analytics, mobile computing, BPO, and testing.

So, Why Am I Bullish on CTSH after Its Breakout?

Cognizant is a peripheral AI play with excellent valuations after its recent double-digit slide. The PEG ratio suggests an undervalued stock with outstanding growth potential, while its AI exposure could drive future growth. It has a healthy balance sheet, and the dividend yield is a nice bonus for an AI-associated tech company.

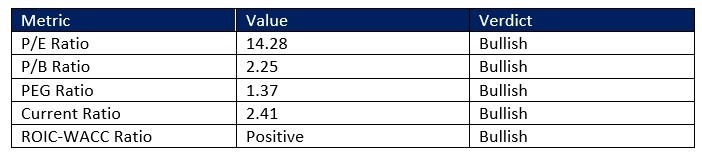

Cognizant Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 14.28 makes CTSH an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 42.43.

The average analyst price target for CTSH is 87.63. It suggests excellent upside potential from current levels.

Cognizant Technical Analysis

Today’s CTSH Signal

- The CTSH D1 chart shows price action completing a breakout above its horizontal support zone

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan level

- The Bull Bear Power Indicator is bearish, but has been increasing since the start of August

- The trading volumes during yesterday’s breakout were higher than average bearish trading volumes

- CTSH corrected as the NASDAQ 100 moved higher, a significant bearish trading signal, but bullish developments are rising

My Call

I am taking a long position in CTSH between 68.84 and 70.48. CTSH ranks among my top AI buys due to its rock-solid balance sheet and fundamentals, which flash green across the board. The recent sell-off made Cognizant an undervalued stock with excellent growth potential.

- CTSH Entry Level: Between 68.84 and 70.48

- CTSH Take Profit: Between 81.61 and 87.63

- CTSH Stop Loss: Between 63.79 and 65.52

- Risk/Reward Ratio: 2.53

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.