- The US dollar rallied a bit against the Japanese yen on Monday, as we are seeing a “rethink” of the entire drop of the market from Friday.

- The market continues to see a massive interest rate differential, despite the fact that the Federal Reserve is now expected to cut rates multiple times going forward.

- However, there are some signs that the cut cycle may not be that long, and of course this would mean that you can continue to see interest in collecting swap at the end of each session.

Technical Analysis

This is a pair that is essentially flat at the moment, and this makes a bit of sense, as the Bank of Japan has a lot to think about, but in the end, they also have the concerns about the Japanese Government Bond markets. There have been a couple days where the bond market had no bids, which of course could put the Bank of Japan in a bit of a bind, where they might have to buy bonds. This of course would be the same thing as “quantitative easing.”

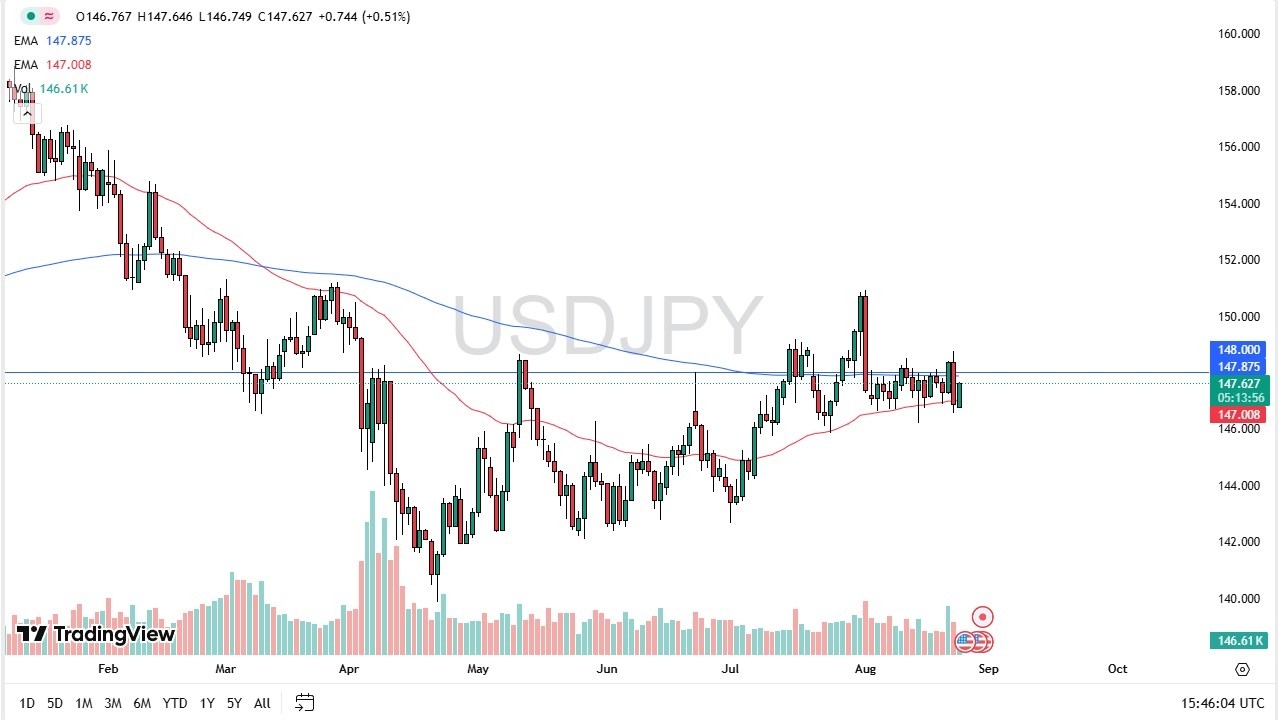

The size of the candlestick on Monday is somewhat impressive, as it goes against the grain of the selling pressure from the Friday session. It is worth nothing that the market bounced from the 50 Day EMA indicator, which attracts a lot of attention in and of itself. This market will be watching the 149 yen level, and if we can break above there, then I believe that the market will continue to see buyers jump in, and it is potentially a situation where “FOMO” could set into the market.

Top Regulated Brokers

However, if we were to break below the 146 yen level, that would possibly bring in more selling pressure. I suspect that it would be accompanied by US dollar weakness around the Forex world overall.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.