Short Trade Idea

Enter your short position between 51.50 (yesterday’s intra-day low) and 55.51 (the last price action rejection by its 50.0% Fibonacci Retracement Fan level).

Market Index Analysis

- Dayforce (DAY) is a member of the S&P 500

- This index pushed higher and hovers near record highs, but cracks in the rally exist

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence

Market Sentiment Analysis

Equity markets recorded new intra-day and closing highs yesterday amid optimism about an interest rate cut next month. Many investors are bullish enough to expect interest rate cuts at the remaining three central bank meetings this year. They argue that the US Federal Reserve can relax its stance on inflation, rather than worrying about a faltering job market. Two Federal Reserve officials have warned against the euphoria surrounding interest rate cuts. They cite tariff uncertainty as their reason. Celebrating premature interest rate cuts due to weak economic data is a dangerous trade.

Dayforce Fundamental Analysis

Dayforce is a human resources software and services company. Its human capital management software handles payroll, tax filing, benefits, HR, talent intelligence, workforce management, and recruiting technology.

So, Why Am I Bullish on DAY Despite Its Bounce?

Dayforce has one of the highest valuations in the S&P 500, which is unjustified. The slowing labor market could hurt revenues over the next 12 to 18 months, and DAY also destroys shareholder value. Negative EPS growth and the dismal return on invested capital are further signs that DAY is an overvalued company with a bleak medium-term future.

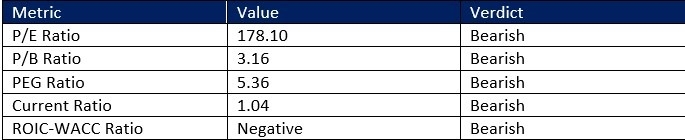

Dayforce Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 178.10 makes DAY an expensive stock. By comparison, the P/E ratio for the S&P 500 is 29.75.

The average analyst price target for DAY is 66.87. While it suggests decent upside potential, the economic backdrop could prevent DAY from reaching it.

Dayforce Technical Analysis

Today’s DAY Signal

- The DAY D1 chart shows price action inside a bearish price channel

- It also shows price action facing resistance from its descending 38.2% Fibonacci Retracement Fan level

- The Bull Bear Power Indicator is bearish, with a descending trendline

- The average bearish trading volumes are higher than the average bullish trading volumes

- DAY corrected as the S&P 500 moved higher, a significant bearish trading signal

My Call

I am taking a short position in DAY between 51.50 and 55.51. The valuations alone are reason enough to sell the rally. Additionally, the balance sheet is unhealthy, the current economic backdrop poses a revenue challenge, and DAY trails in its AI adoption.

- DAY Entry Level: Between 51.50 and 55.51

- DAY Take Profit: Between 38.40 and 43.23

- DAY Stop Loss: Between 57.80 and 59.41

- Risk/Reward Ratio: 2.08

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.