Short Trade Idea

Enter your short position between 182.63 (the intra-day low of its last bearish candle) and 190.22 (an intermediate horizontal resistance level).

Market Index Analysis

- M&T Bank (MTB) is a member of the S&P 500 Index.

- This index remains near its record high, but bearish trading volumes have increased.

- The Bull Bear Power Indicator of the S&P 500 turned bearish.

Market Sentiment Analysis

Following yesterday’s reversal that recovered most of Friday’s post-NFP losses, the focus remains on tariffs and earnings. AMD will grab the attention as investors seek confirmation that the AI story remains strong. US President Trump continues his tariff strikes, once again singling out India and its trade with Russia, to which India responded with its data on US and EU trade with Russia. The last two sessions have shown that volatility is likely to persist, but the cracks in the bull cycle are becoming increasingly apparent.

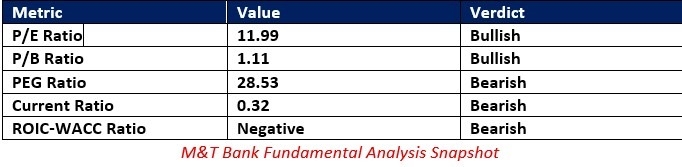

M&T Bank Fundamental Analysis

M&T Bank is a regional bank holding company founded in 1856 with over 950 branches spanning twelve states.

So, why am I bearish on MTB after its recent pullback?

M&T Bank accepts lower yields to defend its market position. Therefore, it opts for quantity over quality. The likelihood of interest rate cuts could further derail its fragile balance sheet. Profit margins have contracted over the past years in a high-interest rate environment, and earnings per share are forecasted to decrease moving forward

The price-to-earnings (P/E) ratio of 11.99 makes MTB an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 28.79.

The average analyst price target for MTB is 215.68. While it shows good upside potential, I believe the current environment will result in downgrades.

M&T Bank Technical Analysis

Today’s MTB Signal

- The MTB D1 chart shows price action inside a bearish price channel.

- It also shows price action breaking down below its ascending Fibonacci Retracement Fan level.

- The Bull Bear Power Indicator is bearish with a descending trendline.

- Trading volumes are bearish and notably higher than bullish trading volumes.

- MTB corrected as the S&P 500 hovers near records, a significant bearish sign.

My Call

I am taking a short position in MTB between 182.63 and 190.22. The outlook for MTB is bearish with negative earnings per share growth, and the acceptance of lower yields flashes a tremendous warning. The risk of interest rate cuts could trigger more balance sheet woes for M&T Bank, and I will sell the rallies.

- MTB Entry Level: Between 182.63 and 190.22

- MTB Take Profit: Between 150.75 and 154.98

- MTB Stop Loss: Between 196.87 and 204.32

- Risk/Reward Ratio: 2.24

Ready to trade our free daily signals? Here is our list of the best brokers for trading worth checking out.