Long Trade Idea

Enter your long position between 434.85 (the approximately mid-level of its current rally) and 444.50 (yesterday’s intra-day high). io

Market Index Analysis

- Lockheed Martin (LMT) is a member of the S&P 100 and the S&P 500

- Both indices trade near records, but bearish trading volumes are higher than bullish ones

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence and is nearing a bearish crossover, with several days of contractions

Market Sentiment Analysis

Investors await the release of the Federal Reserve minutes from the last meeting for insight into the Central Bank’s thinking. The Jackson Hole Economic Symposium could provide more details on future interest rate cuts. Technology companies led stocks lower, as the future AI boom and excessive valuations provide headwinds. Meanwhile, President Trump is considering equity stakes in tech companies that received funds from the CHIPS Act. Earnings releases from Target and Walmart today and tomorrow will provide a barometer for consumer spending.

Lockheed Martin Fundamental Analysis

Lockheed Martin (LMT) is a defense and aerospace manufacturer with four divisions: Lockheed Martin Aeronautics, Lockheed Martin Missiles and Fire Control, Lockheed Martin Rotary and Mission Systems, and Lockheed Martin Space. In 2024, LMT derived 73% of its revenues from the US government.

So, why am I bullish on LMT despite its earnings miss?

The valuations are reasonable. LMT is one of the largest global defense companies, and a significant supplier to NASA and other non-defense government agencies. It has a well-diversified order book and one of the best R&D facilities, ensuring this company remains at the forefront of innovation, which delivers future growth. Therefore, I believe the recent sell-off has created an excellent long-term buying opportunity.

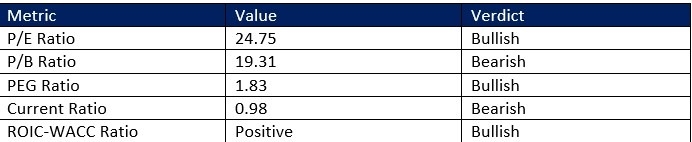

Lockheed Martin Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 24.75 makes LMT an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.76.

The average analyst price target for Lockheed Martin is 487.16. It suggests double-digit upside potential from current levels.

Lockheed Martin Technical Analysis

Today’s LMT Signal

- The LMT D1 chart shows price action inside a bullish price channel

- It also shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan following a double breakout

- The Bull Bear Power Indicator turned bullish and has been improving for over three weeks

- The average bullish trading volumes are higher than the average bearish trading volumes

- LMT is moving higher as the S&P 500 struggles to hold on to gains, a significant bullish trading signal

Top Regulated Brokers

My Call

I am taking a long position in LMT between 434.85 and 444.50. The return on equity ranks among the best in the industry. LMT is a well-diversified defense stock with an excellent product and services portfolio. I believe LMT will ride the bullish price channel higher.

- LMT Entry Level: Between 434.85 and 444.50

- LMT Take Profit: Between 487.16 and 491.07

- LMT Stop Loss: Between 417.00 and 423.91

- Risk/Reward Ratio: 2.93

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.