EUR/USD Analysis Summary Today

- Overall Trend: Neutral with an upward bias.

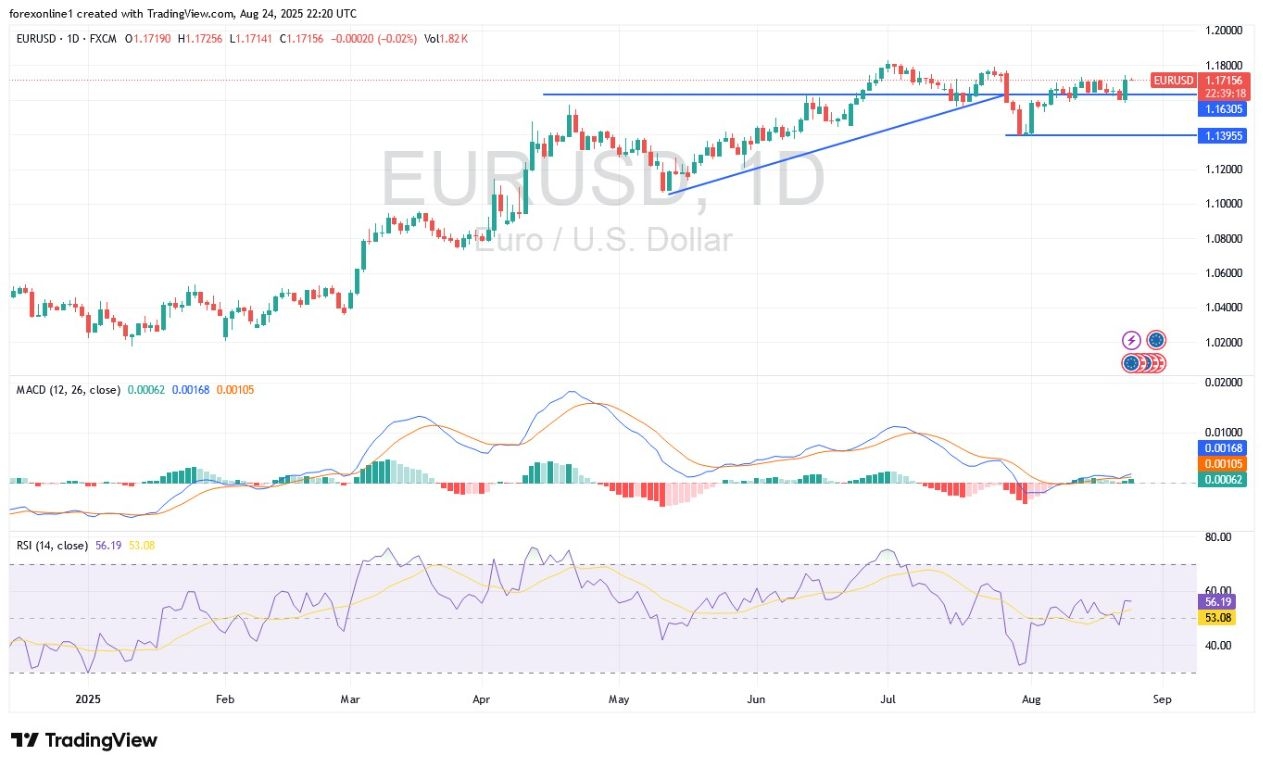

- Today's Support Levels: 1.1660 – 1.1590 – 1.1520.

- Today's Resistance Levels: 1.1770 – 1.1830 – 1.1900.

EUR/USD Trading Signals:

- Buy EUR/USD from the 1.1650 support level, with a target of 1.1800 and a stop-loss at 1.1590.

- Sell EUR/USD from the 1.1785 resistance level, with a target of 1.1500 and a stop-loss at 1.1860.

EUR/USD Technical Analysis Today:

Recent signals from Federal Reserve officials on the future of US interest rate cuts have increased selling pressure on the US dollar. This created a good opportunity for the EUR/USD bulls, who pushed the pair up to the 1.1742 resistance level. It begins the new week trading around 1.1720, awaiting further positive momentum to continue its recent rebound. For the bullish shift to be successful, the bulls need to advance toward the 1.1830 resistance level and then the psychological resistance of 1.2000.

The EUR/USD bullish scenario requires moving towards the aforementioned peaks. The recent rebound gains, based on the performance on the daily chart, have moved the 14-day RSI towards a reading of 56, away from the neutral line, paving the way for bulls to advance further. Meanwhile, the MACD lines are poised to move higher. Today's EUR/USD price will react to investor reactions to the statements made by monetary policy officials from the US Federal Reserve and the European Central Bank at the Jackson Hole Symposium. Also, this will include the release of the German IFO Consumer Climate reading at 11:00 AM Cairo time, followed by the release of US new home sales at 5:00 PM Cairo time.

Top Regulated Brokers

Trading Advice:

Traders are advised to wait for more positive momentum to support the EUR/USD's current bullish shift. Therefore, it's recommended to be cautious about buying at the peaks until there is a clearer picture.

EUR/USD bearish Scenario: During the same timeframe on the daily chart, the EUR/USD's attempts to rebound upwards may be affected if the bears return the currency pair to the 1.1630 support levels, then to 1.1550 and 1.1480, respectively.

Will the EUR/USD price rise in the coming days?

According to forex trading experts, the US dollar exchange rate fell after Fed Chair Powell's statements, causing the EUR/USD pair to rise to nearly 1.1742. Powell hinted at the possibility of a US interest rate cut in September. Experts believe that a sustainable rise for the EUR/USD requires a clear breakthrough above 1.1780. Any break above the 1.1830 resistance would quickly spark talk of the psychological resistance at 1.2000.

In the medium term, experts predict the EUR/USD exchange rate will reach 1.20 by the end of 2025.

Regarding the most influential factor on currency rates recently, in his keynote speech at the Jackson Hole Economic Symposium, US Federal Reserve Chairman Jerome Powell stated that a shift in the balance of risks could require a monetary policy adjustment. According to Powell, GDP growth has slowed significantly, while downside risks to the labor market are increasing. He also commented, "While the labor market appears to be in equilibrium, it is an unusual kind of equilibrium, resulting from a marked slowdown in both the supply and demand for workers. This unusual situation suggests that downside risks to employment are rising. If these risks materialize, they could materialize quickly."

Regarding tariffs, he noted that their effects on US consumer prices are now clear and are expected to accumulate in the coming months. However, his baseline assumption is that the inflationary effects will be short-lived. Following Powell's remarks, expectations for US interest rates shifted, with the probability of a September cut rising to over 90%, from just under 70% before the speech. Traders' confidence has also been renewed in the possibility of at least two US rate cuts by the end of 2025.

Generally, financial markets continue to monitor threats to the Fed's independence. On Friday, President Trump stated that he would fire Fed Governor Cook if she did not resign. According to UBS, "We expect the Fed to resume its easing cycle in September, with the possibility of further cuts at every meeting this year. This is expected to weigh on the US dollar through the first half of 2026."

The bank added, "The euro continues to benefit from a combination of strong growth, lower upcoming monetary easing, and its role as a default alternative for global investors seeking to diversify away from the US dollar."

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.